by Juli Lennett, vice president and industry advisor, toys, The NPD Group

According to The NPD Group’s Retail Tracking Service, U.S. retail sales of toys generated $20.9 billion last year compared to $21.8 billion in 2018, a decline of 4%.

Industry performance last year was one of contrast. Sales in the first half of the year declined 9% due to comparisons to the Toys “R” Us liquidation sales, which grew the first half of 2018 by 7%. This was followed by 3% growth in the third quarter (July–September), which was expected as we came off declines

in 2018 caused by pantry loading from the liquidation.

Finally, we wrapped up with fourth-quarter (October–December) results, declining 3%, which was burdened with six fewer shopping days between Thanksgiving and Christmas. Last year was one of the more complicated years to get a good read on toy industry health — every time period had a substantial “one-off” event that impacted the trend. This year will be far less complicated and we should get a clean, like-for-like comparison of toy industry trends as early as January.

While holiday sales for toys were down, U.S. holiday sales for key general merchandise categories were up just 0.2% last year compared to 2018, according to weekly point-of-sale* results tracked by The NPD Group throughout the holiday season. The final holiday shopping week, which included Christmas and Hanukkah, showed robust growth and sales volumes across the apparel, toys, technology, small appliance, athletic footwear, and prestige beauty industries, but overall season results were still flat.

For the toy industry, Black Friday week was flat when we compare like-for-like weeks. Cyber week grew 13% and, notably, for the first time ever Cyber week was larger than Black Friday week. Christmas week grew 40%, or $306 million. As a point of comparison, in 2013 when we had the same number of days between Thanksgiving and Christmas, Christmas week grew 43%, or $280 million. This is the third year in a row that there has been one extra day to shop in the week of Christmas, and each year that one week has grown at least $200 million. This year, Christmas moves from Wednesday to Friday, and with two extra shopping days before Christmas, we should expect growth that final week.

2019 Highlights

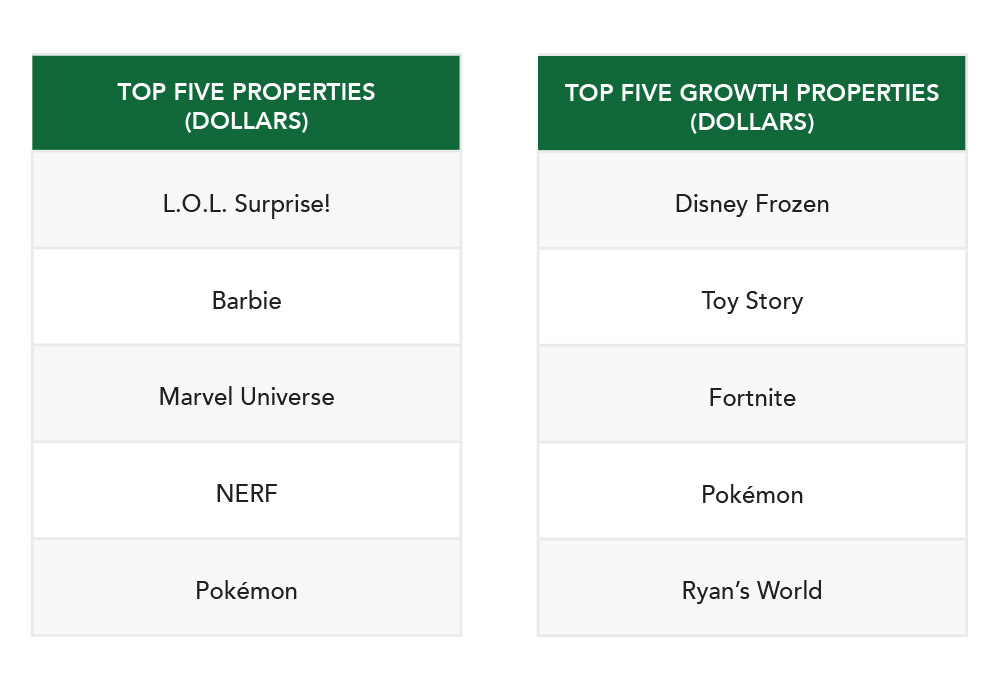

For the second year in a row, L.O.L. Surprise! was the top-selling property for the U.S. toy industry. Among the top-five growth properties (dollars), three had movie releases last year, one came from a popular video game, and the last is a YouTube influencer. Content-supported toys, which came from many different content formats, was one of the key drivers of growth in the toy industry last year.

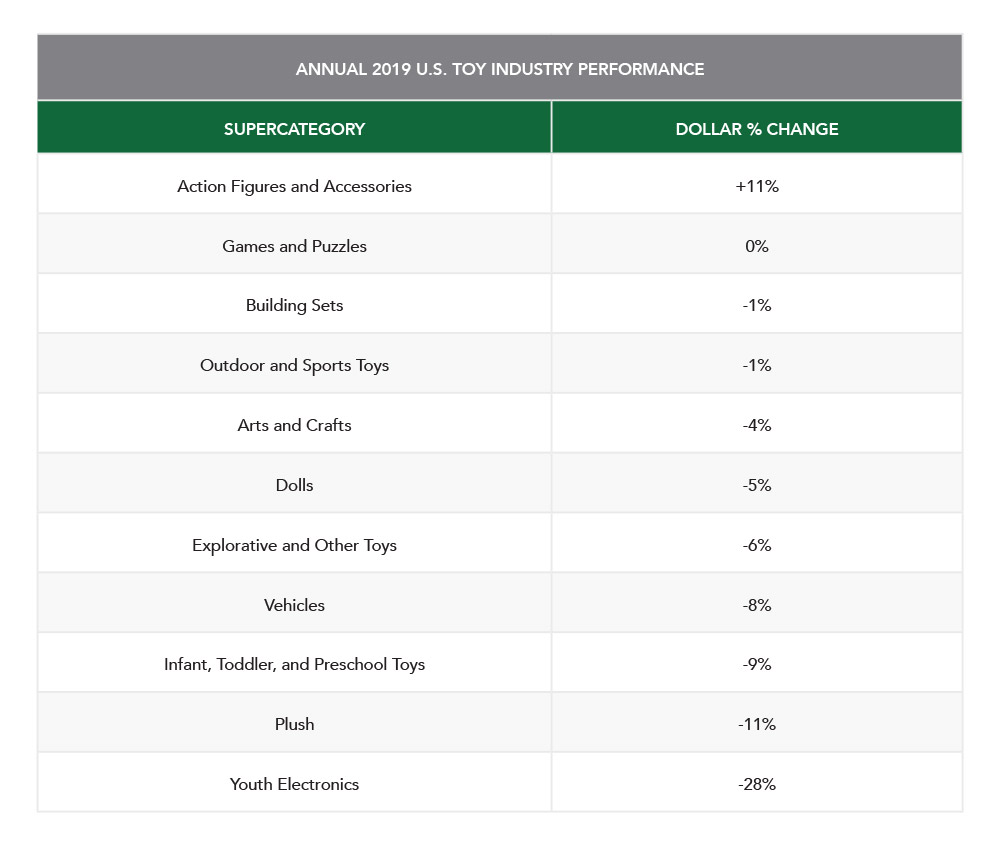

Supercategory sales highlights include action figures growing 11%, led by growth in the action figures and battling toys classes. Toy Story and Fortnite combined were almost half of the growing properties in action figures. Sales were flat in games and puzzles, but strategic trading card games and family strategy games posted positive gains. Pokémon and Magic: The Gathering contributed to the growth in strategic trading card games, while Dungeons & Dragons, getting a lift from the exposure on Stranger Things (Netflix), was the top growth property in family strategy games. Building sets declined $22 million versus last year but outperformed the total market. The standard building sets class had its smallest decline in three years, down 1%. In outdoor and sport toys, which also outperformed the market despite the declines, Fortnite was the largest growth property due to its collaboration with NERF. Skates, skateboards, and scooters was the largest growth class in outdoor and sports toys.

This article originally appeared in the February 2020 issue of the Toy Book. Click here to read more!