By Chris Elliott, Edge by Ascential

Following the biggest shopping frenzy of the year, U.S. Black Friday sales trends are beginning to emerge. Our insights experts at Edge by Ascential looked at the U.S. ecommerce landscape across a range of categories, as well as the tactics of some of the region’s largest online retailers. We can report early findings in pricing and promotional activity for the U.S.’s most sought-after seasonal buys.

Online spending increased 14.8 percent this year to $124.1 billion (Adobe Analytics). Although this is just 0.1 percent higher than the increase last year, consumer confidence has reached a near 18-year high (WSJ). It comes as no surprise that some U.S. retailers are bringing the seasonal discount period forward, hoping to secure an early advantage from enthusiastic bargain-hunters.

Amazon and Target appear to be the most eager to capitalize on increased consumer confidence, promoting their Black Friday deals as soon as seven and five days (November 16 and 18, respectively) before the day itself.

What’s the Deal with Toys?

There had been some speculation that retailers would prominently promote toys to exploit the gap left by Toys “R” Us. Walmart and Target both had large banners publicizing their Black Friday toy deals. Furthermore, Walmart positioned itself as “America’s Best Toy Shop.”

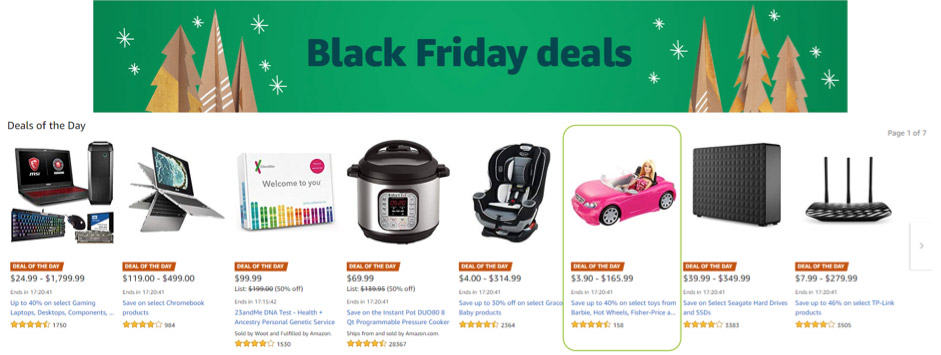

Amazon’s focus on toys was not so apparent; only one toy deal was featured on the first page of its Deals of the Day. However, it advertised savings of “40 percent on select toys from Barbie, Hot Wheels, Fisher-Price, and more.” All of these toys are Mattel-owned brands and their specific discounts were promoted with banner advertising in the days leading up to Black Friday.

There were a total of 63 Mattel toys under this deal, 27 of which were Amazon exclusives. Edge by Ascential took a sample of 10 toys and compared Amazon’s pricing to that of Target and Walmart.

Unsurprisingly, Amazon listed the lowest prices across all of the items when we look at shelf price alone. Target and Walmart promoted some of these items but largely focused promotional activity on other Mattel items and other brands, under its own Black Friday banners.

!function(e,t,s,i){var n=”InfogramEmbeds”,o=e.getElementsByTagName(“script”)[0],d=/^http:/.test(e.location)?”http:”:”https:”;if(/^\/{2}/.test(i)&&(i=d+i),window[n]&&window[n].initialized)window[n].process&&window[n].process();else if(!e.getElementById(s)){var r=e.createElement(“script”);r.async=1,r.id=s,r.src=i,o.parentNode.insertBefore(r,o)}}(document,0,”infogram-async”,”https://e.infogram.com/js/dist/embed-loader-min.js”);

Target’s most noticeable Toy promotion was a ‘Buy One Get One 50 Percent Off’ on a variety of brands which included Mattel’s Hot Wheels and WWE. Holiday toy shoppers could potentially get a better deal using this promotion than purchasing from Amazon. For example, Amazon was $9.99 cheaper than Target for the Hot Wheels Roto Revolution Playset. However, if a shopper purchased the product from Walmart with another more expensive item, they would effectively get the Hot Wheels Roto Revolution Playset for $19.24, cheaper than Amazon by $9.26.

Are Deals as Good as they Seem?

Even though promotion-savvy consumers shop around and use bulk discount promotions, they might not always get the best deal because the item might have been available at a lower price previously.

A clear example of this is Mattel’s My Passport Journal on the Walmart website, which promoted it for $15.99, the same price it held throughout the second half of August and all of September. A shopper could have bought this item for $1 less just four days before the Black Friday sale.

Some of the Black Friday deals were significantly cheaper in 2017. The KitchenAid 1.9 c.u. Ft Over The Range Microwave was $50 cheaper last Black Friday, and was available at this price for a whole month.

The iRobot Roomba 614 appeared this year under Target’s Black Friday deals banner at $248.99, the same price it has been for 13 weeks. It was $224.99 on Black Friday 2017, $24.01 cheaper than this year’s price.

Best Buy promoted a rose gold variant of the Beats By Dr Dre Beats Solo3 Headphones for $239.99, however it was frequently available for $197.99 throughout July and August 2018, 17.5 percent cheaper.

!function(e,t,s,i){var n=”InfogramEmbeds”,o=e.getElementsByTagName(“script”)[0],d=/^http:/.test(e.location)?”http:”:”https:”;if(/^\/{2}/.test(i)&&(i=d+i),window[n]&&window[n].initialized)window[n].process&&window[n].process();else if(!e.getElementById(s)){var r=e.createElement(“script”);r.async=1,r.id=s,r.src=i,o.parentNode.insertBefore(r,o)}}(document,0,”infogram-async”,”https://e.infogram.com/js/dist/embed-loader-min.js”);

Retailer Rivalry in Home Automation

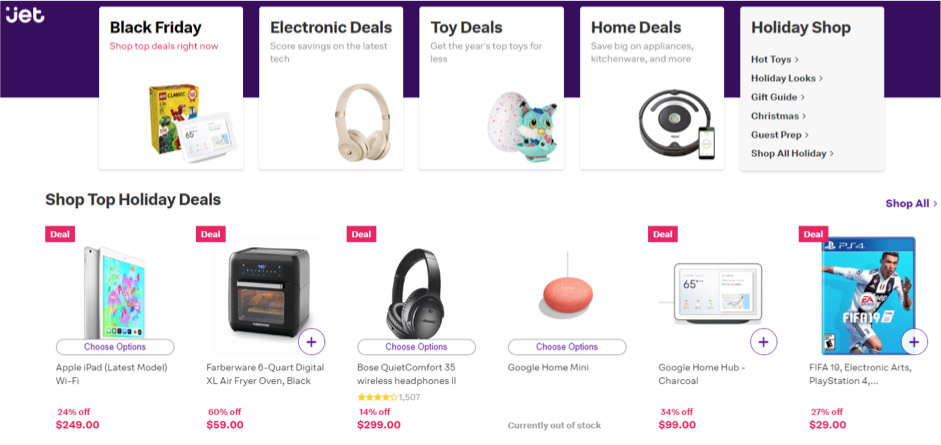

Walmart and Best Buy started their promotions comparatively much later on November 21 and 22 respectively, however they each appear to have taken up a different challenge with Amazon, partnering with Google and prominently promoting the Google Home Hub and Home Mini, as they did on Prime Day.

This strategy is most apparent in the promotional activity of its subsidiary, Jet.com where the Google Home Hub features in its main Black Friday image and it is positioned, with the Home Mini, as one of its ‘Top Holiday Deals.” (Although, at the time of writing, the Coral variation of the Home Mini was out of stock.)

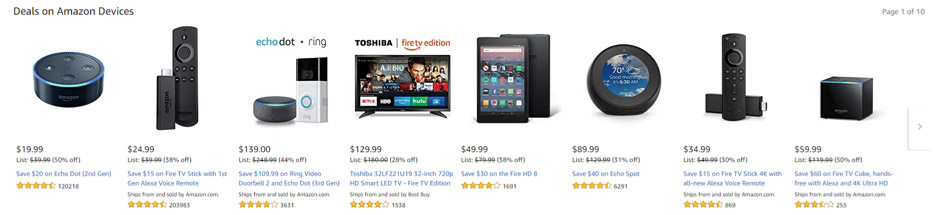

In a counter move, Amazon listed 80 deals on its own devices, significantly more than Prime Day 2018 or Black Friday last year.

Many of the deals were on bundles that included an Amazon device such as the Echo Dot, and Alexa-enabled products such as the Sonos Beam.

The Amazon Echo Dot 2nd Generation was the first deal on the carousel at $19.99, its lowest ever price. It might imply that Amazon is trying to clear stock of this item to make way for the 3rd generation which was also on promotion at just $24.00, only $4.01 more.

Amazon offered its lowest ever price on a range of its devices; the Echo Spot was $10 cheaper than on Prime Day, and the Echo 2nd Generation was priced at $69 which is $0.99 less than Prime Day.

However, not all Amazon devices were more keenly priced. The Amazon Fire TV Stick was available for $24.99, an increase of $5 since Prime Day. The Fire TV Stick 4K was just $10, which might prove to be a more persuasive deal.

As in previous years, we have uncovered a number of deals which may not be as good as they seem however they are becoming harder to find. Amazon offered its lowest ever price on a significant number of its own devices. Amazon’s rivals, as well as running their own attractive promotions, attempted to counter Amazon’s performance by partnering with Google to promote its Home Automation products, particularly the Google Home Hub.

The collapse of Toys “R” Us earlier this year left a gap for rivals to exploit. Target and Walmart adopted similar approaches to Toy sales with large banners advertising deals across a range of items. Amazon appeared to take a more targeted approach, perhaps partnering with Mattel across an extended period to offer deep price cuts on popular toys. Shoppers would be wise to consider bulk buy discounts offered by some retailers as they could end up with a less expensive basket overall.