by GERRICK JOHNSON, Independent Toy and Leisure Products Expert

News from the public toy companies improved during second quarter earnings season, with more confidence in 2024 than we heard earlier in the year. Still, cautiousness remains heading into Q3. Hasbro (HAS) still sees the industry down mid-single digits this year, while Mattel (MAT) also sees it down “slightly.” The concerns I have heard most often from public toy companies are the impact of the economy on consumer spending as well as shifts in consumer spending towards experiences and services.

Public investors have been skeptical of stabilization in 2024 and growth in 2025 for toy companies, as evidenced by valuation multiples for toy stocks that are at discounts compared to historical data and the overall market. The average price-to-earnings (P/E) ratio for public toy companies is 12.3x 2024 earnings per share (EPS) estimates and 12.1x 2025 EPS estimates. This is a significant discount to the S&P 500 Index, which trades at 22.6x 2024 EPS estimates and 20x 2025 estimates. Historically, toy stocks have traded at ~15x forward EPS. By valuing these companies at a discount, investors are betting that earnings estimates are too high and need to come down.

Yes, it’s a challenging economy. But aren’t toys defensive? And yes, the shift to experiences is real. But why are experiences more appealing than toys? I think the answer is a general lack of compelling innovation. When I walk the toy aisles or surf online, I see little that excites or intrigues me.

The economy is easy to blame for lackluster performance. Few will argue with the challenge consumers face, but I was taught that toys are the last thing to be cut from the family budget. I recall a time when a tough economy meant investors would buy toy stocks because they were defensive, not sell them because they were discretionary. Investors clearly don’t feel that way anymore, with the five North American toy stocks — Funko, Hasbro, JAKKS Pacific, Mattel, and Spin Master — declining, on average, -21% over the last two years (vs +39% for the S&P 500).

But if we look back through history, the toy industry has shown decent performance in poor economies. In 1982, U.S. GDP compressed -1.8% (Bureau of Economic Analysis), and inflation was +6.2% (Bureau of Labor Statistics). The toy industry, however, grew about +20% (according to some old NPD/TRST data I had tucked away). There was some great innovation back then. He-Man was introduced in 1981 and took off a year later (Toy Time, Christopher Byrne, 2013). Trivial Pursuit was released in 1982, bringing folks of all ages together with something new in the game aisle.

In 1983, as the U.S. was climbing out of recession, the toy industry grew by +15%, with more innovations like Care Bears, Rainbow Brite, and, of course, Cabbage Patch Kids. Each Cabbage Patch Kid was unique and adoptable — a truly innovative concept.

During the recession of 1991, the GDP shrank -0.1%, and inflation was +4.2%. Yet the toy industry grew by +15% (and another +12% in 1992). I credit POGs, the re-imagined milk cap game, and the introduction of Larami Corp.’s Super Soaker, a giant leap forward in water blasters.

How about the global financial crisis of 2009? Back then, GDP compressed -2.6%. While the toy industry shrunk -0.5%, that was much better than other consumer discretionary categories. Spin Master’s Bakugan “burst” onto the scene in 2008 with some of the best engineering we’d seen in a toy since Transformers debuted in 1984, and the brand racked up sales in 2009.

We all know that great innovation can help grow the entire industry by creating buzz and excitement while generating multiple trips and clicks to the store. But over the past couple of years, I haven’t seen a whole lot. And this year? I’m still waiting to be titillated. So far, what I’ve seen hasn’t impressed me much. The return of Street Sharks and Moana? Squishmallows as miniature collectibles? Fisher-Price wooden toys? More Transformers, Minions, and Teenage Mutant Ninja Turtles? Of course, I haven’t seen everything coming to market yet, so there is still hope for the holiday season.

Why the scarcity of toy innovation? I have two guesses. The first is the COVID-19 pandemic. Working from home was not ideal for toy development, and I believe we have seen the result of that innovation gap flowing through to the retail channels.

Then, I wonder if the Toys “R” Us bankruptcy chickens have come home to roost. It’s been six years since the nation’s only dedicated big-box toy retailer liquidated its entire store fleet. At the time, I had written that the industry would suffer, particularly in the area of innovation. Toys “R” Us carried an expansive line of products across many categories, allowing toy companies to experiment with new ideas. The current retail paradigm is less conducive to new, fresh ideas.

Or maybe those are just good excuses, and the toy industry has lost its innovative spirit. I can’t say I have the answer, but I know the toy industry is resilient and filled with many intelligent, entrepreneurial people. The industry has overcome many challenges in the past, and I have faith it will regain its mojo. When that happens, hopefully investors will be inspired by new concepts and ideas; take another look at toy stocks; and recognize their defensive characteristics, inexpensive valuations, and growth potential. That should lead to multiple expansions and stock price appreciation.

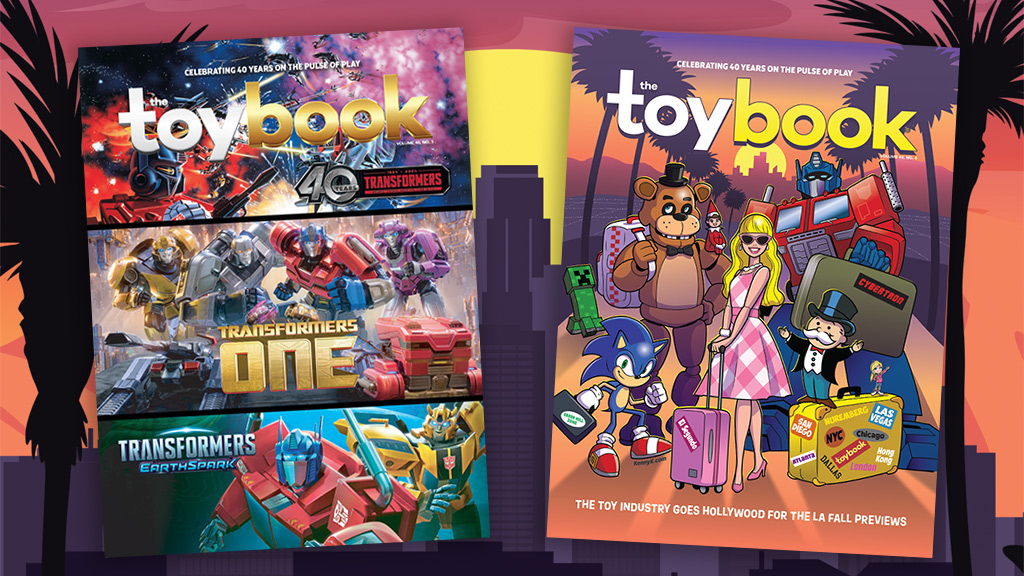

A version of this feature was originally published in The Toy Book’s 2024 LA Fall Toy Preview Issue. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!