by CHRIS BYRNE, The Toy Guy, President, Byrne Communications

If you made it through the pandemic only to be confronted by a whole new set of challenges, well, welcome to the toy industry. That should come as no surprise. The history of the toy business throughout the 20th and into the 21st century is all about challenge, change, and (resiliently) chugging along.

Notwithstanding, the industry has always found creative ways to meet setbacks, and as I like to say, as long as people reproduce and buy stuff for kids, we’ll still be here.

One of my favorite examples of creativity in the face of uncertainty has always been Lionel’s 1943 paper train (aka The Lionel Wartime Freight Train). Since all metal was dedicated to the war effort amid World War II, they made a punch-out set that sold for one dollar. It wasn’t all that popular, but, hey, they tried, and it’s a collector’s item now.

Eighty years later, however, there are developments that couldn’t have been conceived of then, but toymakers are still responding creatively. Over the summer, we spoke to toy folks about the challenges they’ve faced this year, and how they’re responding and moving ahead. The overwhelming sentiment echoed by many: the pandemic sales boom has fallen off a cliff leading to big declines in 2023.

“For me, we play in toys, which is a discretionary category, and year-to-date, the category has struggled,” says Geoff Walker, President and CEO of KidKraft, noting that as consumers are concerned about the costs of food, gas, and other essentials, they’re looking for deals. July’s Amazon Prime Day was a big success for KidKraft. “If you went deeper than 10% [in discounting], you could drive some volume. This is a good sign for the selling season,” he says.

THE RETAIL RESET

Retail is on everyone’s mind, and virtually the entire industry is dealing with the challenges of inventory overhang. Josh Loerzel, Co-Founder of Sky Castle Toys, says that while shipping rates have normalized and lead times have returned to pre-pandemic levels, retailers are still reluctant to commit to new products due to excess inventory. “Brick-and-mortar is backed up. We’re still feeling the ramifications of the shipping crisis,” he says.

Walmart and Target are very good at forecasting sales, according to Bob Moog, President of University Games, but they’re mitigating risk by placing the burden on their vendors. Moog says that retailers are often asking manufacturers to hold onto inventory in the event of an order.

For the specialty market, which thrived in the COVID-19 era, flexibility is key, and the smaller manufacturers that depend on independent toy and game stores are doing what they can to meet changing needs.

Mukikim Executive Vice President Tom Delaney says that his company has been able to leverage the capacity of its own warehouse to break up case packs to give specialty retailers smaller, starter packages. This move allows retailers to expand their offerings without a heavy capital investment.

While going direct-to-consumer (DTC) is a key strategy for many, Loerzel points out that making DTC profitable with small orders isn’t easy. Retail partnerships are also helping manufacturers meet consumers in new ways. KidKraft’s Walker says that they’ve inked an exclusive deal with Costco for their Toy of the Year (TOTY) Award-nominated Beat Board, which doesn’t fit a standard planogram. Foot traffic and in-store prominence will be key to success, he says.

SHIFTING TACTICS FOR SALES SUCCESS BEYOND Q4

Heading into the holiday season, many say they’re resigned to perhaps lower revenue in 2023, but they are excited about the longer-term potential. Ronnie Frankowski, Global President at Moose Toys, says that the company strategy has been to focus on the long-term, versus what he calls “short-term volatility.” The answer, he says, is innovation. “The goal is to be as innovative as humanly possible.” He says that they are also mindful of the global economic situation and deliver innovation at price points below $20 — not always the easiest thing to do these days.

Perhaps the greatest shift in the industry, though, is in promotional strategies and tactics. It’s challenging and, sometimes, wildly unpredictable, but that doesn’t stop people. TikTok, user-generated content, and changes in media consumption among key audience segments are affecting all programs.

“It’s gotten harder. There’s no question about that,” Frankowski continues. “We try to do a lot of experimentation, and we have an appetite for trying and failing. We can try a bunch of things with minimal investment. Kids are now inherently digital-first, and linear programming is struggling.”

Frankowski adds that where marketing departments used to experiment with two to three variables, the rise of TikTok, and other social media platforms, allows them to try eight to ten tactics. “[Marketing mix has] gotten a little harder and more expensive, and I don’t think anyone has solved the riddle.”

TikTok is a powerful platform and played a role in revitalizing Educational Insights’ 17-year-old game, Kanoodle.

“We kept throwing a lot of stuff at the wall, and seeing what would stick,” says Lee Parkhurst, Senior Brand Manager for Educational Insights. Kanoodle stuck and created a sensation, opening the door for what Parkhurst calls “an army of 2,100 affiliates” that create content generating millions of views. The success led to Educational Insights opening the first toy and game store on TikTok.

Freddie Jordan, Senior Marketing Manager for Hape, says his company followed suit, launching a TikTok shop to capitalize on the instant appeal of watching a compelling video.

Alex Tongue, President of Vango Toys, says that his company opted out of making a traditional TV commercial for its new Bizzyboo Hide ‘N’ Seek infant toy. Very much on-trend, it’s a sensory product and a manipulative experience that benefits from hands-on, user-generated content (UGC).

Tongue says that the UGC paired with social shares including retail links is working to drive sales.

OLD SCHOOL MARKETING FOR NEW SCHOOL SALES

While grassroots digital marketing is evolving, good old hands-on marketing is part of many programs this year. Steve Rad, CEO of Abacus Brands, says in-store activations are essential to selling his virtual reality (VR) learning kits. Finding ways to deliver a product experience in-store for a product that combines classic books and a VR experience is essential to driving understanding and purchase.

Hands-on play remains a powerful selling tool, according to Kevin Lane, Founder of Create A Castle. “It’s our blessing and our curse,” he says, noting that he and his wife and partner Laurie are the ones out there getting people to play. When families experience Create A Castle’s Shark Tank-backed sand and snow castle building sets hands-on, sales soar, Lane says.

Drew Matilsky, Founder and Managing Partner of Good Soul Brands, agrees that nothing beats the hands-on experience for amping up sales of his Bumpas weighted plush toys. “Something that never goes away is interactive,” he says. Bumpas recently opened an in-store boutique at FAO Schwarz in New York City where kids can engage with toys. Like a weighted blanket, draping the character over the shoulder is comforting — and something that has to be felt to be believed.

The toy industry is a perfect example of the French epigram: plus ça change, plus c’est la même chose — the more things change, the more they stay the same. When has it not been “in transition?” When have there not been stressful challenges? Never. Yet we keep on going.

Anyone who has been in this business for any time has to know that it’s a roller coaster, and the trick is to respond to the realities of a dynamic market … and enjoy the ride!

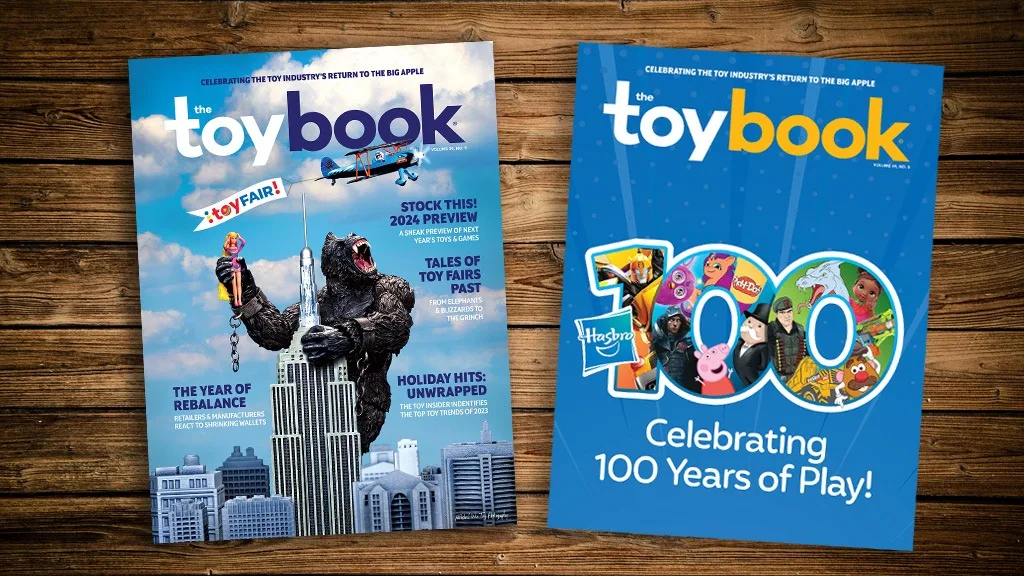

A version of this feature was originally published in the 2023 Toy Fair issue of The Toy Book. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!