Changing the Game

by KHALED SAMIRAH, video games analyst, Euromonitor International

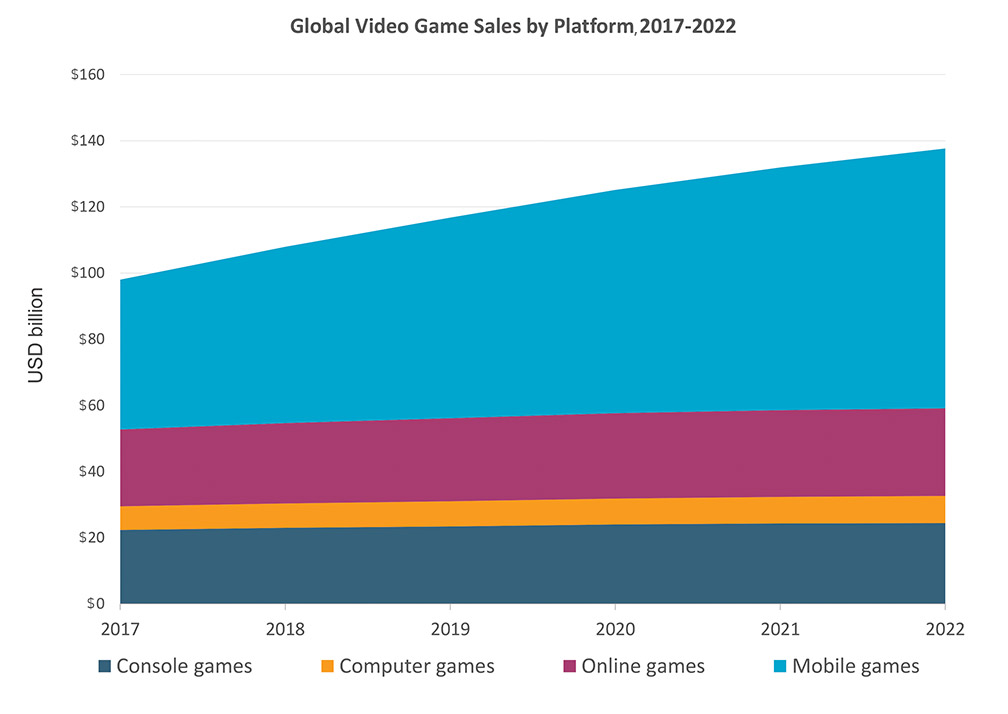

The world of video games has come a long way from massive arcade machines to gaming at our fingertips. Mobile gaming is on pace to become the preferred choice for gamers around the world. In fact, Euromonitor data projects the global value size of mobile gaming to grow larger than all other video game segments combined by 2022. Mobile gaming provides a convenient way for the increasing amount of time- and cash-strapped gamers to indulge in their hobbies — disrupting the industry. The mobile gaming segment grew in double digits last year and is forecasted to grow at a compound annual growth rate (CAGR) of 12% in value terms through 2022, versus the 2% CAGR projected for traditional toys and games. That translates to incremental sales of more than $33 billion in mobile games over the next five years — four times greater than traditional toys and games.

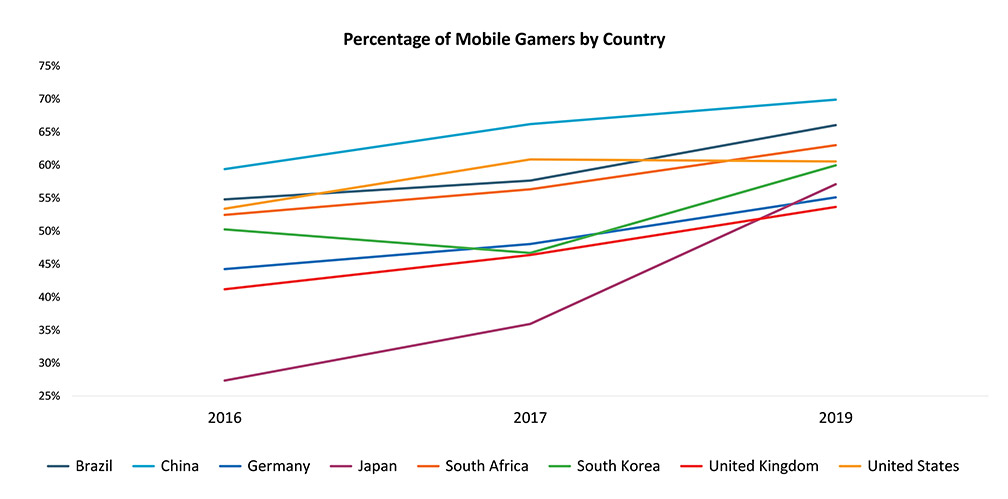

Euromonitor’s global consumer lifestyle survey demonstrates the increase in popularity of online gaming and mobile gaming, specifically. Euromonitor survey results indicate the increase in the percentage of mobile gamers over the past four years worldwide. In 2016, 59% of respondents in China indicated that they played mobile games, and this year the number stands at 70%. In Japan, the number increased by 30% from 2016, to reach 57%. The proportion of gamers in the more established U.S. market rose from 53% in 2016 to 60% this year, while in the UK market it rose from 41% to 53% over the same period.

One key factor supporting the shift to mobile gaming worldwide is the increased usage of mobile devices. Mobile phone and tablet ownership globally increased by 6% and 16%, respectively, to stand at 89% and 48%, respectively, between 2016 and this year, according to Euromonitor lifestyle surveys.

Mobile gaming is convenient for gamers to enjoy and play competitively on the go. It also allows gaming to regain some of the social elements it lost with the advancement of technology. Mobile gamers can now play together in the same room. Additionally, mobile games are easier to develop, require less detail and graphics, and are inexpensive or even free. This affordability allows gamers who do not have access to high-tech equipment to indulge in their favorite games, which levels the playing field. The ease of development also opens opportunities for independent developers to create games on which they can have a personal imprint, while still competing with established industry players, as in the case of Tyson Ibele, who has developed three popular games so far, mainly for Apple’s iOS.

Esports is riding the popularity of mobile gaming and is further boosting the segment. It has experienced a spike in interest among gamers worldwide due to the games’ competitive nature, as well as enhanced interactive experience provided to gamers and viewers. Games such as Clash Royale, Honor of Kings, and Fortnite have been gaining market share in the mobile gaming world. The evolution of online and mobile gaming has changed video game monetization models. Fortnite is free to play, and the game generated $2.4 billion last year leveraging in-game purchases, such as skins, characters, accessories, loot boxes, and in-game drops.

However, esports require additional components to attract gamers. It is important for game developers and publishers to create games that are not only fun to play, but also to watch. Experience factors, such as how much suspense and spectacle are generated, are very important to gamers, viewers, and esports enthusiasts. Euromonitor survey results show that 56% of consumers are willing to spend money on experiences, and 58% are seeking tailored experiences. Game genres such as Battle Royales create a tense gaming and viewing experience. By shrinking the playing area over time, these games take players out of their comfort zones, forcing them to face each other.

Mobile gaming provides unique opportunities across various areas of the video games industry. The ease of use and ability to access content on the go create experiences that encourage gamers to continue to shift to mobile gaming. It also provides developers with an easy platform to launch new games that can be easily accessed by wider audiences. The projected growth of mobile gaming will continue to attract the attention of toys and games industry players globally, which will in turn help the category of mobile gaming grow further through investment and innovation.

Changing ways young consumers approach playtime will continue to present a challenge for the traditional toys and games brands, which not surprisingly increasingly keep a watchful eye on video games and online gaming as a disruptor, a challenge, and for some, an opportunity via licensing. The newest generation of kids — largely coming out of millennial households — will be more digitally connected than ever before, placing digital space more at the forefront of play experiences.

Fortnite is a case in point. Its colorful art style, as well as robust presence on gaming streaming services, such as Twitch, means that it is likely that kids are spending a large amount of their free time on this game. This limits the amount of time they have for traditional toy playtime and reduces the overall demand for toys. Some companies are hoping that having licensed Fortnite products will limit the damage the brand may be doing to traditional toy sales. Jazwares, McFarlane Toys, and Funko all prominently displayed their new products in partnership with Fortnite at this year’s Toy Fair New York.

[author] [author_image timthumb=’on’]https://toybook.com/wp-content/uploads/2019/05/Khaled.jpg[/author_image] [author_info]Khaled Samirah is a research analyst at Euromonitor International and is based in Euromonitor’s Chicago office. Samirah conducts research in the home & technology research group, with principal focus on the U.S. market. Samirah also provides client support, including strategic insight, to help inform the industry about latest trends and projections for the industry growth ahead.[/author_info] [/author]

This article originally appeared in the May/June 2019 issue of the Toy Book.