The U.S. toy industry continues to grow during the first half of 2021.

U.S. toy industry sales increased by 19% from January-June 2021, growing $1.7 billion to a total of $11 billion, according to The NPD Group. This impressive growth was bolstered by unit sales increasing 13% during the same time period. This represents a reversal in trend from the prior two years when unit sales declined. Furthermore, the average selling price (ASP) increased 6% to $10.51 during the first six months of 2021.

Anyone who follows the toy industry understands the impact that the COVID-19 pandemic has created. As a result, when assessing new data, it’s important that we consider how the industry has performed from a historical perspective.

From 2018-2021, the industry experienced a compound annual growth rate (CAGR) of 9% in both dollars and ASP, clearly driven by COVID-19 in 2020 and 2021. However, the CAGR for units was flat.

The first quarter drove dollar growth this year, increasing 42%, compared to Q2, which increased just 3%. The substantial Q1 growth was a result of three major events. First, COVID-fueled sales increases last year didn’t start until very late in Q1, so there wasn’t a substantial “COVID comp” to last year. Second, Easter sales volumes moved from Q2 last year to Q1 this year. And, finally, there were two stimulus checks delivered in Q1 2021— one of which hit just a few weeks before Easter.

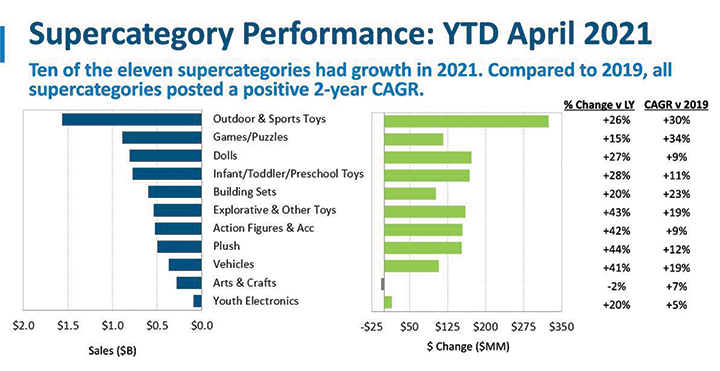

Ten of the 11 supercategories that NPD tracks have grown this year. Outdoor and sports toys continues to be the largest supercategory with $2.9 billion in sales, more than double the size of the second largest supercategory, games and puzzles. Outdoor and sports also had the largest dollar gain — $280 million — while plush had the fastest dollar growth. The only absolute dollar declines this year versus 2020 came from arts and crafts (-1%). This was driven by craft kits, which makes up 42% of the supercategory.

Of course, this is not surprising, as the growth in outdoor and sports toys was partially driven by water-related toys as consumers looked to beat the heat this year. Additionally, parents are still concerned for kids under age 12 who are unable to be vaccinated, and, as a result, “safe social toys,” such as playground equipment and skates/skateboards/scooters also continue to see growth.

Nostalgia has also been a key driver of growth in the past 18 months. Consumers have looked to fill the isolation with memories of happier times in their lives. For example, Pokémon was the No. 1 overall property and top growth property during the first six months of the year and strategic trading card games was the top dollar growth class among all 96 classes tracked by NPD in toys.

Adult males drove growth with nostalgic brands, including Pokémon, Magic: The Gathering, and the National Football League (NFL) in the collectible space, while parents and grandparents leaned heavily on cross-generational properties, including Star Wars, LEGO, and Barbie.

But what does this mean for the rest of the year? There are many moving parts that will serve as headwinds and tailwinds for the toy industry as we head into 2022, but one tailwind that we know will not change before the end of the year is the child tax credit.

We know for a fact that the two stimulus checks issued in Q1 of this year had a profound effect on industry performance. I think it’s safe to assume that the industry should see a similar benefit from the child tax credit. During the week that the first child tax credit checks hit bank accounts, the toy industry grew 17%.

If the past 18 months have taught us anything, it’s that when challenging times emerge, the toy industry often prospers as parents reassess their own personal investments in an attempt to prioritize the happiness of their kids.

Sources: The NPD Group/U.S. Toys Retail Tracking Service, week ending July 17, 2021 The NPD Group/U.S. Toys Retail Tracking Service, January-June 2021

This article was originally published in the October 2021 edition of the Toy Book. Click here to read the full issue!