by JULI LENNETT, Vice President, Industry Advisor, U.S. Toys, The NPD Group

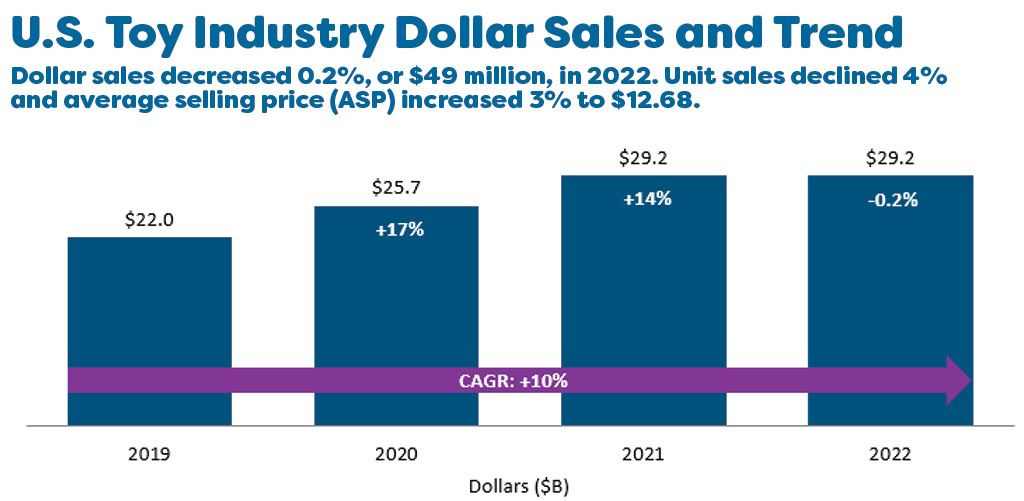

U.S. retail sales of toys generated $29.2 billion in 2022, a slight decrease of 0.2% or $49 million compared to 2021. Unit sales declined by 4% and the average selling price (ASP) of $12.68 was 3% higher than in 2021. While unit sales declined by 4% in 2022, it’s worth noting that the industry is coming off two consecutive years of unit sales increases, including growth of 9% in 2021.

While sales remained relatively flat in 2022, the market saw strong growth over the last three years, including 14% growth in 2021 and 17% growth in 2020. This growth has contributed to a three-year compound annual growth rate (CAGR) of 10%, driven by ASP growth of 8% and unit sales growth of 2%.

2022 came with many challenges, including double-digit increases in food prices, rising interest rates, weather disruptions, and the ongoing threat of new COVID-19 variants and reinfections. These factors made for a long list of shopping hurdles contributing to a muted holiday season for the U.S. toy industry. Looking at the fourth quarter, specifically, dollar sales decreased by 5% or $628 million, according to The NPD Group’s Retail Tracking Service. Unit sales also declined by 5%, while ASP remained flat. Despite a substantial increase in the share of units sold on promotion in Q4 compared to last year, it wasn’t enough to entice consumers to purchase more toys than last year. Budget-conscious shoppers pulled back on discretionary spending and prioritized services and food. While these headwinds certainly impacted overall consumer behavior, the toy industry still managed to finish the year on a positive note as spending kept pace with the previous high-water mark of 2021.

2022 HIGHLIGHTS

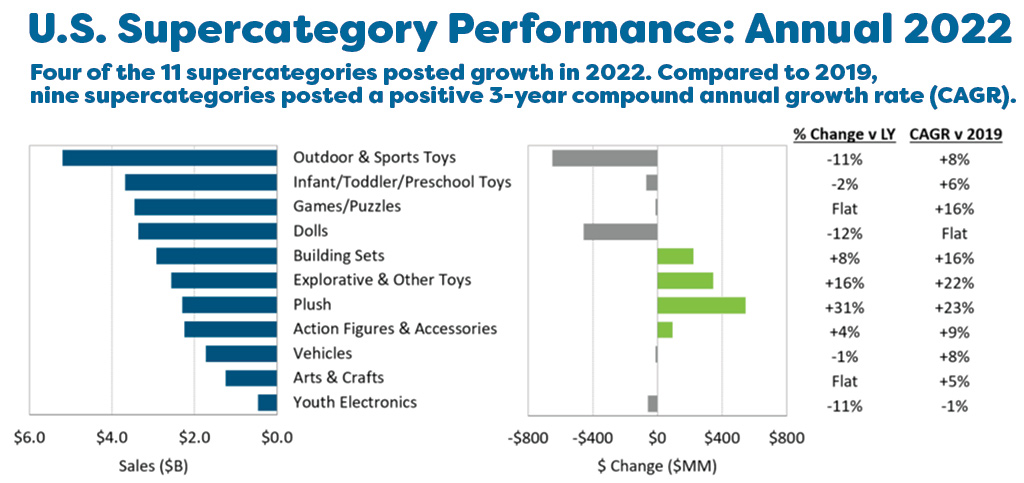

Looking at supercategory performance, four of the 11 supercategories tracked by NPD posted growth in 2022. Compared to 2019, nine supercategories posted a positive three-year CAGR. Outdoor and Sports toys continued to be the largest supercategory, with $5.2 billion in sales in 2022; however, it had the largest dollar sales decline of all the toys supercategories, falling 11% year over year. It accounted for 18% of dollar sales for toys in 2022 and contributed 52% of the annual sales declines. Plush toys had the largest dollar gain of $547 million and the fastest dollar growth, rising 31%. Explorative and Other toys followed, growing 16% year over year.

Moving to CAGR compared to 2019, Plush had the fastest growth of 23%, followed by Explorative and Other toys at 22%. Dolls had a flat three-year CAGR, while Youth Electronics declined by 1%. The top toy properties of 2022 included Pokémon, Barbie, Marvel Universe, Star Wars, Squishmallows, Fisher-Price, Hot Wheels, L.O.L. Surprise!, LEGO Star Wars, and Melissa & Doug. These top 10 properties collectively grew 7%, while the rest of the market declined 2%. On the retail front, the online channel continued to gain share in 2022 and made up 40% of total toy industry dollars, outperforming physical stores all year.

DRIVERS OF CHANGE

- Plush had the largest dollar gain of $547 million, up 31%, with Squishmallows, Magic Mixies, and Pokémon as the main drivers of growth. Jazwares’ Squishmallows accounted for five of the top 10 selling toys for the total toy industry and was the top absolute dollar growth property in 2022.

- Explorative and Other toys increased 16%, or $344 million. The NFL, Disney All Other, and NBA had the largest growth in the category.

- The Building Sets category was up 8% with LEGO Creator Expert, LEGO Technic, and Jurassic Park/World dominating the growth in the category. The LEGO Botanical Collection, which was trending on TikTok, drove the gains for the LEGO Creator Expert brand.

- Action Figures and Accessories saw a 4% increase, mainly driven by Jurassic Park/World, Funko Pop!, and Sonic The Hedgehog. Action figures and Accessories drove more buyers to the category in 2022, with the second largest percent increase (11%) in buyer penetration next to Plush.

- Arts and Crafts remained flat compared to 2021. The largest declines came from Kinetic, while Play-Doh, Crazy Aaron’s, and Lite-Brite had the largest gains.

- Games and Puzzles also remained flat this year, mainly driven by declines in Magic: The Gathering and Monopoly. Pokémon was the largest gaining property in games and puzzles and was also the No. 1 property for the total toy industry.

- Vehicles declined by 1% with the largest declines coming from Nintendo, while New Bright and Jurassic Park/World posted the largest gains.

- Youth Electronics saw an 11% decline with the largest declines coming from Osmo, Little Live, and Squeakee. Robo Alive and CoComelon had the largest gains. Youth Electronics had the steepest decline in buyer penetration, which was reduced by 12%.

- Infant, Toddler, and Preschool toys declined by 2% with the largest declines coming from PAW Patrol and PJ Masks, while Gabby’s Dollhouse and CoComelon posted the largest gains.

- Dolls was down 12% with the largest declines coming from L.O.L. Surprise! and Barbie. Disney Encanto and Monster High had the largest dollar growth.

- Outdoor and Sports toys saw an 11% decline, mainly driven by declines in NERF, Hover-1, and Razor. KidKraft and Minecraft were the largest gaining properties in the category.

LOOKING AHEAD

Like last year, there will be headwinds and tailwinds for the industry, although the headwinds will likely dominate performance in 2023. With a more significant theatrical calendar this year, the U.S. toy industry is poised to enjoy the fruits of several tentpole movies.

However, if inflation and other adverse macroeconomic factors linger later in the year — or become worse — we can expect to see families pulling back on the number of toys they purchase or trading down to lower price points. Looking at the glass half full, as the economy worsens, consumers might spend more time at home for their entertainment. During the pandemic, this home-centric lifestyle was a boon for the toy industry.

What’s keeping me awake at night is losing the momentum in sales of toys to kidults, ages 12 and up. This group made up $9.3 billion in annual toy sales, or nearly 25% of the dollar share, and represented $1.7 billion in dollar growth, nearly 60% of the growth for the 12 months ending Sept. 2022. Adults ages 18 and up made up more than half of that growth. We’ll need to hold onto that substantial growth just to remain flat. Manufacturers need to keep this consumer interested.

The potential downward shift in ASP is another potential headwind. Although the ASP of a toy increased only 3% in 2021, it increased 25% compared to 2019. There were six supercategories in which the ASP increased 8% or more in 2022 alone. As pressure escalates to bring down ASP, and consumers scale back on the number of toys purchased, this could have a domino effect on dollar sales trends. The first three quarters of this year will face the most challenging comparisons since increases in ASPs drove revenue gains last year. With Easter falling in early April, Q1 will benefit the most from those purchases and put added pressure on Q2.

At the end of the day, 2023 could be our new benchmark rather than focusing on 2019. The story for manufacturers will likely be around protecting margins with pricing strategies, investing in marketing, and growing share, but not necessarily growing sales. I would caution manufacturers to not hold back at the expense of the future; the consumer will come out of this period looking to spend on innovative, new toys. As I’ve been saying for three years, do your scenario planning, take advantage of the various datasets and insights NPD has to help you strategize, and be prepared to pivot — you will be pivoting at some point.

Data Sources:

- The NPD Group/Retail Tracking Service, Jan.-Dec. 2022 vs. 2021. The NPD Group/Checkout, Jan.-Dec. 2022 vs. 2021

- Data is representative of retailers that participate in The NPD Group’s Retail Tracking Service. NPD’s current estimate is that the Retail Tracking Service represents approximately 78% of the U.S. retail market for toys.

A version of this article was originally published in the 2023 edition of The BIG Toy Book. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!