As much of the specialty toy industry gathers in Long Beach, California for ASTRA’s Marketplace & Academy this week, The NPD Group has released a fresh batch of public-facing data focused on the U.S. toy industry. The numbers reflect the reality that many in the global toy industry have come to realize in recent weeks: growth is slowing amid a new raft of economic challenges.

According to The NPD Group’s Retail Tracking Service, overall U.S. toy industry dollar sales rose 1% in the first four months of 2022. From January to April, unit sales declined 6% while the average selling price (ASP) spiked 7% to $11.17 per toy.

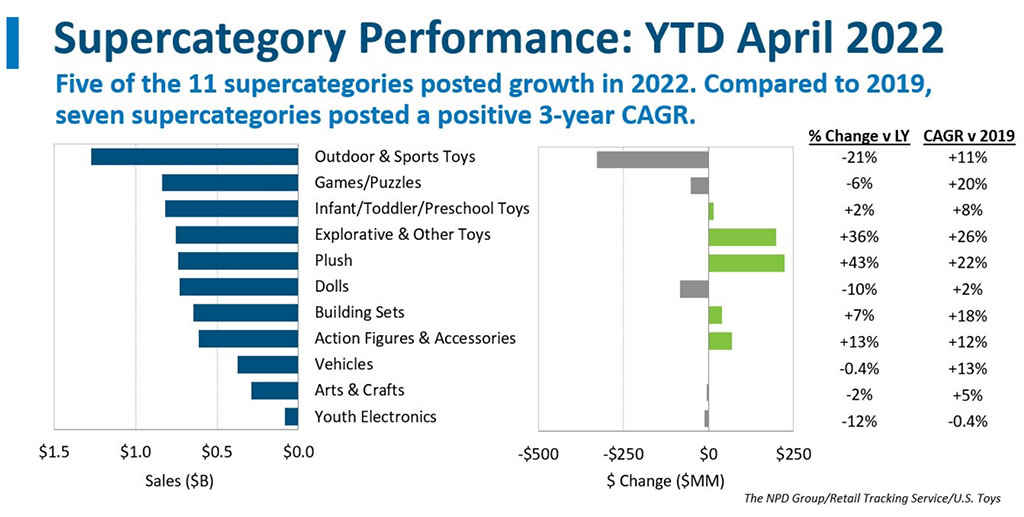

Five of the 11 tracked supercategories have seen growth this year, led by a 43% gain in plush followed by explorative and other toys (36%), action figures and accessories (13%), building sets (7%), and infant, toddler, and preschool (2%).

“While the U.S. toy industry dollar growth slowed to 1% January-April, this was on top of unprecedented dollar growth of 28% in the same period last year with two stimulus checks lining the pockets of some consumers,” says NPD’s U.S. Toy Industry Advisor Juli Lennett. “The decline in units was not unexpected [but] the strong increase in average selling prices for the third year in a row was unexpected and drove the growth over last year.”

Most industries are looking at 2020-2021 as an anomaly — a mixed bag of numbers skewed by the pandemic — and are rolling back the calendar to compare 2022 performance with the pre-pandemic numbers of 2019.

Looking deeper into the NPD data, from 2019 to 2022, the compound annual growth rate shows that toy industry dollars grew 13% year-over-year, driven by ASP growth of 11% alongside a 1% gain in unit sales. Seven supercategories posted double-digit CAGR versus 2019.

“Although we are in the middle of a challenging economic cycle, parents will not miss important occasions to buy toys for their children,” Lennett says. “However, we might see some consumers trading down or looking for sales to get those toys.”

Top 10 Toy Properties for the First Four Months of 2022

- Pokémon

- Squishmallows

- Star Wars

- Marvel Universe

- Barbie

- Fisher-Price

- L.O.L. Surprise!

- Hot Wheels

- LEGO Star Wars

- Funko POP!

NPD says that these 10 properties saw 15% growth, collectively, while the remaining market declined .05%. Collectibles has grown 28% in the first four months of the year with nearly 80% of its growth attributed to plush and sports trading cards.

Overall Industry Highlights

Jazwares’ Squishmallows brand had eight of the top 15 best-selling toys for the entire toy industry. Other products called out for driving notable sales in the first four months of the year include Magic Mixies (Moose Toys), 5 Surprise (ZURU), POP! Vinyl (Funko) and assorted Disney products lumped into a “Disney All Other” tracking category.

In the action figure aisle, products from DC and Marvel performed well while growth in building sets was driven by LEGO Star Wars, LEGO Creator Expert, and DC Universe.