by JULI LENNETT, Vice President, Industry Advisor, U.S. Toys, Circana (formerly The NPD Group)

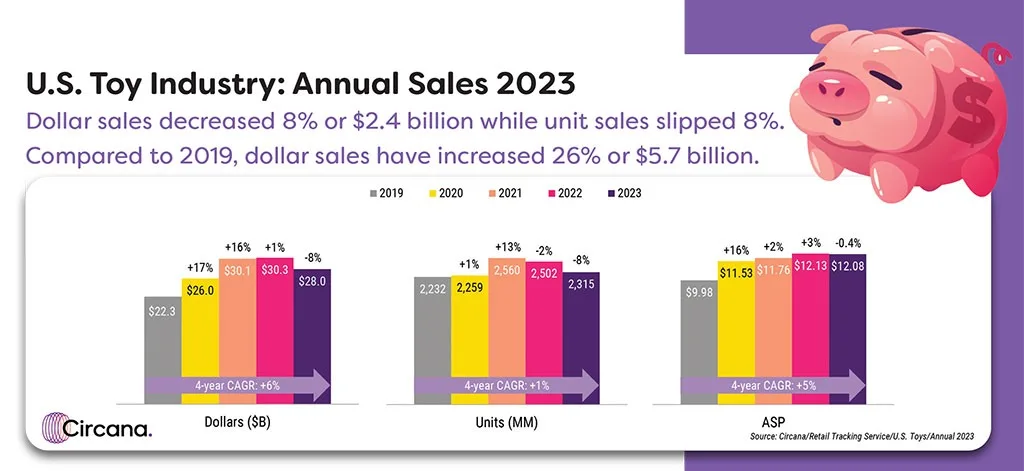

In 2023, retail sales of toys in the U.S. totaled $28 billion, reflecting an 8% decrease — equivalent to $2.4 billion — compared to 2022. This decline was mirrored in both unit sales and average selling price (ASP), which experienced an 8% and 0.4% drop, respectively, with the ASP settling at $12.08.

Looking beyond the annual figures, it’s important to recognize the resilience of the toy industry. Despite the decline in 2023, the overall picture reveals a sizable $5.7 billion increase in sales since 2019. This positive trend is largely attributed to the consistent growth in ASPs over the past four years, driving an average 6% year-over-year increase in dollar sales. The toy industry has demonstrated the ability to adapt and thrive, even in the face of challenges.

The industry experienced several headwinds in 2023, including persistent inflation, dwindling consumer savings, and a rise in consumer credit card debt. These factors markedly affected consumer spending trends, as many shoppers began to prioritize essential purchases and reduce discretionary spending. In the fourth quarter, specifically, dollar sales decreased by 8% compared to last year, according to Circana’s Retail Tracking Service, while unit sales declined at a slightly slower rate of 6% and ASP dropped by 2%.

While economic challenges have impacted overall consumer behavior, the toy industry has still reaped the benefits of an influx of new consumers since 2019. Engaging with these consumers and keeping them interested with innovative and exciting products is essential for driving future growth.

2023 Highlights

Consumer preferences shifted throughout 2023 across product categories, with three out of the 11 supercategories tracked by Circana experiencing growth. Building Sets led the charge with the most significant dollar gain, followed by Plush and Vehicles. While Outdoor & Sports Toys maintained its position as the largest supercategory, it also faced the most substantial dollar decline.

The year’s top-performing toy properties, including Pokémon, Barbie, Squishmallows, Star Wars, Marvel, Hot Wheels, Fisher-Price, LEGO Star Wars, Disney Princess, and Melissa & Doug, offer a snapshot of 2023’s consumer preferences and trends.

Drivers of Change

- Building sets had the most significant dollar gain of $220 million and the fastest dollar growth, up 8%, with LEGO Icons, LEGO Disney Classic, and LEGO Speed Champions dominating the growth in the category. LEGO Icons was the top growth property for the total toy industry in 2023. The top-selling new* item launched in building sets in 2023 was the Icons Botanical Collection Wildflower Bouquet from The LEGO Group.

- Plush had the second largest dollar gain of $31 million, up 1%, with Pokémon, Furby, Harry Potter, ZURU’s Snackles, Sesame Street, and Moose Toys’ Cookeez Makery as the main growth drivers. Jazwares’ Squishmallows had five of the top 10 selling toys for the total toy industry in 2023. The top-selling new* item launched in plush in 2023 was Hasbro’s Furby Plush Interactive Toys 6-inch Assortment.

- Vehicles increased sales by $6 million, or 0.3%, with the most significant boost coming from Hot Wheels, The Fast and The Furious, and Ninja Turtles. The top-selling new* item launched in vehicles in 2023 was the Hot Wheels City Ultimate Garage Playset With 2 Die-Cast Cars from Mattel.

- Youth Electronics saw an 11% decline, with the largest declines coming from Osmo and Kidi, while Spin Master’s Bitzee and WowWee’s relaunched Fingerlings had the largest gains. The top-selling new* item launched in youth electronics in 2023 was the Bitzee Interactive Digital Pet And Case With 15 Animals.

- Games & Puzzles declined by 2%, mainly driven by Connect 4, Pokémon, and Warhammer declines in this supercategory. Lord of the Rings and Ravensburger’s Disney Lorcana posted gains. Nevertheless, the top-selling new* item launched in games and puzzles in 2023 was the Pokémon Crown Zenith Elite Trainer Box from The Pokémon Co. International.

- Arts & Crafts declined 8%, driven by Crayola, Kinetic, and Cra-Z-Art declines. The most significant increases came from LEGO Art. The top-selling new* item launched in arts and crafts in 2023 was the Cool Maker Popstyle Bracelet Maker from Spin Master.

- Action Figures & Accessories experienced a 13% decline, mainly driven by Funko Pop!, Mattel’s Jurassic Park/World, and Marvel Universe. Playmates Toys’ Teenage Ninja Turtles, JAKKS Pacific’s Super Mario Brothers, Hasbro’s Transformers, and Moose Toys’ Beast Lab posted the largest dollar gains. The top-selling new* item launched in action figures and accessories in 2023 was the Teenage Mutant Ninja Turtles Mutant Mayhem 4.25-inch Action Figure Assortment from Playmates Toys.

- Infant, Toddler, & Preschool toys declined by 9%, with the most significant declines coming from Fisher-Price, CoComelon, and Little Tikes, while Tonie Box, PAW Patrol, and Bluey posted the largest gains. The top-selling new* item launched in this this supercategory in 2023 was the PAW Patrol The Mighty Movie Vehicles Assortment from Spin Master.

- Explorative & Other toys declined 12%, driven by ZURU’s 5 Surprise, NBA, and NFL. MGA’s Miniverse and Bonkers Toys’ LankyBox had the most considerable growth in the category. The top-selling new* item launched in explorative and other toys in 2023 was the MLB 2023 Chrome Baseball Trading Card from Topps.

- Dolls declined $554 million, down 16%, with the largest declines coming from L.O.L. Surprise!, Disney Encanto, and Rainbow High. Monster High, Disney Princess, and DreamWorks Trolls had the largest dollar growth. The top-selling new* item launched in dolls in 2023 was the Monster High Skulltimate Secrets Doll Assortment from Mattel.

- Outdoor & Sports toys saw the most considerable dollar losses, down $879 million or 16%, mainly driven by declines in Little Tikes, NERF, Jetson, Razor, and Bunch O Balloons. ZURU’s X-Shot was the largest gaining property in the category. The top-selling new* item launched in outdoor and sports toys in 2023 was the NERF Elite 2.0 Double Punch Assortment from Hasbro.

A Look Ahead

To reset and rebalance was my overarching theme for the toy industry in 2023. This year, my message is one of correction and consistency, to pave the way for stability. With that, as an industry, we need to get through some inconsistency before we can get back on solid ground. Consumers will continue to face financial pressures in 2024 so we’re still in for a bumpy road ahead.

Inflation, despite a slowdown, remains a notable challenge. Elevated prices persist, and consumer demand across the discretionary categories is still yet to fully rebound despite slower inflation. Student loan repayments will further impact parents with young children and the kidult demographic. This financial strain is expected to peak in September 2024, as the deadline looms for starting repayment without negatively impacting credit ratings.

Amidst these macroeconomic challenges, there are some nice tailwinds to lift the industry. Overall, the economy, labor market, and consumer confidence are all showing signs of improvement. On the retail front, retailers are recognizing that they need to improve the shopping experience and are investing in their stores. With many retailers successfully shedding excess inventory from the holiday season, the stage is set for improved inventory management and enhanced reported sell-in to retailers compared to 2023. From a demographic perspective, grandparents are stepping up to the plate, buying more toys for their grandchildren in the third quarter of 2023 compared to the prior year. Grandparents have big spending power in the toy industry, so implement a grandparent strategy if you don’t already have one.

Consumers will be more focused on their immediate needs in the year ahead, but they naturally will not forgo the top toy-buying occasions including birthdays, Christmas, Easter, and so on. Doubling down on these occasions will be critical as consumers manage tighter budgets. Highlighting overall value to justify spending and offering something for everyone, across all price points, will be important for success.

Furthermore, adopting a strategic approach to marketing, inventory management, and adapting to shifting demographics will offer toy industry

leaders a way to navigate and thrive in 2024. Consumer demand will be heightened by newness, innovation, and evergreen or nostalgic products showcased in a new light.

Data Sources: Circana, Retail Tracking Service, January-December 2019-2023; Circana, Checkout Recipient Insights, Q3 2023. Data is representative of retailers that participate in Circana’s Retail Tracking Service. Circana’s current estimate is that the Retail Tracking Service represents approximately 76% of the U.S. retail market for toys.

*New = no sales volume in 2022

A version of this feature was originally published in the February 2024 edition of The BIG Toy Book. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!