by JULI LENNETT, Vice President, Industry Advisor, U.S. Toys, Circana

In 2024, retail sales of toys in the U.S. totaled $28.3 billion, remaining flat (-0.3%) over 2023. Decline rates across dollars and units have slowed substantially compared to the big drop in 2023 as the industry moved from a state of correction to greater consistency in the past year.

Looking at the five-year compound annual growth rate, toy industry dollars grew by 5% year over year, driven by an average selling price (ASP) growth of 4%, while units sold increased by 1% on average year over year. The toy industry is 26% larger than it was in 2019, which equates to nearly $6 billion in sales.

The toy industry remained quite stable throughout 2024 compared to the roller coaster ride of the prior three years, so we landed at a flat performance. There were some nuances along the way, like a calendar shift in the fourth quarter (Q4), but consumers bought nearly the same number of toys at the same price as last year. This narrative is remarkable.

THE YEAR IN REVIEW

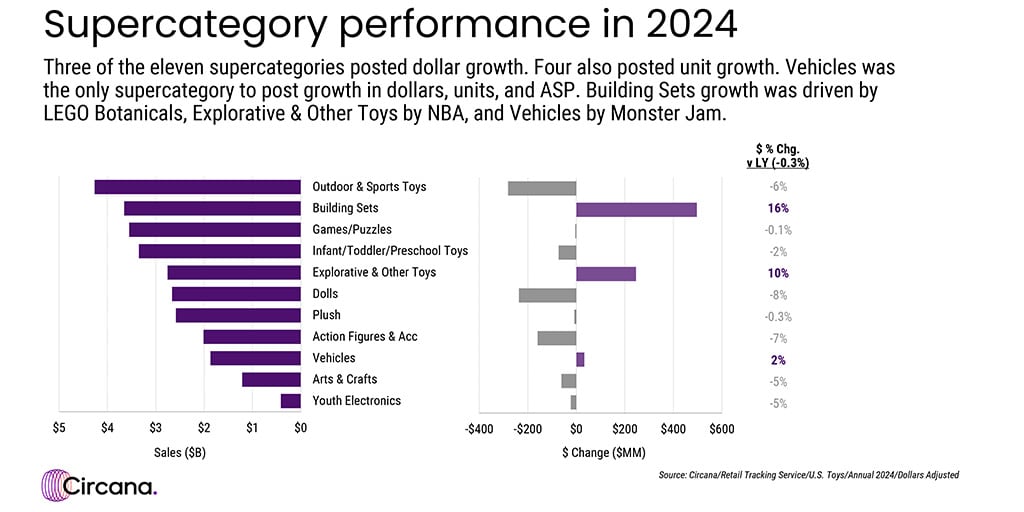

Looking at product categories, three of the 11 supercategories tracked by Circana posted dollar growth in 2024.

Building Sets was the fastest-growing supercategory, with both dollar and unit sales up 16%, and had the most significant dollar gain of close to $500 million. Because of the strong growth in building sets, it catapulted from the No. 4 ranked supercategory in 2023 to claim the No. 2 spot in 2024. LEGO Botanicals, LEGO Ideas, LEGO Icons, and LEGO Creator 3-in-1 dominated the growth in the category. The LEGO Group’s Botanicals Bouquet of Roses (pictured top) was last year’s top-selling item in Building Sets.

Year-over-year dollar sales of Explorative & Other toys grew by 10%, contributing $246 million in gains. Growth for this category was driven by NBA and NFL trading cards, as well as MGA’s Miniverse, Donruss, MLB, and Little Tikes. The top-selling item for 2024 was the MGA’s Miniverse Make It Mini Food Diner Minis Assortment from MGA Entertainment.

The other supercategory to post dollar growth in 2024 was Vehicles, up 2%. Monster Jam, Cars The Movie, Godzilla x Kong, and Hex Bots primarily led this. The best-selling product in 2024 was Mattel’s Hot Wheels Singles 1:64 Assortment.

Among the supercategories to experience the steepest annual dollar losses, sales of Outdoor & Sports toys declined by $282 million, or 6%, for the year, driven by NERF, KidKraft, and Hover-1 declines. ZURU’s X-Shot, Bluey products, and KidKraft’s Cedar Summit performed well. The top-selling item in outdoor and sports toys was the Bunch O Balloons 3-pack from ZURU.

Dolls were down 8%, mainly driven by year-over-year declines in L.O.L. Surprise!, Barbie, and Disney Princess. Growth properties included Hello Kitty & Friends, which turned 50 last year, Basic Fun!’s relaunched Littlest Pet Shop, and Disney Princess Moana. The top-selling doll item in 2024 remained a perennial classic that tops the charts every year: the Barbie Dreamhouse from Mattel.

Action Figures & Accessories experienced a 7% decline, mainly driven by Star Wars, Marvel Universe, Super Mario Bros., and Funko Pop! figures. Godzilla x Kong, Sonic the Hedgehog, and MrBeast posted the most significant dollar gains. The top-selling Action Figures & Accessories item was the Godzilla x Kong: The New Empire 6-inch Figure Assortment from Playmates Toys.

Based on dollar sales, the year’s top 10 toy properties include Pokémon, Barbie, Squishmallows, Marvel Universe, Hot Wheels, Star Wars, Fisher-Price, LEGO Botanicals, LEGO Star Wars, and NFL. Looking at the top growth properties of the year, LEGO and sports are the common themes. We are also starting to see the positive effects of the box office, with Sonic the Hedgehog and Lilo & Stitch making the growth list.

CATALYSTS OF CHANGE

Circana’s receipt-based Checkout data reveals interesting findings regarding recipient insights and reasons for purchasing toys. Looking at purchase occasions, “no special occasion” remained the top reason to buy a toy in 2024. The fastest-growing occasions inspiring purchases were achievements/rewards and Easter. The combined Christmas and Hanukkah holidays experienced declines in 2024 versus 2023.

Q4 was the softest performing quarter for toys last year (Q1 and Q2 seasonally adjusted for Easter) — a somewhat expected result due to the shorter holiday season and one fewer weekend to shop between Thanksgiving and Christmas. While toys did land on par with the average when we look across other discretionary categories, this is positive news; however, it is worth noting some competition the toy industry faces from some of these other categories.

Kids are expressing growing excitement and interest in beauty products. Circana’s Omnibus Survey found that 46% of parents planned to give a beauty product as a gift for their child under 13 years old this past holiday season — and 79% of those parents said their child asked for it. More than one-third (36%) of parents anticipated buying cologne for their sons ages 13-17 during the holiday season. As an industry, it is crucial to understand the whole gamut of what our consumers want, as some of the declines we feel may be attributed to these buying shifts.

The kidult market, ages 18 and over, continued to drive market growth in toys, with a year-over-year increase of more than $800 million in 2024, according to Circana’s Checkout. Female recipients comprised about two-thirds of the gain and grew twice as fast as their male counterparts. Adults now make up $7.6 billion in annual toy sales. Furthermore, consumers making toy purchases for themselves had the fastest and largest dollar growth among all segments — up 11% in 2024, versus 2023. If we look at Q4, that growth is even higher. The adult market is a huge white space opportunity for growth. This age group has low penetration for toys, and there are so many more adults to reach if we can make the right toys for them.

INTO THE FUTURE

Stabilizing tailwinds, such as growth in the kidult space and higher-income household spending, helped balance out the headwinds in 2024, such as higher grocery prices and rising consumer debt. In 2025, I expect the toy industry to move from stability, or consistency, to creativity. We have a strong lineup of toyetic movies coming in 2025 and 2026 to stimulate growth for the industry and excite younger audiences.

While the toy industry did reach stability in 2024, I hope the new year will usher in more stability across all product categories. The winning companies are proving to the industry that creating fresh, innovative products and targeting what might be an untapped consumer base can work and even thrive in this social media-driven world. Manufacturers and retailers need to be able to discern these white space opportunities and create innovation to fill that space.

Data Sources: Circana, Retail Tracking Service, January-December 2019-2024; Circana, Checkout Recipient Insights, January-December 2024.

Data is representative of retailers that participate in Circana’s Retail Tracking Service. Circana’s current estimate is that the Retail Tracking Service represents approximately 71% of the U.S. retail market for toys.

A version of this feature was originally published in the 2025 edition of The BIG Toy Book. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!