by JULI LENNETT, Vice President, Industry Advisor, U.S. Toys, Circana

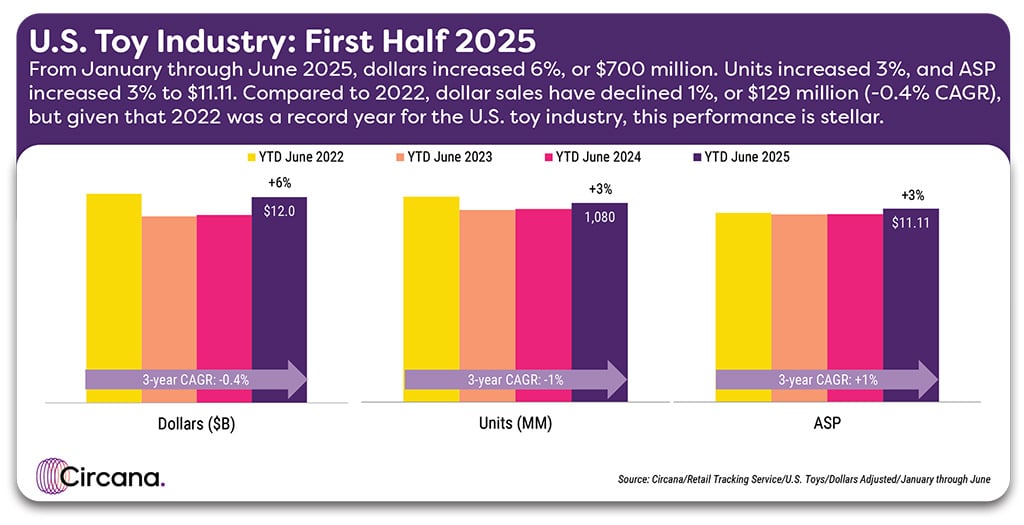

Following sales declines in 2023 and a relatively flat performance in 2024, the U.S. toy industry is back to growth in 2025. In the first half of the year, dollar sales increased by 6%, units sold were up 3%, and the average selling price (ASP) grew by 3% versus the same period in 2024, according to Circana’s Retail Tracking Service data. This increase in ASP is notable since it has been flat for three consecutive years.

FIRST HALF HIGHLIGHTS

Looking at product categories, seven of the 11 supercategories posted dollar growth, including Games and Puzzles (+39%), and Explorative & Other Toys (+19%), which were driven by Pokémon and NFL trading cards, respectively. Other supercategory growth areas include Youth Electronics (+9%), Action Figures & Accessories (+8%), Building Sets (+7%), Arts and Crafts (+4%), and Vehicles (+2%). Outdoor & Sports Toys continues to hold the spot as the largest supercategory based on dollar sales volume, but it also contributed the most significant declines in the first half. In June, the Outdoor category performed slightly better after double-digit declines in May, potentially due to the heat wave driving growth in some summer seasonal categories.

When we consider the factors driving the toy market, trading cards, licensed toys, and products for the adult consumer are leading the charge. Both Strategic Trading Card Games, like Pokémon, and Non-Strategic Trading Cards, dominated by sports, including the NFL, MLB, and WNBA, accounted for 70% of the growth in the first half.

Licensed toys, which make up more than one-third (37%) of toys sold in the U.S., grew by nearly four share points, compared to 2024, with sales increasing by 18%. Every top growth property so far this year is connected to licensing, content, or movie releases in some form. Video game properties were dominant among the top 10 gainers, including Pokémon, Final Fantasy, and Minecraft, which also had a movie release this year. Other movie licenses contributing to the growth were Formula 1, Lilo & Stitch, and Sonic the Hedgehog. I expect licensed toys — especially those with ties to content — will be industry growth drivers for years to come, in part fueled by social media and the tribal mindset that accompanies it.

Looking at demographics, adults continue to drive market growth in toys, with sales increasing by 18% for recipients aged 18 and older. The growth in the adult market is nearly split between males and females. On the other hand, growth in ages 9-11 (+9%) and 12-17 (+6%) was driven by males. It is also worth noting that toy sales for 3-5-year-olds reversed direction compared to 2024 and grew in the first half of 2025.

A PULSE ON PRICING TRENDS AND TARIFF SENTIMENTS

It is too soon to ascertain tariffs’ impact on the toy industry. As I mentioned earlier, in the first half of the year, the average selling price for a toy grew by 3%, compared to last year. However, it is essential to note that tariffs do not necessarily drive this increase; there could be multiple reasons contributing to the increases, including fewer promotions or product mix. But there are a few important callouts that the data reveals to us.

When we drill down into the pricing brackets, price points under $20 lost share to those above $20, which posted double-digit growth in the first half. This tells us that even though overall consumer sentiment remains low, they are still willing to spend their money on the right products. At the same time, there is the possibility that consumers are trading up to higher-priced items for gift-giving later, to get around the anticipation of even higher prices during the holidays.

Seven out of 10 U.S. consumers believe that tariffs will result in higher prices on the shelf — an increase of 11 points since January, according to a Circana survey. Because many consumers expect prices to rise, their behavior is also changing. To combat higher prices, 50% of consumers are looking for sales and deals more often, and 45% are cutting back on non-essentials. This tells us that consumers are bracing for impact.

Good news for the toy industry is that while 35% of consumers anticipate cutting back on their overall spending in the coming months, they are less likely to cut back on toys. In fact, toys fall at the bottom of the list of items consumers plan to trim, in the company of other items that make people happy, like books, video games, and pets, and essentials like car maintenance and school supplies. And, if consumers cut back on more expensive entertainment like vacations and dining out, they may allocate more to spend on less expensive entertainment, like toys.

The toy industry is showing strength during this period as consumers are holding their breath and waiting for higher prices to kick in. This resilience is especially important as we set our sights on the holiday season and what categories are critical for consumers to bring joy to their loved ones.

Data Sources: Circana, Retail Tracking Service, January-June 2022-2025; Circana, Checkout Recipient Insights, January-June 2025; Circana, Monthly Receipt Panel Survey, June 2025; Circana, Shopper Survey, May 2025; Circana, Omnibus Survey, July 2025

Data is representative of retailers that participate in Circana’s Retail Tracking Service. Circana’s current estimate is that the Retail Tracking Service represents approximately 71% of the U.S. retail market for toys.

Stay on the Pulse of Play!

A version of this feature first appeared in the 2025 LA Fall Toy Preview Issue of The Toy Book. Read the full issue here!

Want The Toy Book delivered straight to your desk? Subscribe today and get seven big issues a year — packed with the stories, trends, and insights that keep you on the #pulseofplay.