As families across the U.S. gather for Thanksgiving this year, the eve of the holiday shopping season is upon us.

While the pandemic era skewed the numbers for three seasons — 2020, 2021, and 2022 — with unexpected sales spikes, supply chain issues, and many other factors, I don’t think it’s done yet. If 2023 has been a reset year — or “a year of rebalance,” as Circana’s Juli Lennett called it in our October issue — this holiday season may prove to be the true test for the toy industry: A return to the days when Black Friday flipped the switch to signal four weeks of shopping madness.

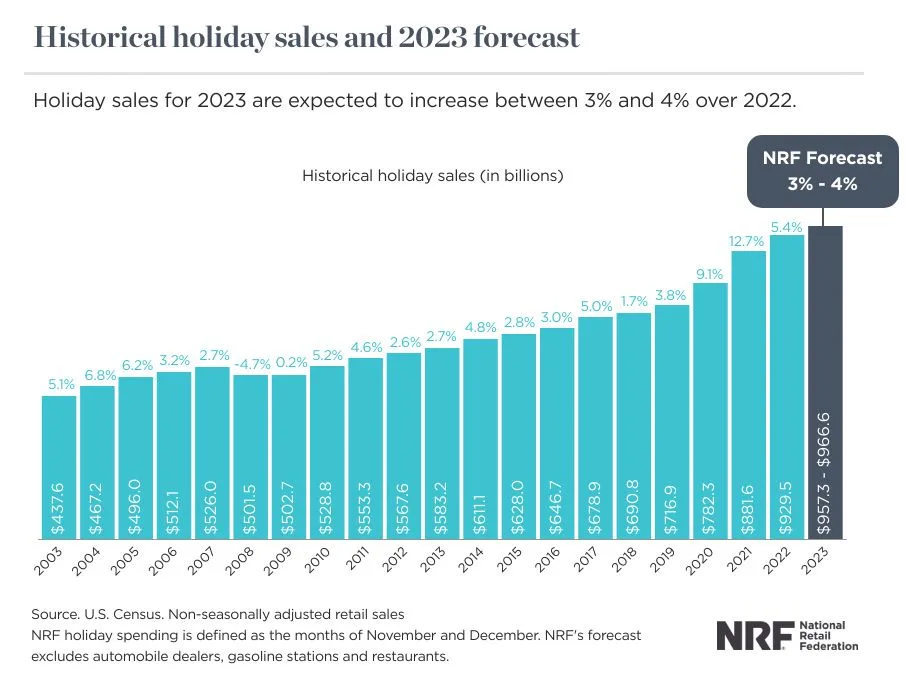

The National Retail Federation (NRF) believes that overall holiday spending will reach record levels this season with growth between 3% and 4% over 2022 to land between $957.3 billion and $966.6 billion for the November/December selling season.

According to a survey conducted by the NRF and Prosper Insights & Analytics, 74% of U.S. consumers are planning to shop during the five-day Thanksgiving holiday weekend. That’s a 5% increase over the 69% of consumers that planned to shop during Thanksgiving weekend in the last pre-pandemic year, 2019.

“This holiday season, particularly the busy shopping days surrounding Thanksgiving, marks an important time of year for many Americans who enjoy traditions and celebrations with family and friends,” says NRF President and CEO Matthew Shay. “Retailers are stocked and ready with competitively priced products to help customers stretch their budgets and find all the items on their holiday lists.”

Toys rank third among popular gift categories in the survey with 37% of respondents planning to shop for the kids in their lives. In the survey, perennial favorites like Hot Wheels, Barbie, and LEGO were top of mind for those plotting their shopping lists.

A Slow Start, But Excitement is Swirling

For years, the importance of Black Friday had been on a downward slide as consumers heeded the calls to shop early and often, with sales tracking earlier in the season, particularly into October. Last year, despite what felt like a return to tradition in terms of early advertising and promotional activities at retail, the season was lackluster for the toy industry, and many caution that this season is essentially the sequel.

The 2023 holiday season was off to a slow start on the retail front despite the arrival of some great new toys and games for the season. Economic concerns still loom, and as much as we all like to use 2019 as a benchmark for where things should be, the world is forever changed.

During third quarter earnings season, Mattel and Hasbro led the charge in cautioning a slow season, something echoed nearly unanimously across the board by the publicly traded toy companies despite the overall sense that better days lie ahead.

At retail, there are signs of positive activity.

Specialty remains strong with many of our contacts in that space reporting sustained business and growth as independent toy stores are nimble and quick to react to new trends.

At mass retail, inventory levels have largely normalized as many toymakers offloaded excess inventory to the value channel with Ollie’s, Ross Dress for Less, TJ Maxx, and Burlington shoppers among those benefiting from the arrival of name brand products for pennies on the dollar.

Macy’s President and CEO-elect Tony Spring noted on the company’s Q3 earnings call that the company’s extended assortment of Disney 100 products, including items from YuMe, Lionel, The LEGO Group, McFarlane Toys, and others is a notable early win. Products from this assortment are available in Toys “R” Us at Macy’s shop-within-a-shop locations and the Macy’s at Herald Square in New York features a Disney Princess augmented reality (AR) try-on experience in its Toys “R” Us.

Target’s Chief Growth Officer Christina Hennington said during her company’s call that price and selection are resonating with consumers and that more than two-thirds of this season’s new toy assortment is priced under $25, with around 25% being Target exclusive. While she noted some seasonal staples including Pokémon, PAW Patrol, Barbie, LEGO, and Teenage Mutant Ninja Turtles among the big hits, it’s the house brand items that are really moving the needle.

“So far, among the most popular toys in our assortment are ‘All Things Target,’ including plush Bullseye dogs, the Barbie Skipper’s First Job at Target doll, and the Target cash register and shopping cart toys, a nod to the Target brand love even among our youngest guests,” she explained. “And back by popular demand, we have an exciting array of toys from FAO Schwarz, including only-at-Target exclusives with 50% of the assortment under $20.”

At Walmart, executives called out new Rollbacks on products from Melissa & Doug, Mattel, and Hasbro — including Barbie’s Malibu Dreamhouse and the relaunched Furby — as spiking sales.

“It’s great to see momentum with strong toy items,” said John Furner, President and CEO, Walmart U.S.

But, as we all know, toys and retail are somewhat predictable as it’s a cyclical business. To borrow from MGA Entertainment’s Isaac Larian, “Christmas arrives every year on Dec. 25,” and kids will always be playing with toys.

It’s just a matter of how businesses evolve to changing times, and if all of this (including the very column that you’re reading) seems a little bit like deja vu, you’re not alone. Just take it from Walmart CEO Doug McMillon from the retail giant’s Q3 call with investors and analysts:

“You know, we’re antsy about Christmas every year. This is my 33rd year, and I feel like it’s a bit of a rerun in that it seems like we’re always talking about customers being price-conscious, and they always will be,” McMillon explained. “And they’re always looking for the hot toy and the right gift for Christmas, and they’ll come buy food from us for Thanksgiving and for the Christmas meal. And then, New Year’s will come. And we’ll have clearance prices after Christmas, and we’ll have a strong January because customers will react to clearance.”

As a former Walmart manager myself, I may know a thing or two about that “rerun” and what it’s like to be on the front lines on Black Friday and throughout the important holiday selling season…

The cycle continues!

Happy selling, my friends!