Classic brands including Transformers, G.I. Joe, and the relaunched Furby were bright spots in an otherwise challenging year for Hasbro.

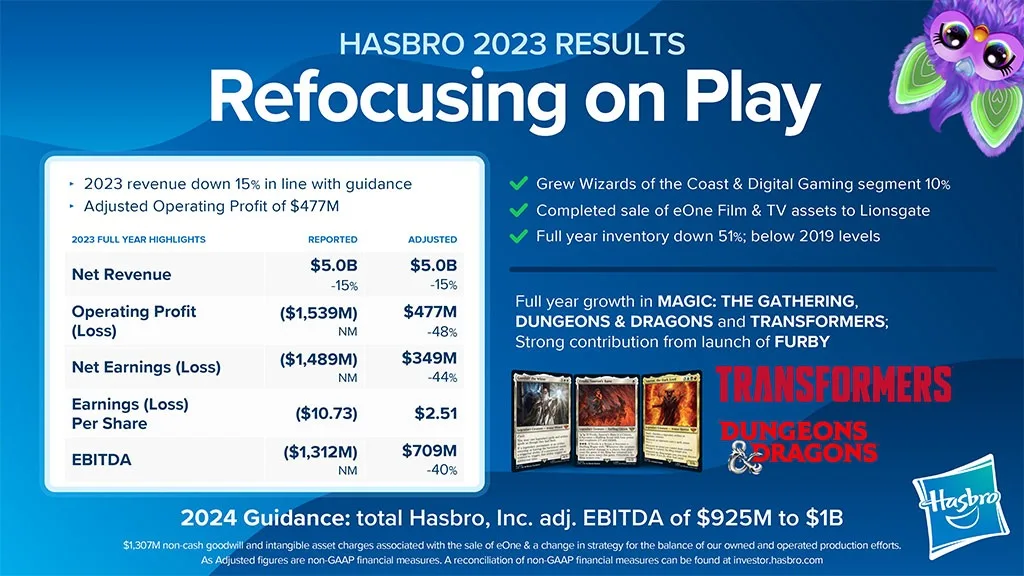

The company, which has been conspicuously repositioning itself as a “toy and game company” after years of branding itself as a “global play and entertainment company,” reported fourth quarter and full year earnings for 2023 today. For the year, Hasbro says that revenue slipped 15% to $5 billion while revenue in Q4 fell 23% to $1.3 billion.

Guided by our strategy of 'Fewer, Bigger, Better,' we had important wins across both toys and games while making progress in our transformation during a challenging 2023. Despite the macroeconomic backdrop, we are entering 2024 with a healthier balance sheet, a leaner cost structure, and a diverse portfolio of industry-leading toy and game brands that support our capacity to invest in the business and maintain our commitment to returning cash to shareholders via our category-leading dividend. Our refreshed leadership team is bringing innovative new products to our fans. At the same time, we are taking the necessary actions to transform Hasbro and deliver long-term profitable growth starting with driving significant profit growth across our segments in 2024 and building momentum in our innovation pipeline between now and 2025.”

Hasbro says that the big holiday dip was in line with its expectations while full-year performance was impacted by the offloading of its eOne entertainment division.

For the year, Wizards of the Coast and Digital Gaming saw revenue spike 10% offset by a 19% dip in Consumer Products Sales and a 31% slide in Entertainment. Baldur’s Gate III from Larian Studios and Monopoly Go! from Scopely led to a 10% spike in Licensed Digital Gaming revenue for Hasbro while tabletop revenue increased 1% attributed to Magic: The Gathering.

Other highlights for 2023 include 76% year-over-year growth in Dungeons & Dragons, 25% growth in Transformers, and 2% growth in Magic: The Gathering, all offset by declines in other brands. Hasbro also reduced its inventory by 51% over 2022, including a 56% reduction in Consumer Products inventory due to offloads into the value channel (Ross Dress for Less, TJ Maxx, Marshall’s, Burlington, Ollie’s) as seen during the holiday season.

Looking ahead, Hasbro plans to use 2024 as a rebuilding year to reset its business by “refocusing on play” and continuing to lean into the licensing business outlined in its Blueprint 2.0 strategy. Under that strategy, partners including Basic Fun!, Just Play, PlayMonster, Super7, Jada Toys, and others create products based on properties from the Hasbro portfolio under license.

Guidance for 2024 points to a 7-12% decline in Consumer Products revenue with a 3-5% dip in Wizards of the Coast as it starts to run up against tough comps this year. The Company’s Board of Directors has declared a quarterly cash dividend of $0.70 per common share. The dividend will be payable on May 15, 2024, to shareholders of record at the close of business on May 1, 2024.

In 2024, Hasbro is celebrating the 50th anniversary of Dungeons & Dragons and the 40th anniversary of Transformers (look for more on that in The BIG Toy Book, out Feb. 26) alongside milestones for Clue, Connect 4, Peppa Pig, and more.