When it comes to innovation in the toy industry, the conversation often moves toward products for the youngest members of the family or kids that are aging out of traditional toys and jumping into the tech-fueled tween and teen years. We look at how kids play and learn, and how toys and games can play a crucial role in human development. But off to the side, there is a growing space that is becoming more important than ever, but what defines it — and its audience — is up for debate: collectibles.

According to The NPD Group, one out of every five toys sold globally is considered a collectible. For manufacturers, retailers, and consumers, “collectible” can be a catch-all category because anything can be considered collectible, from action figures and dolls to non-fungible tokens (NFTs), cereal boxes, and beer cans. If it exists, someone will collect it.

Over the past few years, mass retailers, including Walmart and Target, have added additional space devoted to collectibles adjacent to their electronics departments. Meanwhile, independent specialty retailers have begun exploring ways to reach the adult collector, much in the same way that players in the mass specialty space (FYE, Hot Topic, GameStop, Box Lunch, etc.) have branched out beyond the core offerings that once shaped their identities.

INNOVATION VS. NOSTALGIA

So what does innovation mean in a business where everything from Squishmallows plush and L.O.L. Surprise! dolls to Pokémon Cards, Pop! Vinyl figures, and Hot Wheels can be considered collectibles alongside the growing action figure category? Is it even necessary?

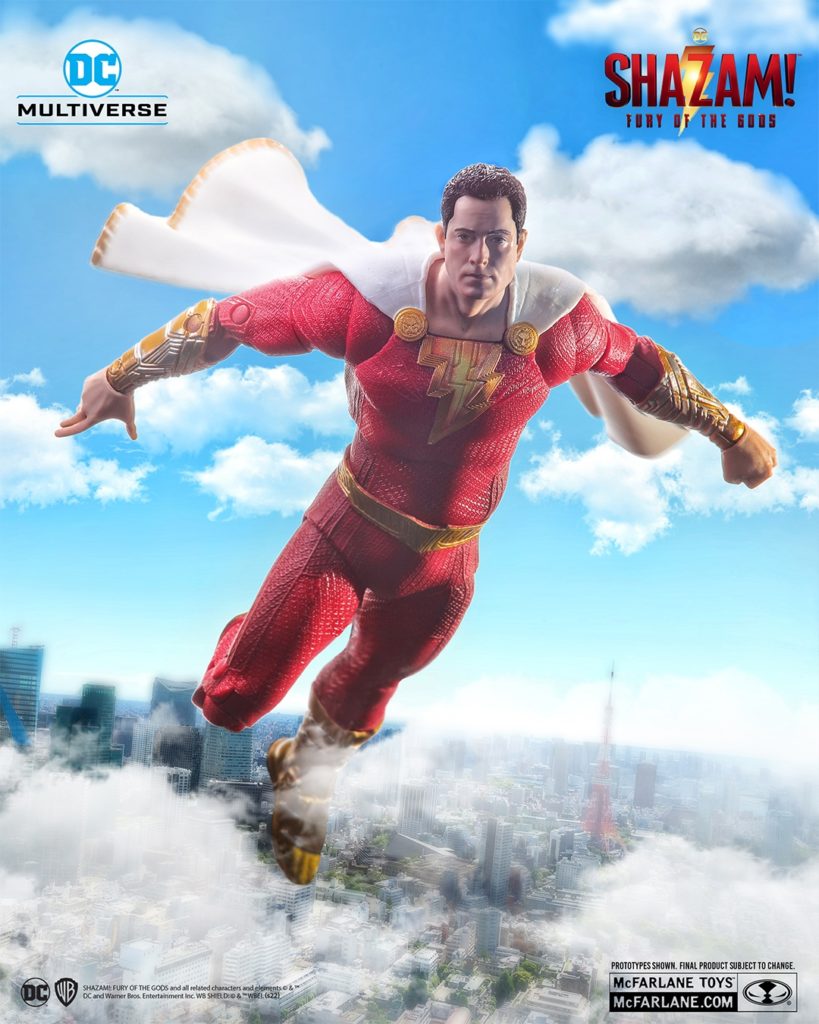

“I would say that the word ‘innovation’ at times is overhyped and overused. In a lot of instances, you don’t have to ‘innovate’ — what you have to do is take what already exists and just make it better,” explains McFarlane Toys’ CEO and Creative Force Todd McFarlane. “People want something that they’ve been collecting, at times, for a decade or more and they have a certain expectation. My job isn’t to break the expectation, my job is to get them excited about what it is that they’re collecting.”

For McFarlane, the “build a better mousetrap” approach is working as its DC Multiverse collection currently ranks as the No. 2 best-seller in action figures, per NPD. Super7, maker of ReAction Figures and Ultimates!, takes a similarly measured approach.

“Innovation can mean a lot of different things to a lot of different people,” says Super7 Founder and Owner Brian Flynn. “In our way, it is always looking to ask ourselves ‘What does the collector not have on their shelf?’ and try to make that product. We really try to focus on something that will enhance your collection, not simply make it bigger.”

At The Toy Association’s 2023 Preview event in Dallas, Basic Fun! presented buyers with an early look at new products for next year, many of which are still under wraps. While the company has been known for its work on licensed brands, including Tonka and Care Bears, there are some new tricks up its sleeve.

“Innovation is important to every business, not just toys. However, the unique thing about toys is they are as limitless as a child’s imagination,” says Basic Fun! CEO Jay Foreman. “[Kids] might play with 10 or 20 different types of toys in a week or even in a day. So, to keep up and keep their attention, you have to keep innovating.”

Part of the innovation process at Basic Fun! involves putting new spins on classic toys and offering versions that cater to different members of the family. The company might first connect with kids, but they keep their fans engaged with new products as they grow up.

“Kidulting has certainly made an impact on Basic Fun!, primarily with our retro brands like Lite-Brite and My Little Pony, as well as new ranges like Coca-Cola Collectibles and the Snacks on Snacks brands,” Foreman says. “The candy brands take us into teens and young adults, and Coca-Cola has very broad appeal in the adult market.”

While some see innovation in new product offerings, others feel that marketing hype, limited offerings, and crowdsourcing are fueling total dollar growth for collectibles.

“In my humble opinion, the space lacks product innovation. For the most part, it just serves up nostalgia — hot, steamy, and sweaty on BBQ paper plates,” says Jonathan Cathey, CEO and founder of The Loyal Subjects, maker of BST AXN. “The Loyal Subjects’ take on innovation is construction, functionality, and a toyetic experience. We certainly bridge the gap from having enough nuance, coolness, sculpt, and deco details for [adult] collectors but also some great ‘play’ functionalities that encourage play — not just display — which we believe creates a ‘big tent’ experience.”

A PHYGITAL FUTURE?

This year, a number of companies have made the jump into “phygital” (digital + physical) toys and collectibles. While some activations have seen players including Mattel, MGA Entertainment, and Funko exploring NFTs, Web3, and other digital offerings to complement their physical products, emerging players are doing it in reverse.

Last month, Toys “R” Us at Macy’s became the first home for Toikido’s VeeFriends, a line of blind box figures, vinyl collectibles, and plush toys inspired by digital NFTs.

“VeeFriends is developed around characters, all of which the founder, Gary Vaynerchuk, imagined, created, and drew himself with traits that he admires and believes will lead to true happiness and success,” says Andy Krainak, president of VeeFriends.

“VeeFriends’ ambition is to grow the intellectual property (IP) around each VeeFriends character and to scale the traits they represent to new audiences, including parents and children.”

Other NFT-first collectibles are set to begin hitting shelves next year, including a collection from PMI inspired by Pudgy Penguins, a crew of characters that live on the Ethereum blockchain.

“The collectibles market has seen tremendous growth in the last few years,” Krainak says. “We believe combining digital collectibles with physical collectibles will go hand in hand to build the development of the collectibles industry.”

NEW RETAILERS AND PRICING

Even before inflation kicked in, concerns about pricing have been a hot-button issue on all fronts. But there is absolutely no one-size-fits-all approach when it comes to finding the balance between the cost of doing business and the price paid at the cash register.

“We create products for anyone who wants to participate,” Cathey says. “We also don’t drum up the price. Mass retail gives us the volume so we can stabilize the pricing, which is below the $20 price point. We’ve worked hard, not just on opening our distribution to the big retailers but by truly being product and engineering geeks.”

According to Flynn, “Prices have been artificially low for years ascribing to the model that lower prices equals larger sales; but toys and collectibles are not a commodity. If anything, they are an affordable luxury and don’t follow the same Bezier curves in supply and demand.”

“Have we tried to hold our line at McFarlane Toys? Yes. Will we be able to do it forever? Probably not, but I’d like to always come in last in that race so that when we have to do any kind of price increase it’s always months and months, if not years after the big boys have done it,” McFarlane says. “My company is private, and I don’t have to maximize profits every 90 days, which is what the big [publicly traded] companies are obligated to do legally. It’s an advantage at times, being small.”

For new retailers looking to add to their product mix, Flynn says they can lean into the knowledge and expertise of manufacturers and vendors.

“I think the biggest opportunities will be for retailers that move out of their comfort zone and buy great product that isn’t tied to their historical sales in other categories,” he says. “The collectibles space has a unique customer base. A retailer that is looking for insights from the traditional toy category to influence their collector strategy will be looking in the wrong place and at the wrong data. A collector is looking for quality first and price second or third. Most collector brands … often know their own market better than anyone.”

As the new year looms on the horizon, a fresh wave of collectibles for preschoolers to grandparents is ready to make a splash. In a crowded field, new offerings, such as Intersell’s Lil Wish Lanterns, will face off against rebooted lines from the past. “Like our new partnership with Hasbro on Littlest Pet Shop,” Foreman says, “sometimes everything old is new again.”

With the right product mix, the industry can continue to grow as it seeks to acquire two coveted collectibles of its own desire: market share and profit.

This article was originally published in the 2022 Innovation & STEM issue of The Toy Book. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!