By ANDREW WABER, manager of data insights, Salsify

A majority of Americans now prefer to buy toys online. To that end, in the year since Toys “R” Us closed its doors for good, Amazon and Walmart have stepped in to capture much of the defunct chain’s $11.5 billion in annual toy sales. Amazon reported a 30% year-over-year increase in toy sales during the latter portion of last year, and Walmart has similarly seen its toy sales help grow overall e-commerce revenue.

If you’re a toy brand, driving increased sales on these major online retailers is critical to your short- and long-term profitability, and that means putting your products in the best position to win sales in these competitive marketplaces. An analysis of product content and sales performance across a combined 80,000 toys and games pages on both Amazon and walmart.com revealed more images, longer descriptions, more reviews, and a broader use of enhanced content (below-the-fold images, videos, and HTML branding) are associated with the top 10% of best-selling products.

Enhanced content matters for toy buyers

Regardless of price, top-selling toys on Amazon and walmart.com were significantly more likely to have enhanced content when compared with poor-selling toys, or those ranking in the lowest 10% of sales.

Consumers value the kind of rich media and product information contained in enhanced content to answer questions, build confidence, and compare products to competitors. To put your product in an advantageous position, roll out enhanced content on your product pages on Amazon or walmart.com, mostly for your highest-volume or highest-margin products.

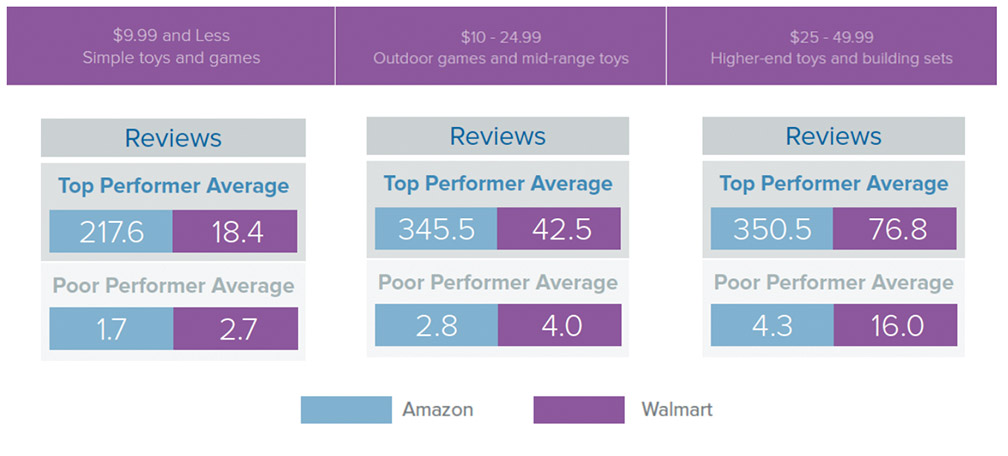

Top sellers have higher review counts

Like the presence of enhanced content, review counts among top-selling toy products were notably higher than those of poor-selling products. The degree to which this was the case varied significantly between Amazon and walmart.com. As with most categories on Amazon, top-selling toy products on the site have an average of several hundred reviews, regardless of price point. On walmart.com, top-seller average review counts ranged from just 18.4 to 178.4.

If your product only has a few dozen reviews on Amazon, it probably won’t compare favorably to competitors, and consumers have proven to be more likely to buy products with that extra degree of validation. However, that same number of reviews on walmart.com would potentially place your product among the more frequently reviewed toy products on the site, depending on the price point. There are many potential tactics for boosting review counts, and it’s worth testing to see which approaches work best for your brand.

Increase your product pages’ image counts

The average U.S. consumer expects six images on a product page, whether on Amazon or walmart.com. These preferences noticeably impact conversion performance in the toy category as you move up in price, but the average image count across top-selling products was significantly higher than that of poor-selling products across every price point studied.

This kind of clear trend across both retailers, in conjunction with those rising consumer preferences, really underscores the importance of increasing your product pages’ image counts — particularly for any higher-priced toys. Keep in mind that the images don’t just need to be different angles of the same product. Top-selling toy product pages use in-image text to call out unique benefits, show relevant product details, or demonstrate the product in use. Use imagery to drive home reasons why a consumer should buy your product.

The product page is a toy’s best selling opportunity

Using these stats to help get your product pages more in line with top performers is simply a first step. Your product page needs to remain compelling over time — especially as the toy market makes its drastic shift to e-commerce. We didn’t study the impact of video or 360-degree product spins in this analysis, but those are the types of immersive product page experiences retailers are offering, and you should be testing them to stay ahead of competitors. For context, just two years ago, consumers wanted an average of three images on the product page, and now that number stands at six. Toy brands that treat online product pages as a key branding opportunity and put in the organizational processes for making their product page experiences consistently robust are going to be in a much better position to boost sales across these key online retailers that own market share for the category.

[author] [author_image timthumb=’on’]https://toybook.com/wp-content/uploads/2019/05/AndrewWaber_Web.jpg[/author_image] [author_info]Andrew Waber is the manager of data insights at Salsify, a product experience management (PXM) platform provider. In his current role, Waber manages the analysis, editorial direction, and strategy for Salsify’s public-facing reporting on the online retail marketplace.[/author_info] [/author]

This article originally appeared in the May/June 2019 issue of the Toy Book.