It’s been a big week here at The Toy Book, and when I say “big,” I do mean BIG.

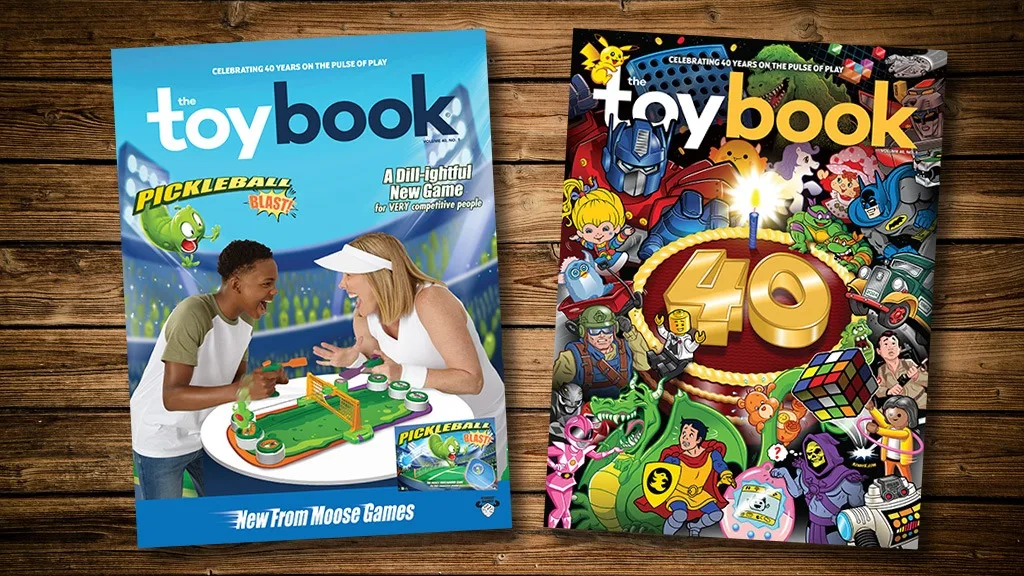

Last week, our team unleashed the 2024 edition of The BIG Toy Book, a colorful issue that kicks off the 40th volume of this storied publication. As the current leader of the longest-running print publication serving the North American toy industry, one thing I never tire of is learning of new readers discovering The Toy Book for the very first time. That happened in a BIG way this week as this year’s BIG Toy Book hit the scene in a big way, shattering records to become our most-read February issue since record-keeping began.

In its first week of release, this issue eclipsed last year’s BIG Toy Book and last fall’s Toy Fair issue in terms of digital reads, both of which were record-breaking at the time. With no February Toy Fair (for the fourth year in a row), this year’s BIG Toy Book is already tracking more than 500% more readers than last February’s issue to date.

This is a testament to the incredible work of our team and the passion they put forth every single day. We work to serve the industry that we love, and to see it embraced in such a big way is truly appreciated. If you’re not a subscriber, here’s the link to change that.

But enough horn-tooting for today, let’s talk…

Is Retail the Biggest Issue Facing the U.S. Toy Industry?

Since January, my “From the Editor” columns have taken a serious turn toward the retail side of the business. As a former retailer myself — in both “mass” and “mass-specialty” (specialty retailers with more than a few locations) — I’m obsessed with the retail experience for consumers and how manufacturers, distributors, and retailers can work together to win together. Of course, my main interest lies in correcting what’s happening in the toy departments across the U.S.

When putting together our annual State of the Industry Q&A Series, I asked several participants to weigh in on the retail experience, including merchandising and activations in the U.S. and abroad. Not a single executive praised the mass retail experience in the U.S. Even notorious rivals, including MGA Entertainment Founder & CEO Isaac Larian and ZURU CEO Nick Mowbray found something to agree on: Mass retail in the U.S. is lagging far behind what retailers are doing elsewhere in the world.

As ToyFest kicked off in Las Vegas this week, my friend David Middleton — owner of three stores in the UK and a driving force at Toymaster — sent me a message after visiting a few major retailers here in the States: “Shocking. Stale as Hell. What’s happening?”

He’s absolutely right, and I’m going to keep doubling down on the state of mass retail until it gets fixed.

Macy’s “Bold New Chapter”

Last week, Macy’s reported its Q4 and full-year 2023 earnings, and they weren’t too hot. The company is under pressure from activist investors mounting a takeover bid, some of whom think Macy’s real estate portfolio is worth more than the retail business itself. History tends to repeat itself and we’ve seen this story before with Sears. Plus, commercial real estate is also a mess right now. Would people rather see thriving beacons of commerce or an increased corporate wasteland of empty storefronts and decaying buildings?

Incoming CEO Tony Spring unveiled “A Bold New Vision” for the company, complete with a deck touting the forthcoming transformation. The good news? The company is acknowledging its aging, dirty store fleet. The bad news? An immediate jump to the oldest cost-cutting tool in the playbook: store closures.

Macy’s plans to reduce its store fleet by 150 over the next couple of years, and again we’ve seen this story before.

As of February 2019, Macy’s operated 653 stores. Today, the Macy’s nameplate exists on 502 locations and dropping. Looking ahead, a potential store fleet of just 350 locations is less impactful than 500, and as the number drops, we’re back in Sears or pre-2018 Toys “R” Us territory. Once consumer perception turns to “the dirty place with high prices that closed,” you have a major problem that’s really hard to come back from.

And speaking of Toys “R” Us, Macy’s execs have seldom mentioned “toys” in their earnings calls, nor have they called out Toys “R” Us by name in quite some time, despite a relationship with WHP Global to have branded departments within its store fleet. Closing 150 stores also means closing 150 Toys “R” Us store-within-a-store departments.

Having visited numerous Toys “R” Us at Macy’s departments over the past two years, the most glaring issue comes down to store-level execution: lack of pricing. In many of my store visits, countless toys had no visible pricing available — no shelf tags or price tags on the items themselves. To my knowledge, every toy is supposed to have a price tag on it. Again, something that I’ve been harping on since January: lack of basic retail fundamentals.

Bullish on the Bullseye?

When the dust settled following the closure of the original Toys “R” Us in 2018, I went on record as saying that “Target won the toy war,” and that was true at the time. Target invested in its toy departments, increased square footage in some cases and made the departments fun to shop. They were well-stocked, had fun fixtures, and then a collaboration with FAO Schwarz presented some new opportunities to cross-pollinate the brands (more on FAO in a minute).

So what happened?

Store visits show stock levels that are all over the place and toy departments that are an absolute mess. Again, basic fundamentals. Zoning, facing, whatever you want to call it — just a sweep through the department a few times a day to make sure that everything is merchandised properly. If folks want to traipse through a mess under the guise of a “treasure hunt,” there are places for that and Target isn’t one of them.

Additionally, the satellite aisle of collector-focused toys located adjacent to the electronics department in most stores is typically a mess. The merchandise is out of place and lacks pricing, and I’ve personally visited a good dozen stores in the past quarter where overstock (and fresh stock!) is in shopping carts and/or stock room rolling carts with no team member working on it.

Fun fact: Proper merchandising and pricing will help save some of this merchandise from the clearance aisle.

While Target’s last year was rocky — its first overall sales decline since 2017 — it did manage to achieve better earnings on softer sales with some bright spots in Q4. In a handout, the retailer touted its “most affordable top toys assortment ever” as a win. That’s great news!

Looking ahead, Target plans to build more than 300 new stores over the next decade and remodel 2,000 of them. Additionally, the company unveiled Gigglescape, a new house brand of toys and books priced at $10 or less.

“The new toy brand sparks joy and imagination for kids and parents with an assortment of plush, books, toys, games, and more rolling out in 2024 and beyond,” the company said in a release.

In the meantime, please send some “Red Shirts” out to the toy departments to clean up some messes.

Hearthsong’s Swansong: A Big Win for Big Lots

Big Lots is another retailer that’s been working to regain focus, and a big part of that is delivering the value that its customers expect. They move a lot of toys, and last week they revealed an influx of new stock from a surprising company: Hearthsong.

Just last summer, Hearthsong, a company that launched in 1983, celebrated its 40th anniversary with refreshed branding and packaging by Pearlfisher and a push toward new retail channels.

In September, Hearthsong set up shop in the Javits Center to show off its new lineup and meet with buyers at Toy Fair in New York. At the time, the company and its CEO, Jamey Bennett, expressed excitement for the future.

Then, in November, the layoffs began.

By January, Hearthsong essentially vaporized with the rest of the staff shown the door shortly after New Year’s Day.

While the Hearthsong website remains online with all products showing “sold out,” a quick look at the brand’s social media profiles reflects an abrupt end to the company as daily posts went dark and consumers began sharing customer service issues in a public forum.

Big Lots’ strategic acquisition of Hearthsong’s inventory adds more than 500 SKUs to its assortment, with products spanning indoor and outdoor toys, inflatables, playscapes, games, arts & crafts items, STEM, nature and science and other learning toys, along with kids décor. Big Lots says it’ll sell the inventory a 50-70% off the original Hearthsong MSRPs.

An Old-School Toy Launch

Over the weekend, Cepia stormed the Big Apple for the launch of its much-anticipated Decora Girlz doll line. The FAO Schwarz flagship in Rockefeller Plaza has been decked out in rainbow colors for a full-scale takeover celebrating the brand of dolls inspired by Japanese Decora Kei fashion. From the front windows to the store-within-a-store presentation, there is no way to miss Decora Girlz as the launch makes a true statement.

“The launch at FAO Schwarz reflects our shared values of wonder and innovation in toys,” says James Russell Hornsby, Founder and CEO of Cepia. “It’s an honor to present Decora Girlz amidst the magic of such a storied location, and we are genuinely excited to see these dolls spark creativity in children.”

David Niggli, Chief Merchandising Officer at FAO Schwarz adds that the retailer is “more than just a toy store — we inspire awe and wonder with one-of-a-kind experiences, and we can’t wait to see how Decora Girlz delights our guests!”

This type of launch used to be a regular thing, but somewhere along the line, the industry — particularly in the U.S. and most of North America — went off the rails. Again, I emphasize the regional issue because these launches still happen internationally.

Specialty retailers can pull it off. Mass specialty retailers (think Hot Topic, FYE, BoxLunch) can pull it off to an extent. But the big-box retailers are dropping the ball.

Remember when you could walk into a big-box and a hot new toy launch was promoted beyond the toy department with pull-togethers and robust displays near the entrances or in seasonal flex areas?

The Buzzwords of 2024: Newness, Innovation, and Value

While I didn’t plan to write an epic tome today, I do need to point out that after speaking with 21 executives on the record for this year’s State of the Industry (and even more way, way off the record), three words popped up more than any others: newness, innovation, and value.

Coincidentally, those three words popped up again yesterday (and in that order) in a supplemental press release from Target following its earnings presentation.

The industry at large knows the task at hand.

It’s time to roll up the sleeves and get to work.