by JULI LENNETT, Vice President, Industry Advisor, U.S. Toys, Circana (formerly The NPD Group)

Year-to-date retail sales through July reaffirm that 2023 is the year of rebalance for the toy industry. Consumers are prioritizing their spending in the face of inflation and other economic factors, as several of the pandemic-era “safety net” benefits many consumers received have, or will, come to a close this year. The fact of the matter is that the portion of the consumer wallet to spend on discretionary goods, like toys, is shrinking. Manufacturers across toys and other industries will need to work hard to capture their share of the dollars that are left after consumers pay their bills.

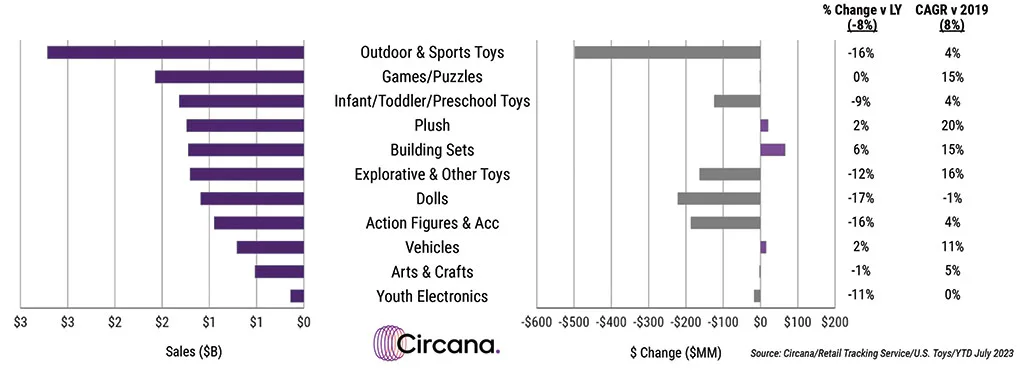

U.S. retail sales of toys declined by 8% from January through July 2023, compared to the same period last year. While both dollar and unit sales fell at the same rate and average selling prices (ASP) were relatively flat, it is worth noting that the four-year compound annual growth rate (CAGR) is still record-setting for the toy industry.

Broadly speaking, two important federal policy changes during the first half likely impacted toy sales. In February, the Supplemental Nutrition Assistance Program (SNAP) benefits, which is the food support for more than 40 million Americans, was reduced and in May, Medicaid continuity ended. These expenses are now coming out of that ever-shrinking wallet, and I suspect that both of these factors contributed to the declines we are experiencing in the U.S. toy market.

Delving into the toy industry results, three of the 11 Supercategories posted growth. Building Sets, up 6%, had the largest dollar gain led by LEGO Icons and LEGO Speed Champions. Plush had the second largest dollar gains, up 2%, driven by Pokémon, followed by Vehicles, which also grew 2%, driven by Hot Wheels.

Devastating weather conditions including the Canadian wildfire smoke stomped on sales of outdoor toys. Outdoor and Sports Toys was the largest Supercategory based on sales volume; however, it also experienced the steepest dollar declines, with year-over-year dollar sales down 16%, primarily due to reduced sales for playground equipment and water/sand toys.

Looking at the top-selling properties, three of the top 10 were also among the top 10 dollar growth properties across the industry: Pokémon, Hot Wheels, and Disney Princess. The others ranked among the top 10 year to date through July include Squishmallows, Star Wars, Marvel Universe, Barbie, Fisher-Price, LEGO Star Wars, and NFL.

As we move through the remainder of the year, the toy industry needs to brace for the impact that several macro-level factors will have on its consumers. While the inflation rate is slowing, it is still growing and the priority for families has to be putting food on the table. Student loan repayments will resume in October. Among the 45 million borrowers affected, the largest segment (25 to 49-year-olds) holds about 70% of the student loan debt. This is also a group of consumers who collectively account for $11 billion in annual toy spending, so their weight in the toy industry is not a drop in the bucket. Child Care Grant Programs will also be ending this fall, leaving the families of as many as 9.5 million children needing to readjust to cover the cost of childcare.

On a positive note, perhaps Barbie will save the day. The July sales results indicated some recovery for the toy industry compared to Q2, which was primarily due to movie properties.

Despite Warner Bros.’ Barbie: The Movie having only been in theaters for two of those weeks, Mattel’s Barbie was the top growth property in July. I have not seen this much buzz surrounding the toy market since Star Wars: The Force Awakens. The film kicked off the Disney Star Wars era upon its release in December 2015, and the toy industry grew 7% that year, led by Star Wars. The following year the industry grew 5%. I believe that The Force Awakens helped drive people to the stores to buy Star Wars products, but they left with a bit more.

With pink at every turn and excitement that crosses industries and generations, the buzz around Barbie is creating enthusiasm that transcends the property itself. This is the jolt that the toy industry needs to get consumers more engaged with toys and lead them to the toy aisle. As economic challenges swirl around us, the industry needs to harness more of these special moments that bring feelings of joy and excitement into our lives.

Note: Data is representative of retailers that participate in Circana’s Retail Tracking Service. Circana’s current estimate is that the Retail Tracking Service represents approximately 76% of the U.S. retail market for toys.

A version of this feature was originally published in the 2023 Toy Fair issue of The Toy Book. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!