By Jason Caine, Director for Compete, a Kantar Media company

The toy industry was a big online winner during the last two weeks of November, which included Black Friday and Cyber Monday. Nearly 24 million consumers shopped online for toys during the time period, an 18 percent increase over the same time period last year, according to market share data released by Kantar Compete.

Amazon’s holiday performance suggests that manufacturers need to shift their focus from thinking of the online retailer as an emerging channel to one that could be an important revenue driver in the next few years. One in four consumers considered a toy product on Amazon.com during the start of the holiday season.

ToysRUs.com appears to be the retailer most impacted by Amazon’s early toys category successes thus far. One in three Amazon toy shoppers also visit ToysRUs.com to shop for the same products. Both Walmart.com and Target.com are experiencing cross shopping rates about half the size.

ToysRUs.com appears to be the retailer most impacted by Amazon’s early toys category successes thus far. One in three Amazon toy shoppers also visit ToysRUs.com to shop for the same products. Both Walmart.com and Target.com are experiencing cross shopping rates about half the size.

A handful of manufacturers appear to have moved quickly to capitalize on Amazon’s success. Roughly 21 percent of consumers who shopped for toys on Amazon considered a Lego product. Fisher-Price, Barbie, and LeapFrog were other big winners on Amazon.

One immediate advantage to selling on Amazon is the ability to sell a much larger SKU assortment than traditional retailers have shelf space for. The brands with the largest Amazon brand share in the toy category largely have one common characteristic: products that lend themselves to a large degree of variety and customization.

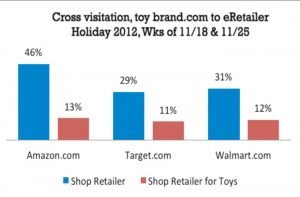

Amazon has an important advantage over its competitors: 46 percent of consumers who visit a toy manufacturer’s brand site shopped on Amazon during the last two weeks of November. This is 17 points greater than its next closer competitor. However, only 13 percent of those consumers shop Amazon for toys. Although this is more than its competitors, Amazon has far more upside in terms of capturing a greater percentage of consumers who visit a toy manufacturer online.

Amazon has an important advantage over its competitors: 46 percent of consumers who visit a toy manufacturer’s brand site shopped on Amazon during the last two weeks of November. This is 17 points greater than its next closer competitor. However, only 13 percent of those consumers shop Amazon for toys. Although this is more than its competitors, Amazon has far more upside in terms of capturing a greater percentage of consumers who visit a toy manufacturer online.

Looking ahead, brands that want to increase their online market share should be trying to understand what other categories and brands that the Amazon shopper is already shopping for today. This could help uncover potential cross-category promotions with other brands that sell more toys while also increasing Amazon’s share of a consumer’s wallet.

Jason Caine is a Director for Compete, a Kantar Media Company and the leading provider of digital insight to global brands, in their CPG & Retail Practice. He can be reached at jcaine@compete.com.