by DAVID HAIGH, CEO, Brand Finance

Every year, valuation and strategy consultancy Brand Finance values the brands of thousands of the world’s biggest companies. Brands are first evaluated to determine their strength on a scale from 0 to 100 (based on factors such as marketing investment, familiarity, loyalty, staff satisfaction, and corporate reputation) and given a corresponding letter grade up to AAA+. Brand strength is used to determine what proportion of a business’s revenue is contributed by the brand, which is projected into perpetuity to determine brand value. The world’s most valuable toy brands are ranked in the Brand Finance Toys 25.

The purpose of a strong brand is to attract customers, build loyalty, and motivate staff. However, for a commercial brand, the first answer must always be to make money.

Huge investments are made in the design, launch, and ongoing promotion of brands. Given their potential financial value, this makes sense. Unfortunately, most organizations fail to go beyond that, missing huge opportunities to effectively make use of what are often their most important assets. Monitoring brand performance should be the next step, but is often sporadic. Where it does take place, it frequently lacks financial rigor and is heavily reliant on qualitative measures poorly understood by non-marketers.

As a result, marketing teams struggle to communicate the value of their work, and boards then underestimate the significance of their brands to the business. Skeptical finance teams, unconvinced by what they perceive as marketing mumbo jumbo, may fail to agree to necessary investments. The marketing spend available can end up poorly directed as marketers are left to operate with insufficient financial guidance or accountability. The end result can be a slow but steady downward spiral of poor communication, wasted resources, and a negative impact on the bottom line.

As a result, marketing teams struggle to communicate the value of their work, and boards then underestimate the significance of their brands to the business. Skeptical finance teams, unconvinced by what they perceive as marketing mumbo jumbo, may fail to agree to necessary investments. The marketing spend available can end up poorly directed as marketers are left to operate with insufficient financial guidance or accountability. The end result can be a slow but steady downward spiral of poor communication, wasted resources, and a negative impact on the bottom line.

Without knowing the precise financial value of an asset, how can you know if you are maximizing your returns? If you intend to license a brand, how can you know you are getting a fair price? If you are intending to sell, how do you know what the right time is? How do you decide which brands to discontinue, whether to rebrand, and how to arrange your brand architecture? Brand Finance conducted thousands of brands and branded business valuations to help answer these questions.

Brand Finance recently conducted a share price study that revealed the compelling link between strong brands and stock market performance. It found that investing in the most highly branded companies would lead to a return almost double that of the average for the S&P 500 as a whole.

Branded Business Value

Branded Business Value

A brand should be viewed in the context of the business in which it operates. Where a company has a purely mono-branded architecture, the business value is the same as the overall company value, or enterprise value.

In the more usual situation in which a company owns multiple brands, business value refers to the value of the assets and revenue stream of the business line attached to that brand specifically.

Brand Contribution

Brand contribution represents the overall uplift in shareholder value that the business derives from owning the brand rather than operating a generic brand.

Brands affect a variety of stakeholders—not just customers, but also staff, strategic partners, regulators, investors, and more—having a significant impact on financial value beyond what can be bought or sold in a transaction.

Brand Value

In the very broadest sense, customers, staff, and other stakeholders hold all the expectations and opinions for a brand’s focus about an organization and its products and services. However, when looking at brands as business assets that can be bought, sold, and licensed, a more technical definition is required.

Brand Finance helped craft the internationally recognized standard on Brand Valuation, ISO 10668, which defines a brand as, “a marketing related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, or a combination of these, intended to identify goods, services or entities, or a combination of these, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits/value.”

Brand Strength

Brand strength is the part of our analysis most directly and easily influenced by those responsible for marketing and brand management.

To determine the strength of a brand we have developed the Brand Strength Index (BSI). We analyze marketing investment, brand equity (the goodwill accumulated with customers, staff, and other stakeholders), and the impact of those on business performance.

Following this analysis, each brand is assigned a BSI score out of 100, which is fed into the brand value calculation. Based on the score, each brand in the league table is assigned a rating between AAA+ and D in a format similar to a credit rating. AAA+ brands are exceptionally strong and well managed, while a failing brand would be assigned a D grade.

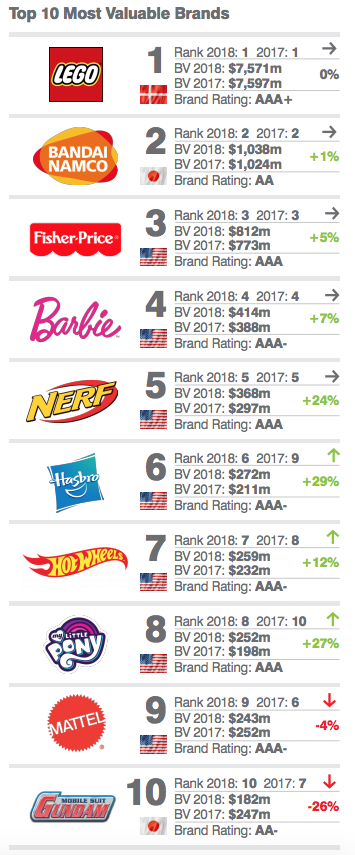

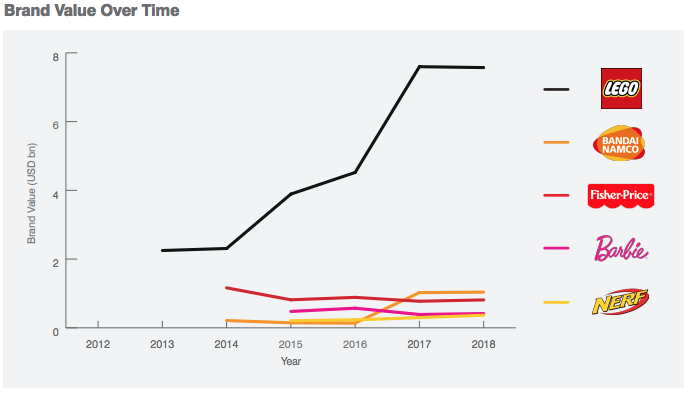

LEGO Builds on Success in Emerging Markets

LEGO remains the world’s most valuable and strongest toy brand, with a brand value of nearly $7.6 billion, an exceptional BSI score of 90.6, and a corresponding brand rating of AAA+. Despite this position, LEGO’s brand value actually slipped this year, down 0.3 percent. While not substantial, it represents a wider challenge for the brand as revenue fell 6 percent in the first half of 2017 and net profit was down 3 percent.

China is the brand’s biggest developing market, enjoying double-digit growth in the first half of 2017, but the more established markets have not been as fortunate. Since sales in Europe and the U.S. account for approximately 75 percent of all revenue, to increase its brand value, LEGO must turn to untapped markets, especially in Asia, and make adjustments to remain relevant in the established ones. LEGO recently formed a partnership with tech giant Tencent to develop licensed games, videos, and other content for children in China. This provides an opportunity for LEGO to maximize growth in China by tapping into the digital space, which should positively impact its brand value in the future.

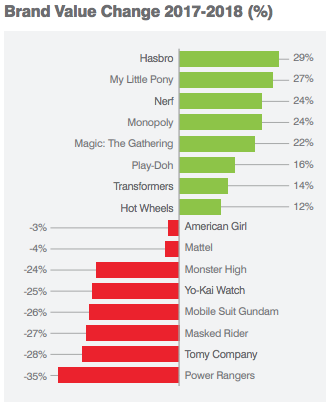

Bandai Namco Experiences Slight Growth

Bandai Namco remains the second most valuable toy brand this year, with a brand value of $1 billion, up 1.4 percent. Its slow growth coincides with a drastic decrease in brand value for the company’s other brands, as Yo-Kai Watch, Mobile Suit Gundam, and Power Rangers have fallen 24.8 percent, 26.3 percent, and 35.2 percent, respectively. The Japanese toy market experienced falling sales in recent years due in part to a population decrease in the 0 to 14 age group.

Despite these challenges, Bandai Namco managed to keep its second place position through a global diversification plan and new agreements. The company recently announced a strategic partnership with Dontnod Entertainment to facilitate the creation of a new IP game based on a narrative adventure experience to take place in a fictional U.S. city. This represents the next stage of Bandai Namco’s diversification strategy, keeping a worldwide audience in mind, and likely benefitting its brand value and brand strength in the future.

Hasbro Performs Best in 2018 Growing Nearly 30 Percent

Owing to the success of its portfolio of brands including My Little Pony, Nerf, and Monopoly, Hasbro is the fastest-growing toy brand, with brand value increasing 29.1 percent to U.S. $272 million. The majority of Hasbro’s brands improved this year, with several increasing their brand value by more than 20 percent. Although Mattel’s portfolio of brands in the table have a higher value than Hasbro’s, Mattel dropped from sixth to ninth, swapping places with Hasbro, with a 3.6 percent decline in brand value to U.S. $243 million.

My Little Pony, Hasbro’s best-performing brand, galloped up the ranks, growing 27.3 percent in brand value to U.S. $252 million. It is the second strongest toy brand in the table, with a BSI score of 87.9 and a brand rating of AAA. The brand transformed itself over the years, bringing its traditional dolls into the entertainment world and reaching its audience through different channels. Most recently, My Little Pony: The Movie was well received, which led to the creation of a new TV show and a line of Equestria Girls dolls. Placing the My Little Pony brand on the big-screen is a step in the right direction, and capitalizing on this will help boost the brand’s revenue and improve its brand value in the future.

[author] [author_image timthumb=’on’]https://toybook.com/wp-content/uploads/2018/03/DavidHaigh.png[/author_image] [author_info]David Haigh is CEO at Brand Finance, the world’s leading brand valuation and strategy consultancy. Certified with ISO 10668 in brand valuation, Brand Finance bridges the gap between marketing and finance and advises organizations with valuable intangible assets on how to maximise their value. Headquartered in London, the company has a global network of offices and partners in more than 20 countries worldwide.[/author_info] [/author]

This article was originally published in the Winter 2018 issue of The Licensing Book.