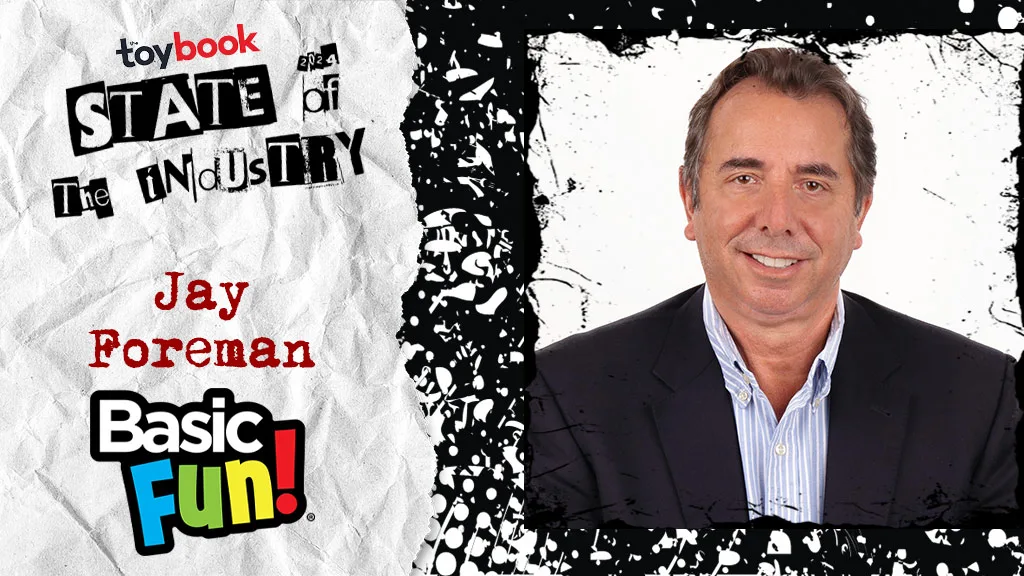

UPDATE: Read an expanded statement from Basic Fun!’s Jay Foreman here.

UPDATE No. 2: 8/6/2024 – Basic Fun! secured DIP financing.

Basic Fun! filed for Chapter 11 Bankruptcy protection today in a move that it’s calling a “strategic action to significantly strengthen its financial structure and position the company for future success.”

The company known for its extensive assortment of licensed products including Care Bears, Littlest Pet Shop, Lite-Brite, and Tonka, revealed that it, alongside “certain affiliated entities,” filed its case in the District of Delaware this morning. The filing involves Basic Fun Holdco, LLC, Basic Fun, Inc., TBDUM, LLC, TGS Acquisition, and K’NEX UK Limited.

Basic Fun! seeks approval of $50 million in debtor-in-possession (DIP) financing from affiliates of Great Rock Capital, as well as a $15 million subordinate facility to be provided by RBC and the company’s founders, Jay Foreman and John MacDonald. The move comes following years of toy industry turmoil, and the company believes that the financing, once approved, will allow it to continue the normal operation of its business through restructuring proceedings.

“Since the demise of our industry’s largest toy retailer Toys ‘R’ Us in 2018, through the tumult of the trade wars with China in 2019, COVID-19 in 2020 through 2021, the travails of the supply chain crisis in 2022, inventory overstocks in 2023, and consumer slowdown in the early part of 2024, our industry and Basic Fun have been through a gauntlet of challenges,” says Jay Foreman, Basic Fun’s CEO and majority shareholder. “We intend to use the restructuring process to put those challenges in the rear-view mirror, enabling us to secure a successful future and position us for growth and value creation.”

At press time, Basic Fun! expects to continue to purchase and sell inventory and to support its licensing, retail, and vendor partners following its financing approval. The company says it plans to present a “comprehensive restructuring plan” an an effort to “emerge from the court-supervised process quickly and effectively.”

Polsinelli PC is serving as legal counsel with Oppenheimer & Co. serving as financial advisor at this time.