The toy industry has seen a mixed bag in the first half of 2024, but there is some good news.

While individual retailers have seen wildly scattered results from single-digit growth to double-digit declines, total toy industry dollar sales in the U.S. declined by just 1% from January through April, Circana reports. The slowing decline versus the same period last year is said to have outperformed the broader general merchandise categories at retail.

Better yet, toy sales remain 38% ahead of the pre-pandemic 2019 levels. According to Circana, that’s a gain of $2 billion.

We are in a transformative period across retail sectors as consumers navigate high prices and manage their budgets, and while the toy industry is feeling the heat, it is ripe with opportunity. Tailwinds, like the growing adult toy market and spending power of higher income households and grandparents, drive positive trends. However, headwinds like rising household debt, slowing GDP growth, and fluctuating consumer confidence indicate potential challenges. By focusing on innovation and addressing diverse consumer needs, the industry can find the propensity to thrive despite an evolving economic environment.”

The adult consumer segment, slapped with the increasingly polarizing “kidult” label in recent years, continues to grow with adults 18 and up contributing more than $1.5 billion to the market in the first quarter of 2024. In the past year, 43% of adults purchased a toy for themselves and the latest Circana data reveals that the adult cohort has overtaken the 3-5-year-old segment as the most important age group for the U.S. toy industry.

Hot Products

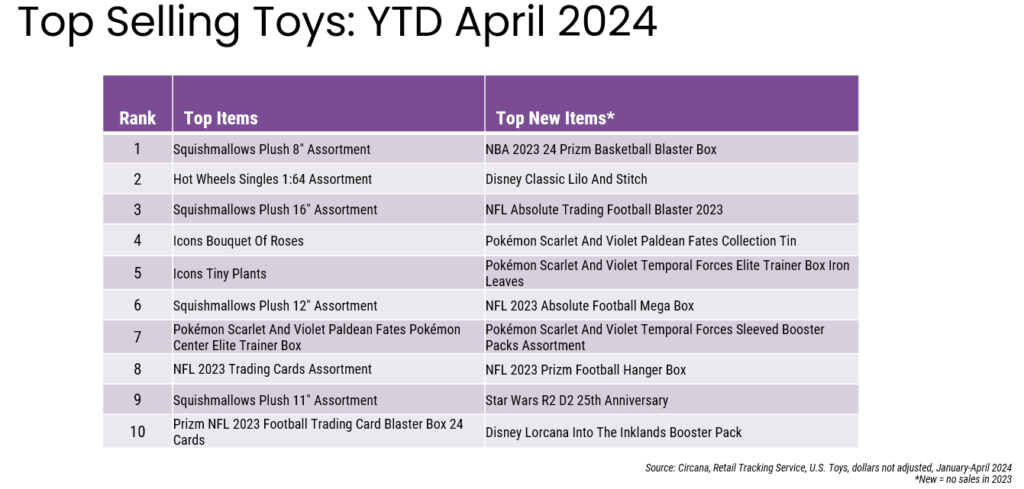

Squishmallows and Trading Cards (with a heavy emphasis on sports) dominated the charts in total sales and new items during the first four months of the year. Just three categories — Building Sets, Explorative Toys, and Vehicles — posted dollar growth from the 11 Supercategories with LEGO Icons, MGA’s Miniverse, and Monster Jam leading the charge.

Looking at the overall top-selling toys across the industry for the four-month period, Squishmallows dominated the list of the top 10 selling items. Trading cards led pack for the top 10 new items for 2024 through April, with a heavy emphasis on sports.

Circana also notes that seasonal sales boosts from Valentine’s Day and Easter led to year-over-year growth in unit sales for Building Sets, Plush, and Outdoor & Sports Toys.

For more data from Circana, be sure to check out Stat Shot in each issue of The Toy Book!