by JULI LENNETT, senior vice president, industry advisor, toys, The NPD Group

The U.S. toy industry grew by 1 percent to $20.7 billion in 2017, according to retail sales data* from global information company The NPD Group. Unit sales grew faster than dollars, up 3 percent, bringing the average retail price down by 2 percent to $9.99. The industry was 14 percent larger in 2017 than 2014, which calculates to a compounded annual growth rate of 4.5 percent.

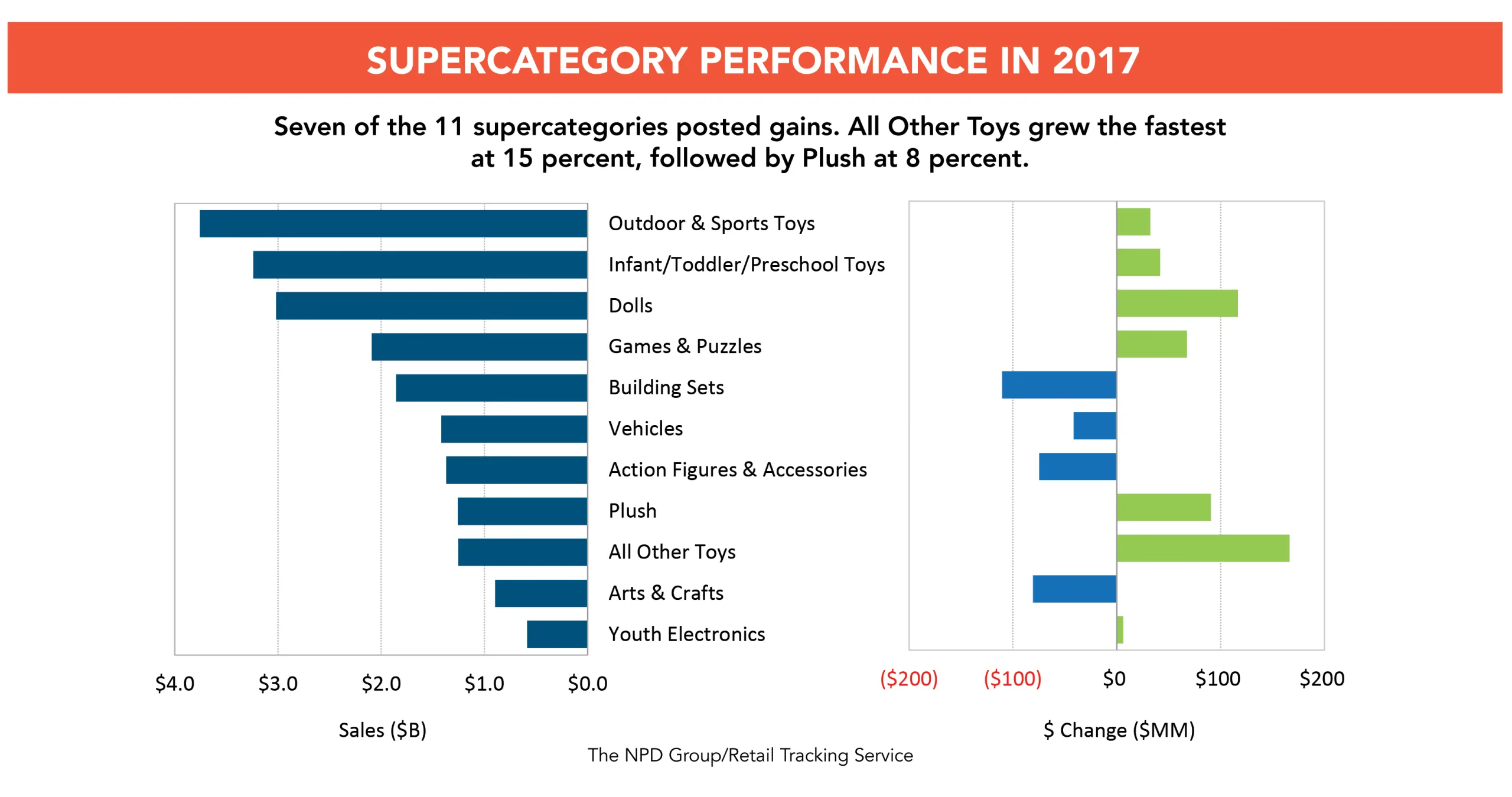

In terms of sales performance across the supercategories tracked by NPD, seven of the 11 supercategories posted gains in 2017. All Other Toys grew the fastest at 15 percent, driven by fidget toys, which gained momentum around Easter and peaked at the end of June. As these toys leveled off, squishy toys seemed to replace them as the new fad, and have the potential for a longer life than fidget toys as they morph beyond the initial products released. In line with the slime craze, Cra-Z-Art and Nickelodeon also contributed to this supercategory’s growth.

Plush sales grew by 8 percent, led by Hatchimals, which represented almost half of all gaining toy properties in the supercategory. Teddy Ruxpin, a blast from the past, and FurReal Friends were also highlights in the Plush category. The third-fastest supercategory growth came from Dolls, up 4 percent from 2016. L.O.L. Surprise! contributed more than one-quarter of the growth, followed by Hatchimals CollEGGtibles. Disney Moana, Baby Alive, and Barbie were additional growth contributors to this supercategory.

While the 2016 list of top-growing properties based on dollars was heavily dominated by newer properties, there was only one property on the list launched in 2017: Fingerlings. Five of the top 10 growth properties were tied to movies released in 2017 or late 2016, including Disney•Pixar Cars 3, The LEGO Batman Movie, Disney•Pixar Moana, Total DC Comics (Batman v Superman: Dawn of Justice, Justice League, Wonder Woman), and Transformers. This showed that movie properties are still a solid driver of sales in toys. While nearly all of the properties have a collectible assortment, only three logged more than $50 million of their sales under collectibles: Hatchimals, L.O.L. Surprise!, and Total DC Comics. Collectibles** continue to be a growth driver for the industry. Though the growth rate slowed in the second half of 2017 due to non-blind pack collectibles, sales were up 11 percent overall in 2017, driven by blind packs, which experienced 84 percent growth.

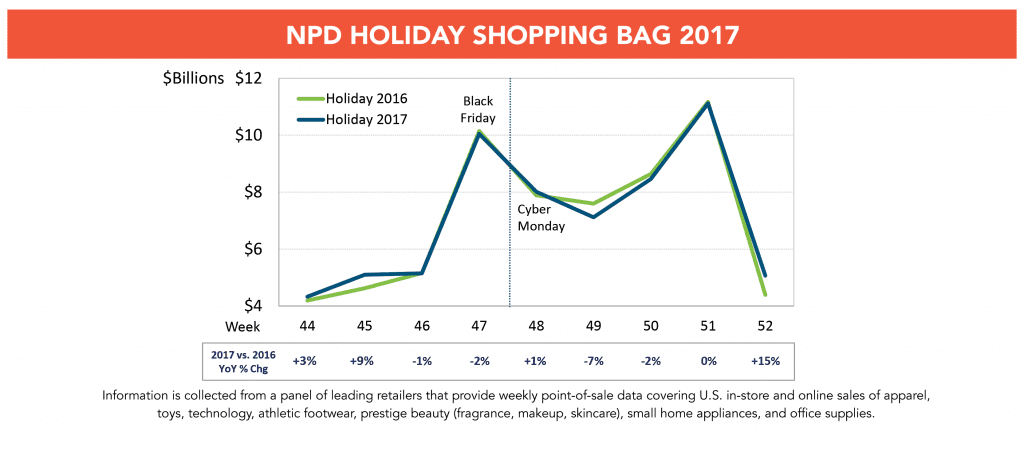

The big question on everyone’s mind is, how did the toy industry fare during last year’s holiday season? Year-to-date through September, the industry posted healthy growth of 3 percent, but the fourth quarter posed a challenge. The quarter began with modest growth in October, followed by dips in November and December, and ended with huge sales growth in the final week of the year.

The big kick-off to holiday was Black Friday week—or week 47—which experienced declines, and the declines continued for the next four weeks. Week 52 experienced a surge in sales, making up for most of the prior weeks’ declines, with the growth supported by Christmas Eve falling into this week. Over the last three years, the sales trend from Black Friday through Christmas shows a shift that points to holiday toy purchases being made later and later each year, as sales in the last two weeks of the year increase at the expense of prior weeks. This poses a task for retailers to determine how to get more consumers to put a toy in their basket during their earlier store visits for other gift items.

NPD reported on weekly sales throughout the holiday season (November and December) for multiple industries, including apparel, technology, athletic footwear, prestige beauty, small home appliances, office supplies, and toys, and there were some interesting parallels between these combined categories and toys specifically. Two of the weeks between Black Friday and Christmas, weeks 49 and 50, posted the sharpest declines of the season for these categories, as well as toys. It is likely that the overall strong consumer spend during Black Friday week caused a bit of a lull for the next several weeks as consumers waited for their next paycheck. Another interesting observation is that holiday sales peaked in week 51 for the combined categories, alluding to the fact that procrastination does not only affect the toy industry. And while week 52 was the highest growth week of the season for these categories, it grew much faster for toys, underscoring that consumers are procrastinating even a bit more when it comes to making a holiday toy purchase.

As the industry moves forward into the future, it must be fast and fresh. In today’s environment, it is more crucial than ever to react quickly to changing tastes and fast-moving trends. In the past, smaller companies have been more nimble and able to react more quickly. It is critical for larger companies to figure out how to react faster and get to market more quickly. New and innovative products are also necessary for success. Our social culture thrives on hot new trends, and the toy industry needs to recognize that and pick up the pace.

*Source: The NPD Group Inc. / Retail Tracking Service, January-December 2017

Data is representative of retailers that participate in The NPD Group’s Retail Tracking Service. NPD’s current estimate is that the Retail Tracking Service represents approximately 80 percent of the U.S. retail market for Toys. Projected to 100 percent of the market, the U.S. toy industry is estimated at about $27 billion annually.

**Collectibles include Non-Strategic Trade Cards/Collectible Stickers, Strategic Trading Card Games, Mini Figures & Scene Sets, Action Figure Collectibles & Accessories, Playset Dolls & Collectibles, Blind Packs as well as assorted brands that are collectible.

[author] [author_image timthumb=’off’]https://toybook.com/wp-content/uploads/2018/02/NPD-Juli.png[/author_image] [author_info]Juli Lennett, senior vice president, industry advisor for The NPD Group’s U.S. Toys division, has spent the past 11 years at NPD managing client relationships and consulting to a variety of manufacturers, licensors, and retailers within the toy industry.[/author_info] [/author]

This article was originally published in the February 2018 issue of The Toy Book.