When it comes to play, one big category is populated by items that aren’t traditional toys at all.

Old-school dress-up and role-play products are still a staple of daily play for kids worldwide, and the elaborate costumes that help fuel days of imaginative play aren’t just for Halloween anymore. The business is evolving, and the companies that support it are, too.

The Toy Book caught up with Tara Hefter, president and general manager at Disguise — the costumes and accessories division of Jakks Pacific — for an update on how the company is growing its business as it looks ahead toward its 35th anniversary next year.

The Toy Book: As an industry, costumes and accessories are still haunted a bit by pre-pandemic sales numbers, but Disguise is bucking the trend with a 21% year-to-date sales increase through the third quarter and seasonal sellthrough that was rivaling 2019 numbers. How has Disguise evolved over the past two years?

Tara Hefter: Disguise is 98% licensed, so the value of our costume brands was able to maintain decent sales numbers during the pandemic. We saw evergreen properties from Disney and Hasbro remain strong throughout 2020 since licensed costumes can be reused outside of Halloween, whereas proprietary costumes like witches generally are not. And, while we don’t have any traditional superhero brands, Disguise has been growing the boys side of the business through gaming costumes over the years.

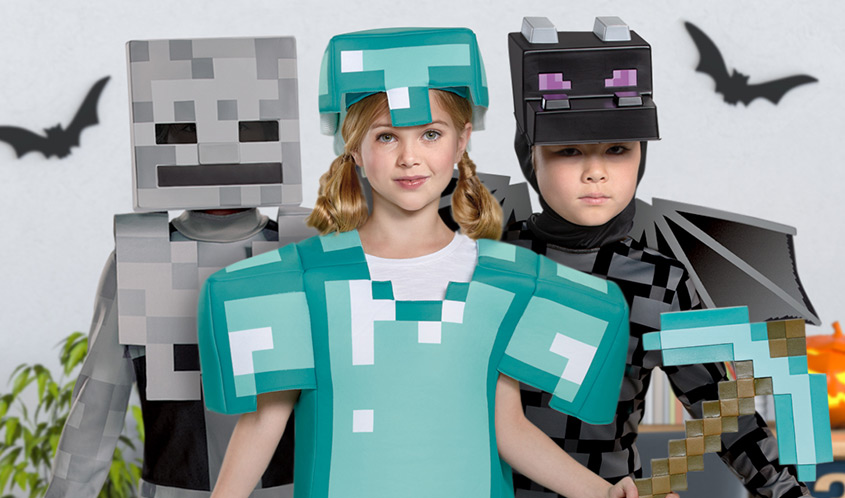

We are the go-to for licensed gaming costumes with Nintendo, Minecraft, Pokémon, Halo, and Apex Legends, to name a few. Next year, costumes inspired by SEGA and Paramount Pictures’ Sonic the Hedgehog 2 are being added to the portfolio. While families were doing a lot more gaming at home during the pandemic, and movies were not being released theatrically, our gaming portfolio saw a natural increase and helped strengthen our business overall. Additionally, we were fortunate to have gained several new licenses and studio portfolios during the pandemic when our biggest competitors were facing financial difficulties.

I moved over from Jakks to head up the Disguise division in early 2019 and brought a toy industry perspective to a somewhat traditional category and business. It has been my goal to innovate our costumes in new ways and to think outside the box. In the past two years, our amazing design team brought to market feature products, such as our Transformers Converting Bumblebee and Optimus Prime costumes; developed the first licensed adaptive costumes and wheelchair wraps; have engaged the inventor community in feature concepts; and launched a collectible mask program with Funko. We have been actively engaging in marketing these products, which is a big point of difference from our competitors. We look forward to new product introductions and ways of looking at the business differently in 2022.

TB: Disguise has had explosive growth in its licensing business during a time when the costume and accessory business became more competitive than ever. To what do you owe the success of Disguise as a go-to partner for IP owners looking to develop costume lines?

TH: Disguise will be celebrating its 35th anniversary next year and has been focused on licensing that entire time. We are the best-in-class at licensing, and I can attest to that personally, having met Disguise back in 2005 when I was managing the Halloween business at Disney. The company was absolutely my favorite licensee and it was a well-oiled machine back then, too. In fact, the majority of Disguise’s employees have been with the company for more than 10 years, with many having worked here for 20-30 years. It is that experience and service that helps us maintain critical licensing relationships.

We also have strong retailer relationships, and that’s important when licensors reach out to ask the buyers who they want to work with for costumes. We are not afraid of developing exclusive products for our retailers and working very closely with them on their many needs. Of the top 25 licensed brands per The NPD Group, Disguise makes products for 20 of them. I’m extremely proud of the team for being able to deliver on that, especially during a pandemic when we all had to pivot to remote working.

TB: The costume business is no longer surrounded by the Halloween holiday, and the world of everyday dress-up and role-play seems to be merging with the toy department in a way that makes the categories seem less “toy-adjacent,” but quite complementary to other brands in the space. How has this evolution affected Disguise?

TH: Since Disguise is part of Jakks, we split the business with them by occasion. In North America, Disguise focuses solely on “Halloween” with the exception of e-commerce that runs year-round, and Jakks focuses on 365 dress-up sold to the toy buyers. We do keep in touch to ensure the businesses align, but we have teams adept in each category that we utilize for the appropriate business and to leverage the strongest retailer relationships with the corresponding buyers. So, we’ve been relatively unaffected by this change on the Disguise side.

On the international side, we are rapidly growing and the lines between Halloween and everyday merge because not every country celebrates Halloween. We will be utilizing the Jakks toy dress-up and role-play range along with our comprehensive Disguise ranges to provide the most robust offering possible.

TB: To an extent, the pandemic era of 2020 really caused the costume industry to take a hit due to the growing popularity of cosplay at live events. How does the return of fan conventions play into the business for Disguise when marketing to an audience that may be looking for some premium offerings for the entire family?

TH: We are extremely excited and eager for the return of cosplay and live events. In 2019, we participated in the Halo Outpost and were not only pleased with the sales from the event, but also appreciated the ability to interact with fans and hear their feedback on our products firsthand. As soon as these events return, we will absolutely be participating with premium offerings for everyone. We participated in a panel at the San Diego Comic-Con Special Edition last month, which had a great turnout, and we will continue to be a part of many conventions. In the meantime, our e-commerce offering continues to grow each year, and that is where we see the fans seeking out all the characters that they might not be able to find in store year-round. And, we look forward to further tapping into Funko’s fanbase as we unveil 30 new character masks in 2022.

TB: According to data from The NPD Group, four of the Top 10 Halloween costumes in the U.S. this year were Disguise products. Transformers, Power Rangers, and Bendy and the Ink Machine all scored hits — and two of those properties are evergreen Hasbro licenses. The rest of the costumes in the top 10 were evergreen. What are some of the challenges in developing new products based on old favorites versus trying to get new licenses to gain ground?

TH: Having come from the toy industry, it was interesting to me when I joined Disguise and realized that the 80/20 rule doesn’t necessarily apply to costumes from a SKU perspective due to the high volume of products we make and because they tend to be exclusive to most retailers. So, if you see a SKU make a top list through NPD, it means that that particular item was likely placed at a large mass retailer and was a top item, or it is not exclusive and was sold to several retailers which led to the high volume. Therefore, the SKU comparison is not always apples to apples. That being said, the top SKUs also correlate with the top brands, but it is the sum of the whole, not an individual item. Halloween is also different from toys in that you don’t want to be in the exact same costume as someone else when you go to a party or show up at school for Halloween so the need for variety is critical. Brick-and-mortar retailers have a more limited offering than e-commerce, but still want to be able to compete with a wide variety and want newness. We are seeing consumer behaviors of seeking out costumes for rare characters or unique properties online, which is a result of fandom but also the rise in family dressing where they need to complete the group.

Traditionally, the biggest evergreen brands drive the most sales, but movies, streaming properties, and gaming all impact which brands customers love and want to make their special one costume (or two costumes) for Halloween. So, net-net it is important to have strong evergreen licenses, but you also need to take a chance on new brands in case they hit.

TB: Looking ahead, Disguise is really gaining ground as a truly international operation with many popular licenses in the U.S. now finding an audience elsewhere in the world. Europe, the Middle East, and Africa (EMEA) seem to be increasingly important territories. What are some key highlights that we can expect to see from Disguise on the international front in 2022?

TH: Disguise didn’t have much of an international presence prior to 2019, but that is now a key area of focus for the company. Licensors would prefer to work with one partner globally if that is possible and there are economies of scale in doing so. With our new Disney EMEA rights kicking in next year, we are using that volume to build an apparel-experienced team on the ground in the UK and Europe that will greatly increase our footprint beyond North America. Our U.S. licensors are already reaching out to us to see if we can bid on their licenses in EMEA and other parts of the world. So, you can expect to see our license acquisitions outside of North America grow significantly in the next 2-3 years, not only in EMEA, but in Australia and New Zealand (ANZ), Latin America (LATAM), and the Asia-Pacific (APAC) as well.