Following a surprise bump in the road during Q3, Hasbro beat the holiday slump with a 3% revenue increase in Q4 driven largely by the successful launch of Disney+ and its corresponding partner brands.

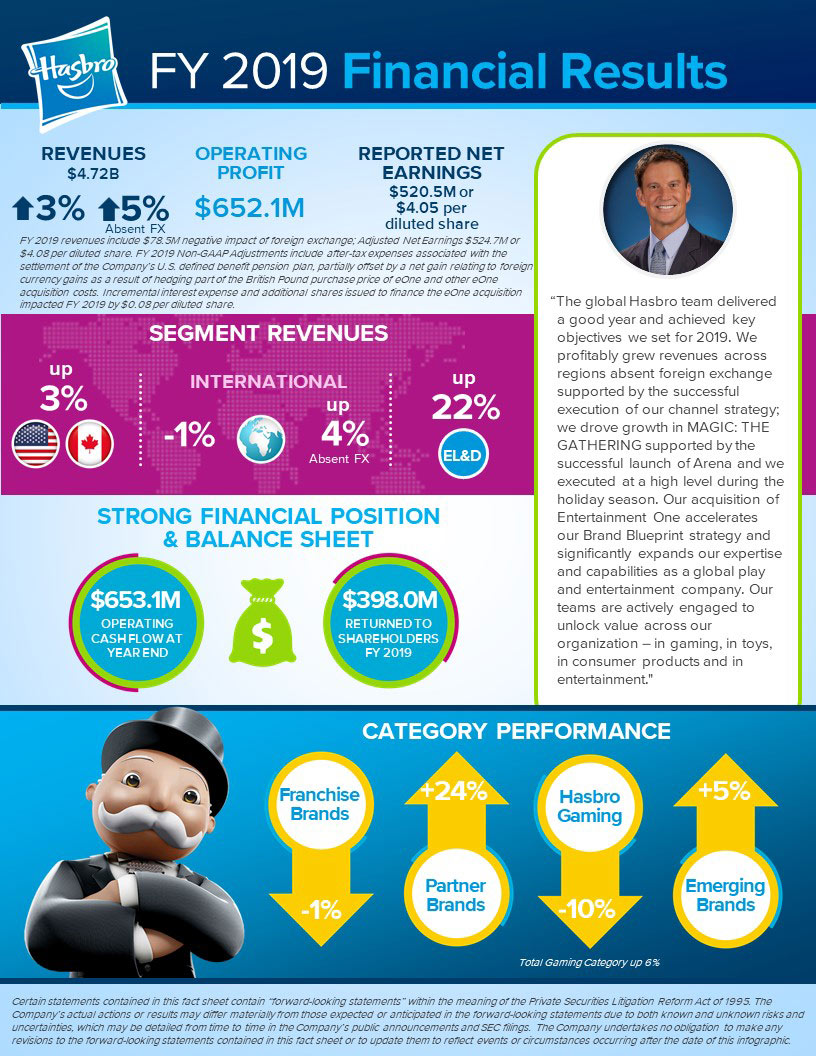

The Rhode Island-based toy and entertainment company reported its Q4 and full-year earnings this morning, coming out ahead for the year with a 3% revenue increase overall. Q4 revenue was $1.43 billion compared to $1.39 billion in 2018. Full-year revenue rose to $4.72 billion versus $4.58 billion in 2018.

Notably, Hasbro’s partner brands, including Star Wars, Frozen 2, Marvel, and Beyblade, did big business, pulling in $409 million in Q4 versus $273 million in 2018. While some retailers have reported softer-than-expected sales from products based on Frozen 2 and Star Wars: The Rise of Skywalker, Hasbro’s sales were driven by successes across its Frozen 2 doll range and Star Wars product related to The Mandalorian — particularly pre-orders of The Child aka “Baby Yoda” items. Additionally, Hasbro Chairman and CEO Brian Goldner notes that the 24/7 availability of older Disney titles streaming on Disney+ is driving sales of products related to the Disney Princess brand. For the year, partner brands were up 24%.

“The global Hasbro team delivered a good year and achieved key objectives we set for 2019. We profitably grew revenues across regions absent foreign exchange supported by the successful execution of our channel strategy; we delivered growth in Magic: The Gathering driven by the successful launch of Arena and we executed at a high level during the holiday season,” Goldner says. “Our acquisition of Entertainment One (eOne) accelerates our brand blueprint strategy and significantly expands our expertise and capabilities as a global play and entertainment company. Our teams are actively engaged to unlock value across our organization — in gaming, in toys, in consumer products, and in entertainment.”

On a call with investors, Golder noted that most of the world’s top properties are multiplatform at this point. He points to The Mandalorian and the success of Fortnite as the key examples.

For the year, Hasbro’s emerging brands category saw a 5% increase driven by shipments of Power Rangers and Playskool product while Hasbro Gaming dropped 10%. The company’s franchise brands declined 1% with soft sales in My Little Pony, Transformers, NERF, and Baby Alive offsetting growth across Magic: The Gathering, Monopoly, and Play-Doh.

Looking ahead, Goldner points to the return of Star Wars: The Clone Wars, The Mandalorian season 2, and new Star Wars offerings from Disney Parks and the forthcoming game show, Star Wars: Jedi Temple Challenge, as continuing to boost Star Wars product sales. At Toy Fair New York, Hasbro is expected to debut new product based on the forthcoming Ghostbusters: Afterlife, G.I. Joe’s Snake Eyes, and more.