This summer, the Toy Book presented its first-ever Specialty Toy Retail Trends Panel at the 2022 American Specialty Toy Retailing Association (ASTRA) Marketplace & Academy in Long Beach, California.

Speaking to a packed house, Toy Book Editor-in-Chief Maddie Michalik and Deputy Editor James Zahn provided an in-depth look at some of the current trends happening at independent toy stores and specialty retailers across the country. While there is no one-size-fits-all approach to working with retail trends, six specifics stand out this year and just might be worth a look as you work to expand or refine your product mix.

Sustainability: Are Consumers Finally Adapting?

In the past, consumers claimed to be eco-conscious but would ultimately still favor price savings vs. sustainability if given an option between two similar products. The rapid acceleration of sustainable practices is leading toward market proliferation and becoming a more attractive option for consumers as prices begin to come down and normalize for sustainable options.

Products include items made out of sustainably sourced materials, eco-friendly packaging, or packing becoming part of the play experience.

The right mix of new and innovative products with a sustainable hook can be a big win for retailers and consumers alike. Plus, if the major toymakers continue on their current path, by 2030, sustainability will be the norm.

Featured Product/Brand Examples: Cubles (Cubles), Playfoam Naturals (Educational Insights), Land of Dough (Crazy Aaron’s), Sunny Patch Bug House (Melissa & Doug), and more.

Aging Up: Growing with Your Customer Base

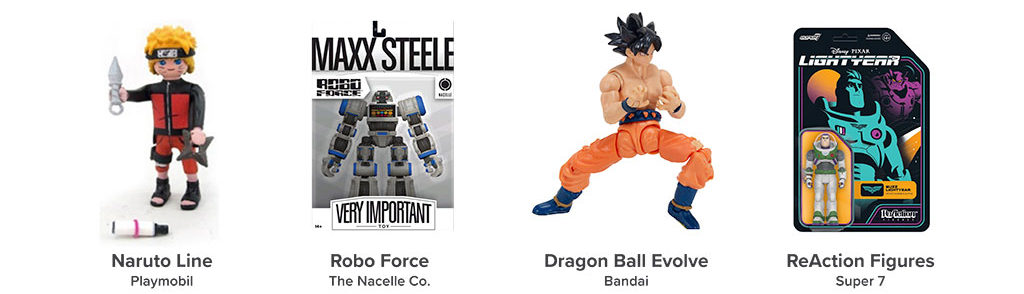

In the past, many specialty stores focused on younger kids, specifically. Now, collectibles and other interests for older audiences are fueling the addition of new categories that can be used to attract and retain new customers while keeping kids coming back beyond childhood.

Anime is having a huge pop culture moment, with shows like Naruto, Dragon Ball Z, One Piece, and My Hero Academia becoming more popular than ever. The popularity of Stranger Things has fueled a renaissance for Dungeons & Dragons and additional gaming titles, toys, and collectibles.

According to the NPD Group, one in every five toys being sold globally this year is considered to be a collectible. The “kidult” trend is largely tied into this concept, and other toy-adjacent items, such as trading cards, are hot again.

Featured Product/Brand Examples: Playmobil Naruto (Playmobil USA), Robo Force (The Nacelle Co.), Dragon Ball Evolve (Bandai), ReAction Figures (Super7).

Lifestyle Products

The tween market took off a few years back and has since fueled growth in toy-adjacent lifestyle products for the whole family. This includes offerings beyond toys and into wearables, journals, DIY, accessories, and more — with a huge emphasis on self-expression and customization. Kids want to show off what they love, whether it’s their outfits or how they’re decorating their rooms, and there is virtually no limit to the products available.

Featured Product/Brand Examples: Loungefly (Funko), STMT (Horizon Group USA), ICEE Collection (Iscream), Licensed Banks (Monogram International)

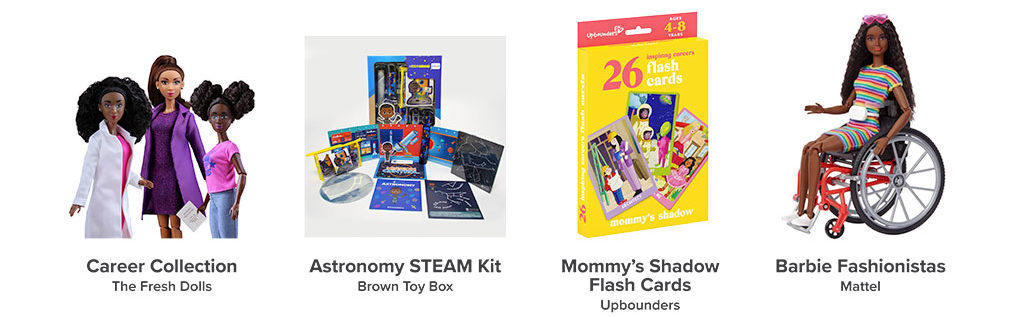

Diversity & Inclusion

A hot topic in recent years, diversity and inclusion has become essential to toy aisles. Kids want to see themselves in their toys, and many emerging and existing companies are finally meeting that demand. These toys and games reflect and represent the world we

live in: all skin tones, cultures, and abilities.

Above all, empowering kids through play to show them that being themselves is their greatest superpower is something that the entire toy industry can champion!

Featured Product/Brand Examples: Career Collection (The Fresh Dolls), Astronomy STEAM Kit (Brown Toy Box), Mommy’s Shadow Flash Cards (Upbounders), Barbie Fashionistas (Mattel)

Toys & Collectibles as Decor and Art

Once thought of as being part of the designer toy culture, families across the country are embracing toys and collectible Items that could function as major display pieces or something that is more subtle. This trend is largely inspired by the kidult trend, as many

millennial adults love to show off their fandoms.

Products include construction sets, puzzles, games, and high-end collectibles that can be used to accent an existing retail mix or be displayed in a special pull-together section of a store.

Featured Product/Brand Examples: LEGO Botanicals/LEGO Art (The LEGO Group), Funko Vinyl Gold/Funko Games (Funko), Hidden Dissectables (Mighty Jaxx), Lite Brite Wall Art (Basic Fun!)

Classics: Upgraded

Classic toys never go out of style, and specialty retailers know that. But fresh, new takes on classic play patterns are emerging for a new generation of kids.

Much of this is cross-generational appeal, fueled by nostalgia and parents wanting to share their childhood memories with their kids, but in new ways beyond simply being “retro.”

The category includes new versions of classic toys and games or classic concepts with a twist.

Featured Product/Brand Examples: Trestle Tracks (Fat Brain Toys), Gel Blasters (Gel Blaster), Clay Sculpting Station (Crayola), Rubik’s Phantom (Spin Master)

Looking ahead into the back half of 2022 and into 2023, these trends offer the potential for independent retailers to build their businesses in new ways. No one knows the customer better than the stores that serve them. What’s right for one store may not work in another, so it’s always best to use a measured approach when trying new products and categories before going all-in.

For more trends delivered six times a year, be sure to subscribe to the Toy Book! And, for weekly updates delivered directly to your inbox every Thursday morning, subscribe to the Toy Book’s Toy Report®!