The Mattel turnaround continues at a slow, but steady pace.

The El Segundo-based toymaker reported its Q4 and full-year earnings this afternoon, beating expectations by coming out flat for the year with $4.5 billion in sales. Q4 revenue declined 3% to $1.47 billion, reflecting the challenges that the entire toy industry and retailers shared this past holiday season.

“2019 was an important inflection point in our turnaround. We stabilized our topline after five consecutive years of revenue decline, continued to significantly improve profitability, and achieved positive operating cash flow and positive free cash flow for the first time in three years,” says Mattel Chairman and CEO Ynon Kreiz. “We are very encouraged by the consistent progress the company is making and expect to continue to build on this momentum. We remain focused on the execution of our multi-year turnaround strategy to transform Mattel into an IP-driven, high-performing toy company and create long term shareholder value.”

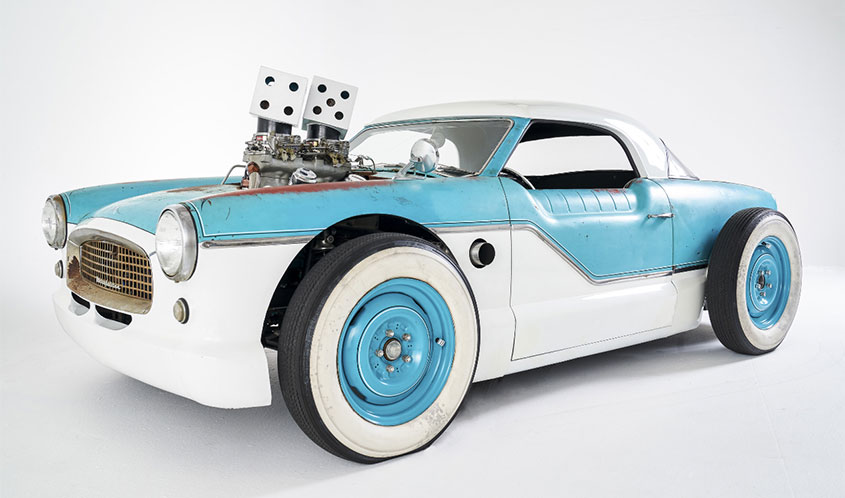

Hot Wheels Continue to Speed to the Cash Registers

The vehicles category, which includes Hot Wheels and Matchbox was up 3% for the year, driven largely by increases in Hot Wheels, specifically. The increase could’ve been higher had it not been offset yet again by declines in Disney•Pixar Cars and Jurassic Park/Jurassic World vehicles. Sales for the Hot Wheels division alone grew 11% for the year.

“2019 was the biggest Hot Wheels year ever,” says Mattel President and COO Richard Dickson. “It’s the sixth consecutive year of POS growth, both in the U.S. and globally. This is a story of complete innovation … We’ve done experiential marketing with the Hot Wheels Legends Tour; introducing Monster Trucks as a new segment … and a variety of other really exciting narratives for Hot Wheels that has proven incredibly successful.”

Dickson says that last year’s Hot Wheels Mario Kart line was the biggest license launch for Hot Wheels since Star Wars in 2015.

“We’re going to continue to surprise consumers with the product that we have lined up that you’ll see as we move into Toy Fair,” he says.

Matchbox, which was recently inducted into the National Toy Hall of Fame, also grew, and Kreiz revealed that the brand will include products utilizing Paramount Pictures’ Top Gun: Maverick license this year.

Action Figures are Doing Big Business

The combined action figures, building sets, and games category was up 14% for the year and 9% in Q4. Sales in Toy Story 4 product led the charge, with gains offset by decreases in Jurassic Park/Jurassic World.

![]()

Barbie Had a Great 60th Birthday

Sales of Barbie products rose 2% in Q4 contributing to a 7% gain for the year. Numerous consumer outreach initiatives connected with families, kids, and collectors. The doll category as a whole was flat for the year, pulled down by the weight of American Girl (see below).

Declines Continue in American Girl, Infant, Toddler, Preschool

We sound like a broken record at this point, but quarter after quarter, American Girl continues to slide, bringing down the doll category (which was flat) with a 21% decrease in sales for the year. Despite new leadership for the division and new retail initiatives last year, American Girl is failing to connect with an audience.

Worldwide gross sales for infant, toddler, and preschool declines 11% for the year. The biggest drops came from Fisher-Price Friends, Fisher-Price, and Thomas & Friends. An excellent brand reinvention campaign from Fisher-Price may not have taken hold with consumers yet as the company still takes a hit stemming from the sleeper recall early last year. Going forward, Fisher-Price is tapping into consumer interest in sustainability with classic products reinvented for a new generation of parents and kids.

Movies on the Way

Kreiz continues to emphasize the theatrical slate for Mattel Films. During 2019, five films were announced, bringing the total up to eight films that are in development in partnership with major studios. The films currently in development include Barbie and Hot Wheels with Warner Bros., American Girl and View-Master with Metro Goldwyn Mayer Pictures (MGM), Magic 8-Ball with Blumhouse, Barney with 59% and Valparaiso Pictures, and Major Matt Mason with Paramount, Tom Hanks and Akiva Goldsman.

Additionally, Kreiz says that Masters of the Universe is still on track with Sony Pictures “and an additional partner as part of a new structure.” That “additional partner” is largely rumored to be Netflix, with which two animated series’ are currently in production. Most recently, Sony Pictures removed the film from its previously announced March 2021 date.

Looking Ahead

Mattel will be showing new product in its private showroom at Toy Fair New York next week. The company expects to achieve low single-digit growth this year as it continues moving back to profitability.