Hasbro held its first-ever Virtual Investor Event this morning as a digital replacement for its annual in-person event that usually takes place at Toy Fair New York (TFNY). While the company has been holding virtual press and retailer presentations to showcase new toys and games for 2021, the Virtual Investor Event went heavy on entertainment at the payoff from its acquisition of Entertainment One (eOne) is well underway.

As the toy, game, and family entertainment businesses continue to evolve and morph into one another, Hasbro is joining its competitors, including Mattel and Spin Master, in re-segmenting its business for future reporting that more accurately represents what the company does. Hasbro is now divided into three new financial reporting segments: Consumer Products, Wizards of the Coast and Digital Gaming, and Entertainment.

“The integrated and assembled value of consumer products, Wizards and digital gaming, and entertainment is how we unlock the next level of return for our business and for our stakeholders,” says Brian Goldner, Hasbro’s chairman and chief executive officer. “We have simplified our structure to maximize our growth and provide a clearer view to the drivers of Hasbro revenues, profit, margin, and cash generation. Our Brand Blueprint thrives as we create value from these three areas of our business, and we are building scale behind them to drive more profitable revenue and meet the needs of our consumers and audiences with innovation and creativity for a modern era.”

- Hasbro Consumer Products will include all revenue associated with Hasbro’s traditional business — the sales of toys and games — plus licensing and the company’s Global Operations unit that services the supply chain.

- Wizards of the Coast and Digital Gaming includes all revenue associated with Wizards of the Coast tabletop and digital games, including Magic: The Gathering, Dungeons & Dragons, and licensed Hasbro digital gaming.

- Entertainment includes all revenue associated with Hasbro and eOne entertainment across the company’s family brands, TV and film, and music divisions.

On the financial note, most of the presentation echoed what was said when Hasbro reported its Q4 and full-year 2020 earnings earlier this month. Goldner notes that Hasbro’s e-commerce business grew 30% last year. Check out some of the big reveals from the massive presentation below.

Preschool Brands: Insourcing and Brand Building

Goldner says that insourcing the preschool brands that had been licensed out to other toymakers prior to the eOne acquisition should lead to $75 to $80 million in revenue on its own. That begins this fall when the company brings in PJ Masks from Just Play and Peppa Pig from Jazwares.

- PJ Masks will enter the Hasbro portfolio with a refreshed assortment of toys this fall. Kids can look forward to a Deluxe Battle HQ, Launching PJ Seeker, Romeo’s Bot Builder, Deluxe Vehicles, and more.

- Peppa Pig will relaunch with Hasbro’s first batch of five new toys featuring Peppa and friends. Beginning Aug. 1, Peppa Pig Peppa’s Adventures Peppa’s Family Motorhome, Peppa’s Playtime to Bedtime House, Peppa’s School Playgroup Preschool, Peppa’s Ice Cream Truck Vehicle, and Oink-Along Songs Peppa Singing Plush Doll will hit stores.

- Kiya is an all-new preschool brand that will launch in 2023. Kiya is about a 7-year-old African girl, whose passions in life are dancing and martial arts. When Kiya and her two best friends put their magical crystal headbands on, they become superheroes, ready to defend their community against villains. Disney+ and Disney Junior will distribute in the U.S.

Going Big on Entertainment

- G.I. Joe will extend beyond the forthcoming Snake Eyes: G.I. Joe Origins with a live-action original series on Amazon. The series is said to focus on Lady Jaye.

Source: Hasbro - My Little Pony G5 will launch with a new feature film on Netflix to be followed by a 44-minute special and an all-new animated series. The new generation of My Little Pony could be around for at least five years, and will be accompanied by toys and consumer products.

- Transformers is getting new theatrical films — both live-action and animated — plus a pair of Transformers Cyberverse TV specials, a Transformers BotBots series on Netflix, and a new animated series on Nickelodeon.

- Power Rangers continues to be reinvented. Two seasons of Dino Fury are in production.

- Dungeons & Dragons is getting a film from Paramount Pictures and premium animated series on Netflix.

Hasbro Gaming + Gaming on TV

- Following the success of Candy Land on the Food Network last fall, Hasbro is working to bring Monopoly, NERF, Play-Doh, Easy Bake Oven, and other titles into the world of unscripted television.

- Three new Monopoly games — Monopoly Builder; Monopoly Crooked Cash; and an all-new community-based Monopoly campaign — will debut on March 19.

Hasbro x Fortnite

- Hasbro signed a new, five-year deal with Epic Games to extend its Fortnite product licensing deal beyond board games and outdoor (NERF/Supersoaker items) and into item collectible action figures, vehicles, and role-play gear.

It’s NERF or Nothin’

- NERF Hyper is a new blaster segment that includes three new blasters that load quickly and with increased capacity.

- Hasbro x NFL FLAG sees the NERF brand return to sports in a big way as the official supplier of NERF footballs and flag belts for NFL FLAG league play in the U.S.

Live Experiences

- Hasbro and Merlin Entertainment have teamed up for the world’s first Peppa Pig Theme Park. The park will open sometime next year at LEGOLAND Theme Park and will be a separately ticketed event.

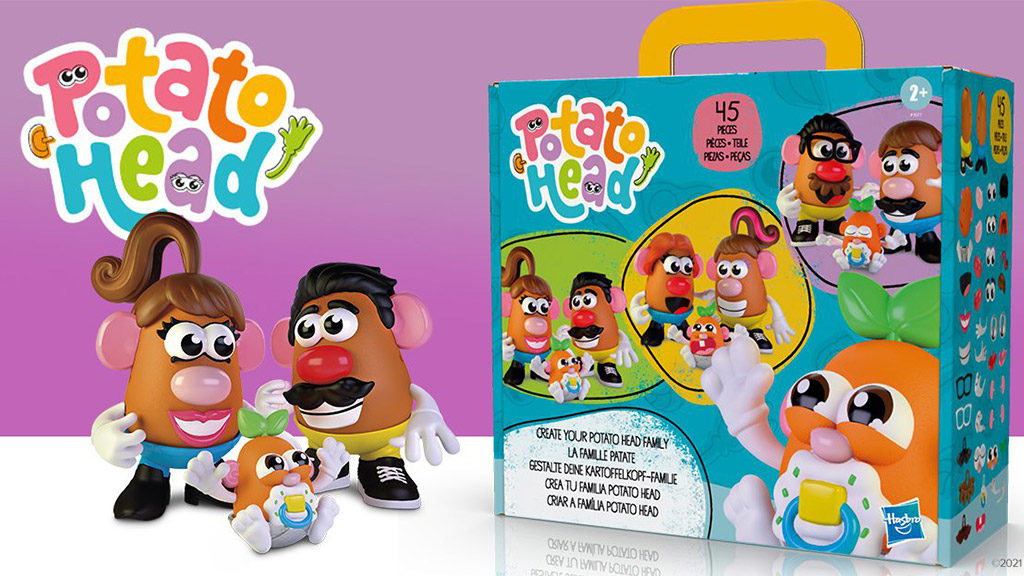

Potato Head Gets a Rebrand

Potato Head brand is dropping “Mr.,” but only for the brand itself. In a move that is meant to be inclusive in letting kids mix and match parts to create whatever kind of family they’d like, the Potato Head family will roll into stores later this year. But Mr. Potato Head and Mrs. Potato Head will continue to be sold under the new Potato Head banner.

Goldner says that the company expects to release 2-3 film projects and 3-5 TV projects every year.