The NPD Group recaps toy performance in 2018, and discusses what it means for this year.

The NPD Group recaps toy performance in 2018, and discusses what it means for this year.

by Juli Lennett, vice president and industry advisor, toys, The NPD Group

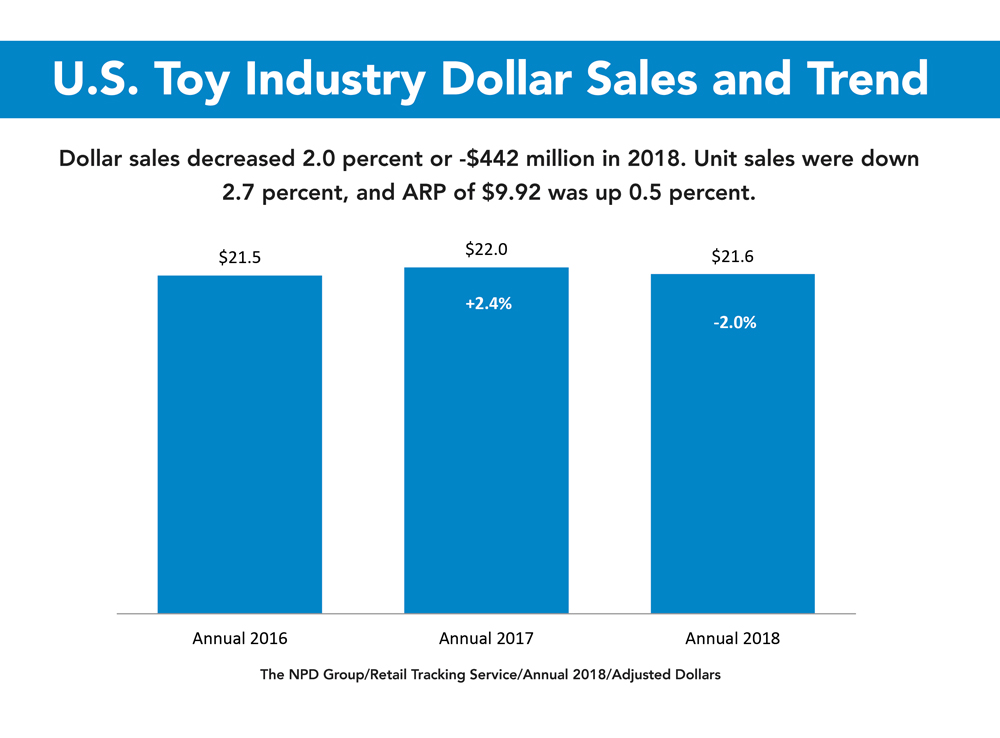

According to The NPD Group’s Retail Tracking Service data*, U.S. toy retail sales generated $21.6 billion in 2018 compare d to $22.0 billion in 2017. This 2 percent decline comes after four straight years of growth in the toy industry.

Overall, a 2 percent decline is a solid performance after such a significant shift in the retail landscape. After the liquidation announcement of Toys ”R” Us last year, there was a great deal of speculation about what would happen to the industry, with some predicting double-digit declines. It’s also worth noting that annual 2018 sales are slightly higher than 2016, which experienced mid-single-digit growth.

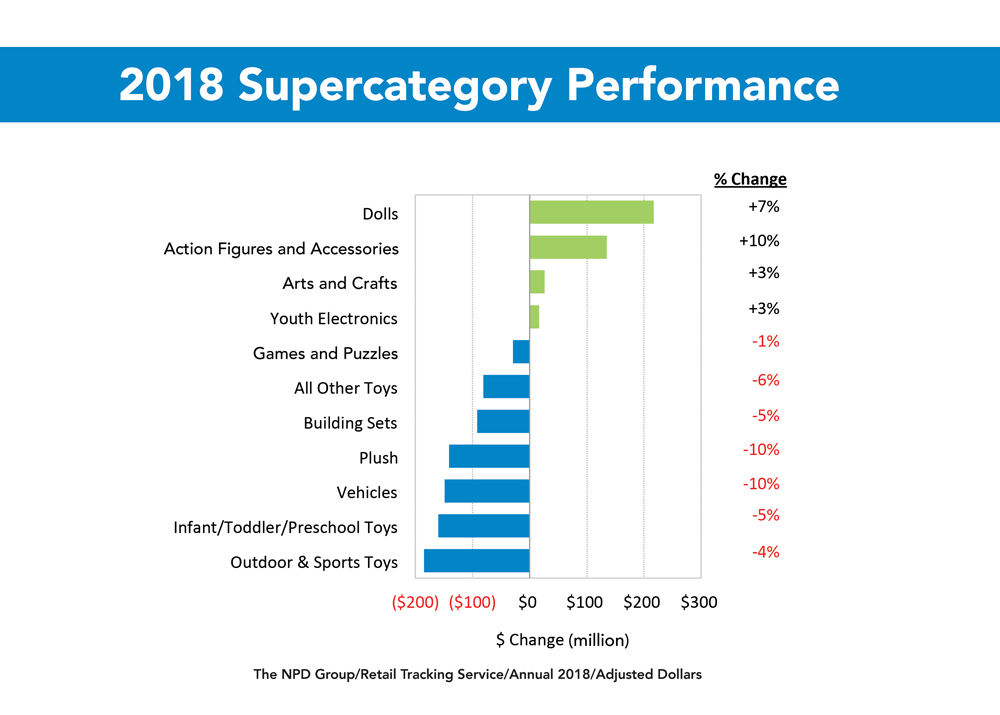

Looking at supercategory performance in order of absolute dollar growth, dolls had the strongest growth thanks in large part to L.O.L. Surprise!, Barbie, and Hatchimals. Action figures followed, with sales from Jurassic World, Marvel Universe, and Beyblade driving most of the growth. Cool Maker, Cra-Z-Art kits, and Kinetic helped the gains in arts and crafts, while Fingerlings, Kidi, and L.O.L. Surprise! helped the youth electronics super-category grow.

The top properties for the year based on total dollar sales included L.O.L. Surprise!, Barbie, Nerf, Marvel Universe, and Hot Wheels.

Performance last year was one of contrast, showing growth in the first half and declines in the second half.

Dollar spend in the first two quarters totaled close to $8 billion, a 7 percent increase over last year. L.O.L. Surprise!; Marvel Universe with the Black Panther and Avengers: Infinity War movies both releasing in 2018; and Jurassic World, supported by the movie release of Jurassic World: Fallen Kingdom, fueled this growth. Toy sales in the first half of the year also benefitted as a result of the Toys ”R”Us liquidation program.

The declines in the third and fourth quarters—close to 6 percent and 7 percent, respectively—were due to several factors, including Toys ”R” Us closing its doors in the U.S. (on the last day of the second quarter, June 30).

Leading up to the holidays, many retailers stated that they made larger investments in toys for the fourth quarter in an attempt to gain the share that Toys “R” Us left behind. It appears, however, as if some did not lean in enough with respect to the right additional inventory. It also appeared that some retailers focused on stocking brands that were sure to be big sellers, while others were out of stock of the most popular higher-priced toys toward the end of the season, which had a negative impact on sales. To me, it seemed as if everyone was taking the safe route this holiday when a little more risk-taking could have led to a stronger holiday.

Adding fuel to the declines, there was also increased competition for kids’ time and interest across other industries, including video games, which had a very exciting year. A few weeks ago, NPD announced that video game sales in the U.S. were up 18 percent in 2018. This marks the highest annual-tracked consumer spend total since 2011. There were a number of kid-friendly releases this year contributing to that growth that likely took dollars away from toys, including Super Smash Bros. Ultimate and Mario Kart 8, both setting records.

So, what lies ahead for the toy industry in the U.S.? Will the year see growth or a decline? In reality, it could go either way depending on the steps retailers and manufacturers will take.

The industry will continue to work through the loss of Toys ”R” Us in the first half of the year. However, the U.S. is going to have a strong year for movies that appeal to kids, which often translates into great sales for toys. For example, Frozen 2 toys will be on shelf in 2019 and could be a game changer for the holiday.

The industry needs some broader excitement this year and—while some of it will come from movie-related toys—new and innovative toys are what drives growth. In addition, retailers will need to lean in more this holiday, not only on the sure bets but also to go bigger on some of the higher-ticket items that Toys ”R” Us used to do so well with during the holiday season. Parents and grandparents will spend the money, but only if they are able to find the toys in stock in stores or online.

*Source: The NPD Group Inc./Retail Tracking Service, January to December 2018. Data is representative of retailers that participate in The NPD Group’s Retail Tracking Service. NPD’s current estimate is that the Retail Tracking Service represents approximately 78 percent of the U.S. retail market for toys. Projected to 100 percent of the market, the U.S. toy industry is estimated at about $28 billion annually.

[author] [author_image timthumb=’off’]https://toybook.com/wp-content/uploads/2017/02/Juli-Lennett.jpg[/author_image] [author_info]Juli Lennett is the senior vice president and industry advisor for The NPD Group’s U.S. Toys division. She has spent the past 12 years at NPD managing client relationships and consulting a variety of manufacturers, licensors, and retailers within the toy industry.[/author_info] [/author]

This article was originally published in the February 2019 issue of The Toy Book.