The remainder of 2019 should see a reversal in negative sales trends.

by JULI LENNETT, vice president, industry advisor, U.S. toys, The NPD Group

Year-to-date through June, the total U.S. toy industry saw retail sales drop by $705 million to $7.5 billion, a decline of 9%, according to the NPD Group’s Retail Tracking Service. This decline comes after strong growth of 7% over the same time period last year, which was largely a result of the Toys “R” Us liquidation sale.

Not surprisingly, June was the best-performing month this year (when excluding Easter calendar shifts), down 1.9%, as the Toys “R” Us liquidation sales last June were winding down, and the industry is now beginning a new comparison period.

To get a better picture of the health of the industry, I prefer to look to the year-to-date compounded annual growth rate (CAGR) from 2016 to 2019, which was up nearly 1%. When drilling down into Census regions, it shows the dichotomy between regions that were considered “Toys “R” Us country” versus those that were not. For example, the Northeast region, which was overdeveloped for Toys “R” Us, was the only region with a negative CAGR. All other regions posted a positive CAGR. The South, with a CAGR close to 2%, has recovered the fastest and has the lowest declines of any of the regions.

In the next six months, we should see a complete reversal of the negative trends, as we will see gains due to new sales compensating for the pantry loading from the liquidation last year, as well as a reduction in the evaporation of toy sales due to the Toys “R” Us closure.

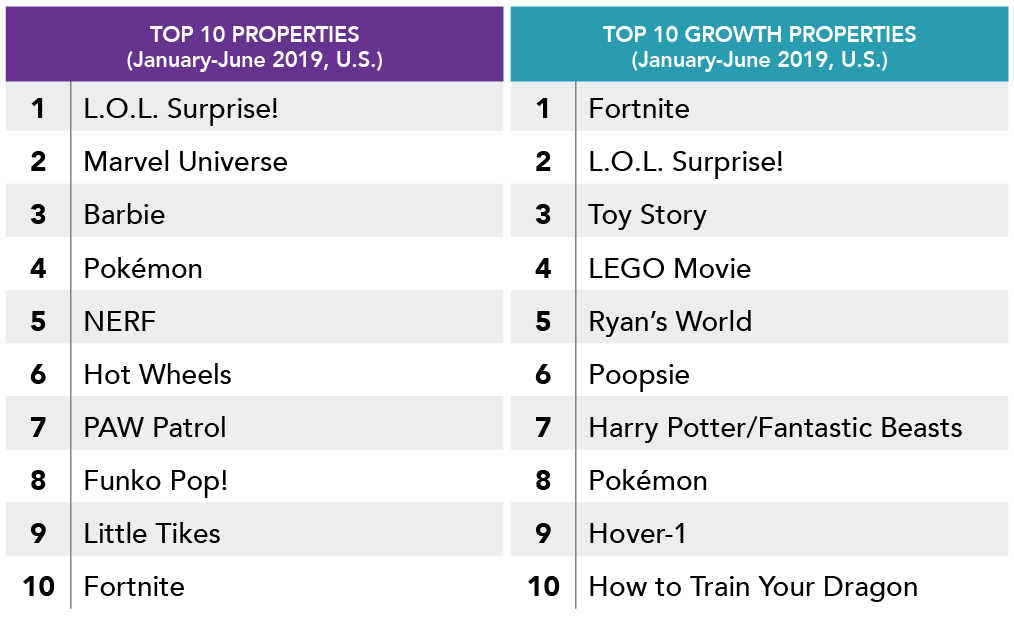

January through June this year, Fortnite was the top growth property. Fortnite appears in 11 different toy classes in NPD’s data, but is only No. 1 in one of them: Action Figure Playsets & Accessories. It is the No. 3 property in the action figure supercategory, its largest supercategory by dollars.

The action figures class was the top dollar growth class of the 96 toy classes tracked by NPD. Toy Story led the growth in this class, followed by Fortnite and How to Train Your Dragon. These movies were only recently released, so their futures could be promising. In fact, Toy Story sales, within the action figures class, are already larger than Fortnite sales in this class.

Interest in manga is on the rise, with the growth in toys tied to some familiar names, such as Pokémon, Beyblade, and Bakugan. At NPD, we’re seeing growing interest in manga in the video games, books, and media entertainment industries, which leads me to believe there is a larger opportunity in the toy industry to pursue outside of these already-popular manga toy properties.

The top-performing toy properties based on total dollar sales include L.O.L. Surprise!, Marvel Universe, Barbie, Pokémon, and NERF. Fortnite continues to be the No. 1 dollar growth property so far this year, followed by L.O.L. Surprise!, Toy Story, LEGO Movie, and Ryan’s World. Also notable, collectibles continue to drive toy sales growth with four of the top 10 growth properties having half or more of their dollars tied to collectible toys.

Now that the negative Toys “R”Us comparisons are no longer impacting current trends, as well as the anticipated positive effects of a strong slate of license-friendly movies in the second half of the year, the remainder of the year looks positive. The industry is already experiencing positive growth, with a 6% increase in sales in the first six weeks of the third quarter this year, versus the same time period in 2018.

This article originally appeared in the September/October 2019 issue of the Toy Book.