by Lutz Muller

In a pretty flat overall market place, Amazon continues to make headway as it is propelled by the ongoing move to cyber space, lower prices, and convenience.

Amazon has three major assets. First, the absence of brick-and-mortar stores allows Amazon to offer an unlimited inventory. Second, Amazon pays no sales tax in most states, which allows the company to undersell its competitors. Third, Amazon’s infrastructure allows it to grow almost limitlessly without the need for expensive retail stores.

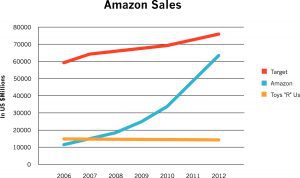

This is how Amazon’s sales developed over the past few years against two major competitors:

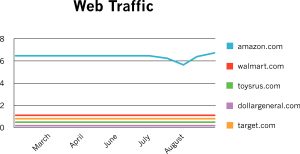

Amazon is also holding its own when you look at web traffic numbers (as estimated percentage of global Internet users who visit the sites as per Alexa.com).

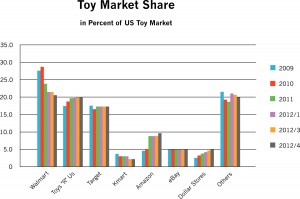

In the toy category, Amazon did fantastically well, nearly doubling its market share since 2009:

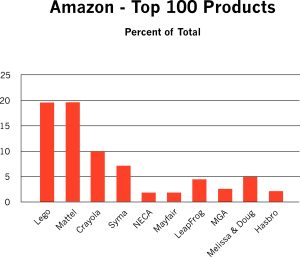

However, not all manufacturers profited equally from this expansion. Here, the top 100 toys sold by Amazon at the end of August are each assigned a weight according to their rank—the top product got a higher weight than the second product, and so on. This is how individual toy companies fared:

Surprisingly, second-tier companies such as Crayola, Syma (a Hong Kong-based manufacturer of R/C helicopters), Melissa & Doug, and others prove to be vital to Amazon’s sales, while top-tier Hasbro brings considerably less to the table. Hasbro’s two main categories are action figures and board games. Here is a comparison of the four major retailers of board games:

Hasbro’s market share in board games is thought to be between 40 and 50 percent, which is shown in the chart for the three brick-and-mortar retailers. Yet, in the case of Amazon, Hasbro’s share is a mere five percent, dwarved by Mayfair’s Settlers of Catan.

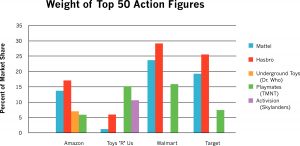

For action figures, the numbers are as such:

Again, there is a statistically significant difference between Amazon and Walmart, Target, and Toys “R” Us. Activision plays an important role in Toys “R” Us due to the popularity of Skylanders.

Amazon and Toys “R” Us have one significant thing in common: depth of assortment. Toys “R” Us devotes 50 percent more shelf space to action figures than Target, and three times more than Walmart. The data suggests that any market shares gained by Amazon are inherently harmful to the interests of the major brick-and-mortar retailers.

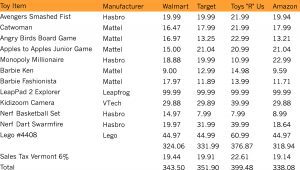

Amazon has a major advantage in that the company pays no sales tax in most states. A comparison of the retail pricing of 12 leading toy products across the four retailers shows that Amazon and Walmart offer considerably lower prices than Target and Toys “R” Us before sales tax. With or without paying sales tax, Amazon offers the lowest prices of all four retailers.

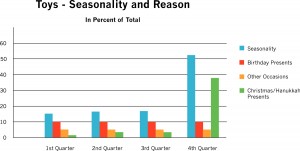

This is likely a look at the future, as state governments and brick-and-mortar retailers are pushing Congress to require e-tailers to pay sales tax. One response to this challenge is for Amazon to institute a same-day receipt of goods policy. The downfall, of course, is that any price advantage would be negated by the cost involved in same-day service. The benefit, on the other hand, is that the almost-instant gratification of the purchase, coupled with a lower price, will appeal to consumers. In the specific case of toys, however, consumers almost always purchase for others—mostly children—eliminating much of the desire for instant gratification. Toys are often purchased in advance for holidays and birthdays. While Amazon undoubtably has an advantage during the holiday season in allowing consumers to avoid the mayhem of a shopping mall, there is little need for same-day delivery.