The toy industry can’t say that it wasn’t warned.

Hasbro, the global toy and entertainment titan, reported a 15% decline in revenue for the third quarter as its operating profit fell 47% to $194.3 million. According to the company, revenues of $1.68 billion were negatively impacted by a shift in schedules on multiple fronts. Pull-forward by retailers to avoid anticipated supply chain challenges, entertainment content delivery, and a shift of major Magic: The Gathering releases to Q4 versus Q3 last year made a dent.

“As expected, the third quarter is our most difficult comparison and was further impacted by increasing price sensitivity for the average consumer,” says Hasbro CEO Chris Cocks. “To achieve our full-year outlook, we are projecting Hasbro’s Q4 revenue to be approximately flat versus last year on a constant currency basis with particular strength from our Wizards [of the Coast] and Digital Gaming segment. Growth will be driven by what we expect to be one of the biggest fourth quarters for Magic: The Gathering as we kick off the brand’s 30th anniversary and celebrate Hasbro’s first-ever $1 billion brand.”

Hasbro says that revenue declined across all three of its reporting segments, including a 10% drop in Consumer Products (including toys), a 16% slide in Wizards of the Coast and Digital Gaming, and a 34% drop in Entertainment.

The Entertainment segment continues to be a point of contention for many analysts as Hasbro’s acquisition of Entertainment One (eOne) at the end of 2019 has consistently delivered a negative impact on the entire operation. Following the sale of its music division last year, rumors have been swirling that the company may be exploring a sale of additional eOne assets. In Q3, operating profit in the Entertainment segment declined by 86%.

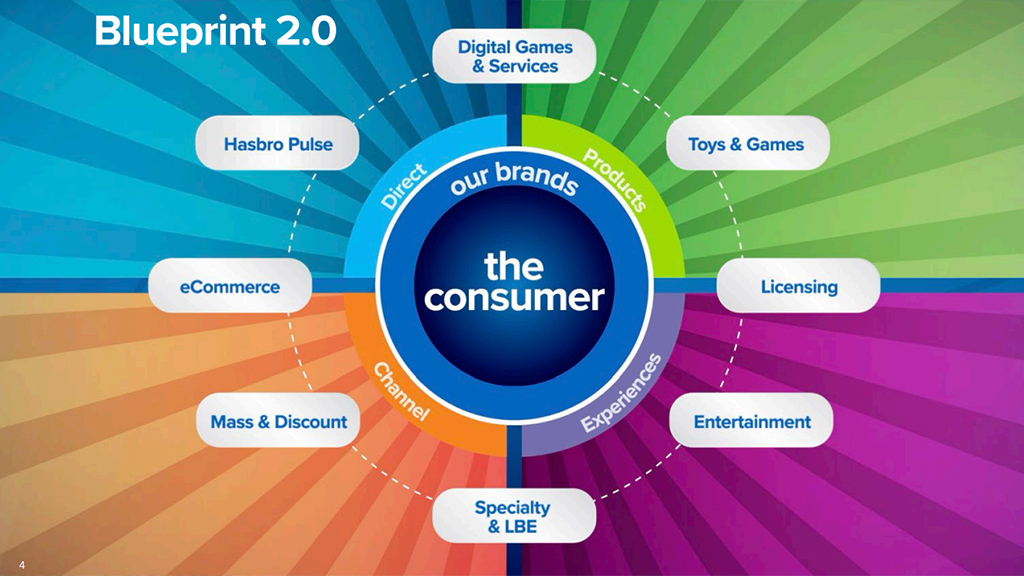

Cocks says that Hasbro is focusing on growth in the coming year as it leans into the Blueprint 2.0 plan revealed during the company’s investor day presentation earlier this month. Under the new plan, Hasbro expects to place much of its focus on developing its biggest brands as it expands its licensing efforts to place more of its portfolio brands with other toymakers, including Basic Fun! (Tonka, Lite-Brite, etc), PlayMonster (Koosh, Playskool, etc.), and others.

“Hasbro is well positioned for growth in 2023 and beyond as we execute our new strategic plan focused on bigger brands, stronger profits, and consumer-focused leadership,” Cocks says. “We are committed to an industry-leading dividend and a three-year program to drive $250-300 million per year in cost savings, including $50 million in annualized run-rate for year-end 2022. We have a strong lineup of new products in Q4 and into next year, seven new blockbuster films and more than 20 streaming and TV shows that we are merchandising against starting with November’s Marvel Studios’ Black Panther: Wakanda Forever and our Transformers: EarthSpark.”