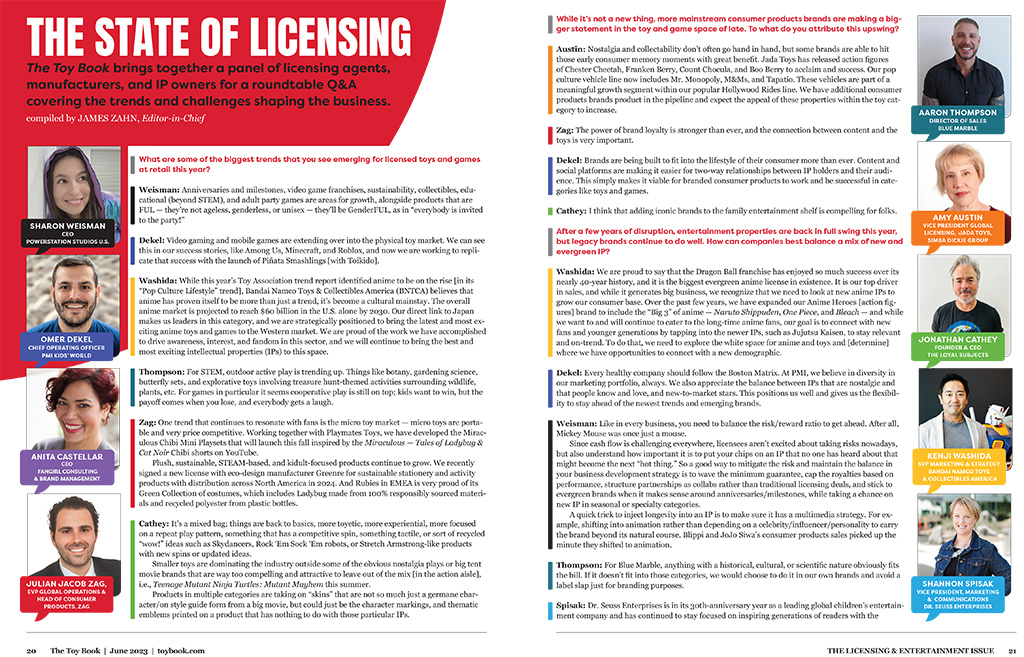

Timed with Licensing Expo, The Toy Book brings together a panel of licensing agents, manufacturers, and IP owners for a roundtable Q&A covering the trends and challenges shaping the business.

The Toy Book: What are some of the biggest trends that you see emerging for licensed toys and games at retail this year?

Sharon Weisman, CEO PowerStation Studios U.S.: Anniversaries and milestones, video game franchises, sustainability, collectibles, educational (beyond STEM), and adult party games are areas for growth, alongside products that are FUL — they’re not ageless, genderless, or unisex — they’ll be GenderFUL, as in “everybody is invited to the party!”

Omer Dekel, Chief Operating Officer, PMI Kids’ World: Video gaming and mobile games are extending over into the physical toy market. We can see this in our success stories, like Among Us, Minecraft, and Roblox, and now we are working to replicate that success with the launch of Piñata Smashlings [with Toikido].

Kenji Washida, Senior Vice President Marketing & Strategy, Bandai Namco Toys & Collectibles America: While this year’s Toy Association trend report identified anime to be on the rise [in its “Pop Culture Lifestyle” trend], Bandai Namco Toys & Collectibles America (BNTCA) believes that anime has proven itself to be more than just a trend, it’s become a cultural mainstay. The overall anime market is projected to reach $60 billion in the U.S. alone by 2030. Our direct link to Japan makes us leaders in this category, and we are strategically positioned to bring the latest and most exciting anime toys and games to the Western market. We are proud of the work we have accomplished to drive awareness, interest, and fandom in this sector, and we will continue to bring the best and most exciting intellectual properties (IPs) to this space.

Aaron Thompson, Director of Sales, Blue Marble: For STEM, outdoor active play is trending up. Things like botany, gardening science, butterfly sets, and explorative toys involving treasure hunt-themed activities surrounding wildlife, plants, etc. For games in particular it seems cooperative play is still on top; kids want to win, but the payoff comes when you lose, and everybody gets a laugh.

Julian Jacob Zag, Executive Vice President, Global Operations & Head of Consumer Products, ZAG: One trend that continues to resonate with fans is the micro toy market — micro toys are portable and very price competitive. Working together with Playmates Toys, we have developed the Miraculous Chibi Mini Playsets that will launch this fall inspired by the Miraculous — Tales of Ladybug & Cat Noir Chibi shorts on YouTube.

Plush, sustainable, STEAM-based, and kidult-focused products continue to grow. We recently signed a new license with eco-design manufacturer Greenre for sustainable stationery and activity products with distribution across North America in 2024. And Rubies in EMEA is very proud of its Green Collection of costumes, which includes Ladybug made from 100% responsibly sourced materials and recycled polyester from plastic bottles.

Jonathan Cathey, Founder & CEO, The Loyal Subjects: It’s a mixed bag; things are back to basics, more toyetic, more experiential, more focused on a repeat play pattern, something that has a competitive spin, something tactile, or sort of recycled “wow!” ideas such as Skydancers, Rock ‘Em Sock ‘Em robots, or Stretch Armstrong-like products with new spins or updated ideas.

Smaller toys are dominating the industry outside some of the obvious nostalgia plays or big tent movie brands that are way too compelling and attractive to leave out of the mix [in the action aisle], i.e., Teenage Mutant Ninja Turtles: Mutant Mayhem this summer.

Products in multiple categories are taking on “skins” that are not so much just a germane character/on style guide form from a big movie, but could just be the character markings, and thematic emblems printed on a product that has nothing to do with those particular IPs.

TB: While it’s not a new thing, more mainstream consumer products brands are making a bigger statement in the toy and game space of late. To what do you attribute this upswing?

Amy Austin, Vice President, Global Licensing, Jada Toys at Simba Dickie Group: Nostalgia and collectability don’t often go hand in hand, but some brands are able to hit those early consumer memory moments with great benefit. Jada Toys has released action figures of Chester Cheetah, Franken Berry, Count Chocula, and Boo Berry to acclaim and success. Our pop culture vehicle line now includes Mr. Monopoly, M&Ms, and Tapatio. These vehicles are part of a meaningful growth segment within our popular Hollywood Rides line. We have additional consumer products brands product in the pipeline and expect the appeal of these properties within the toy category to increase.

Zag: The power of brand loyalty is stronger than ever, and the connection between content and the toys is very important.

Dekel: Brands are being built to fit into the lifestyle of their consumer more than ever. Content and social platforms are making it easier for two-way relationships between IP holders and their audience. This simply makes it viable for branded consumer products to work and be successful in categories like toys and games.

Cathey: I think that adding iconic brands to the family entertainment shelf is compelling for folks.

TB: After a few years of disruption, entertainment properties are back in full swing this year, but legacy brands continue to do well. How can companies best balance a mix of new and evergreen IP?

Washida: We are proud to say that the Dragon Ball franchise has enjoyed so much success over its nearly 40-year history, and it is the biggest evergreen anime license in existence. It is our top driver in sales, and while it generates big business, we recognize that we need to look at new anime IPs to grow our consumer base. Over the past few years, we have expanded our Anime Heroes [action figures] brand to include the “Big 3” of anime — Naruto Shippuden, One Piece, and Bleach — and while we want to and will continue to cater to the long-time anime fans, our goal is to connect with new fans and younger generations by tapping into the newer IPs, such as Jujutsu Kaisen, to stay relevant and on-trend. To do that, we need to explore the white space for anime and toys and [determine]where we have opportunities to connect with a new demographic.

Dekel: Every healthy company should follow the Boston Matrix. At PMI, we believe in diversity in our marketing portfolio, always. We also appreciate the balance between IPs that are nostalgic and that people know and love, and new-to-market stars. This positions us well and gives us the flexibility to stay ahead of the newest trends and emerging brands.

Weisman: Like in every business, you need to balance the risk/reward ratio to get ahead. After all, Mickey Mouse was once just a mouse.

Since cash flow is challenging everywhere, licensees aren’t excited about taking risks nowadays, but also understand how important it is to put your chips on an IP that no one has heard about that might become the next “hot thing.” So a good way to mitigate the risk and maintain the balance in your business development strategy is to wave the minimum guarantee, cap the royalties based on performance, structure partnerships as collabs rather than traditional licensing deals, and stick to evergreen brands when it makes sense around anniversaries/milestones, while taking a chance on new IP in seasonal or specialty categories.

A quick trick to inject longevity into an IP is to make sure it has a multimedia strategy. For example, shifting into animation rather than depending on a celebrity/influencer/personality to carry the brand beyond its natural course. Blippi and JoJo Siwa’s consumer products sales picked up the minute they shifted to animation.

Thompson: For Blue Marble, anything with a historical, cultural, or scientific nature obviously fits the bill. If it doesn’t fit into those categories, we would choose to do it in our own brands and avoid a label slap just for branding purposes.

Shannon Spisak, Vice President, Marketing & Communications, Dr. Seuss Enterprises: Dr. Seuss Enterprises is in its 30th-anniversary year as a leading global children’s entertainment company and has continued to stay focused on inspiring generations of readers with the whimsical world of Dr. Seuss. For decades, the characters of these books have moved beyond the pages to have success within the pop-culture realm, and key to this is to build upon original IP that fans know and love with new content that brings the world of Dr. Seuss to life. An example of this is through the upcoming launch of Seuss Studios, where emerging authors and illustrators will create original stories inspired by Ted Geisel’s (aka Dr. Seuss) unpublished sketches and illustrations for a new line of books for early readers.

TB: Newness fuels toy industry growth, but most of the original IPs that have been big hits over the past decade have really targeted the preschool crowd. Is there an opportunity for a great IP for the 5-10 range that’s being missed, and how can that be addressed?

Zag: Absolutely, and Miraculous is a testament to that with a core audience of 6-12-year-olds. And one of the reasons I think this content is so popular with families is that Jeremy [Zag] and his creative team understand what kids are looking for in their content: It’s not only entertaining, but also aspirational programming that helps kids to believe in themselves.

Cathey: There’s always an opportunity, but it doesn’t have to be the next superhero. Great stories are great stories, but we just have to get beyond the barricade and wood chipper of this sort of draconian mega studio system, and create the environment encouraging new concepts, new stories, [and] new character development. There are tons of great creatives out there. Story is king, and there are a ton of opportunities to poke the proverbial head above the clouds. The Dragon Prince is a really cool show, great characters, great stories, sort of nonbinary, but it just needs to find its way to retail and arm-lock with its audience.

Also, IPs hitting that age range not named Spider-Man can be things with an anti-hero like Five Nights at Freddy’s, or similarly from the indie game developer universe like Poppy’s Playtime, at least for a hot minute. Will these be the next Star Wars? Probably not, but what is?

TB: What are some of the biggest challenges that have emerged in the licensing space over the past few years, and how are you addressing them?

Washida: The majority of the challenges we experienced were largely due to the pandemic, similar to others in the industry.

Now, with the U.S. entertainment industry in the midst of a writer’s strike, there is the potential for the toys and games market to be impacted due to delays in content production. However, since anime is a large driver for our content, which originates in Japan, we may actually be at an advantage as we can bring the best-of-the-best merchandise based on our chosen entertainment category regardless of what is happening in the U.S. and other Western markets.

Weisman: I will say that from where I am sitting, we licensing pros are getting very lazy at educating and challenging retailers on how to tell a compelling story at retail. Consumers love a good story, which will give brands a competitive edge over others at retail. I will buy the tea bags that have cool mantra labels over the plain boring version. I will buy the licensed PJs of the creator who was bullied as a kid over some mass fashion brand label.

We gave the retailers too much power. Licensing is visual storytelling. [We need to] make them get creative and tell stories at the point of purchase, even if it means the agent or brand owner must cough up some money to make it happen.

Anita Castellar, CEO, FanGirl Consulting & Brand Management: The biggest challenge is consolidation within the toy manufacturers. Toy companies are merging and consolidating their brands and their resources, allowing smaller companies to make bigger impacts within the industry. However, in order to maximize ROI on these mergers and acquisitions, risk has to be minimized. That means potentially less opportunity for experimentation and innovation with new licensed brands.

TB: Looking ahead, what do you believe will drive the business forward in the next 12-18 months?

Austin: Social media platforms will continue to adjust and develop based on the changing desires of the public. While ads fill our feeds, there is a growing shift in acceptance of organic product demonstration and presentation. Look at the many “get ready with me” (GRWM) clips across Instagram and TikTok. This continued prevalence of content will drive brand and product awareness.

Additionally, new outlets will become more mainstream, like Twitch, Discord, Caffeine, and Supernova. [We expect] great opportunities to create and present custom, relatable marketing collateral to a dedicated audience to inform consumers and ultimately drive product revenue.

Dekel: Finding the perfect mix between a hot brand, developing an innovative toy line, and creating it as high-value yet affordable for kids and their parents. We are targeting this in all of our near-future developments.

Thompson: It sounds cliché, but: innovation. Consumers want something new. Yes, there will always be a need for your legacy items, but developing new play patterns and thinking outside the box is what gets kids excited. Blue Marble takes a “fun first” focus on STEM with National Geographic, and we want to make it fun for kids to learn and not just be more school after school.

Cathey: Hopefully we can all get past these wakes left from the pandemic era, i.e. the inventory issues at retail. It looks like things are starting to flow again, which is fantastic. I think the north star is always the same: value, quality, experience. Let that mantra rule and folks will be there to buy. There are some great movies coming, too, like Teenage Mutant Ninja Turtles: Mutant Mayhem. It should be a great one, not a bad time to be in the turtles biz [Ed. note: The Loyal Subjects is a licensee].

Also, some of the nostalgia plays look like they’re going to crush it this year. Comfort food for the soul … nothing like good memories and building new ones. Isn’t that like every toy company’s mantra? It’s so typical, but sort of rings true.

TB: With “fashion” taking the stage as the central theme for Licensing Expo this year, how do you view the convergence of toys, games, and fashion outside of the traditional process of slapping a hot property on a T-shirt or a set of pajamas?

Castellar: I love how much innovation has been happening within the licensed apparel space! Most often, fans who buy highly detailed licensed fashion are adults. They have grown up with these legacy toy and game brands and want to celebrate their fandom beyond a logo slap on a T-shirt. These consumers can appreciate more subtle designs that only fans with deep brand knowledge can appreciate. And because they are older consumers, they have more expendable cash to afford fashion with more details.

Washida: When done properly, fashion can be used as a way for consumers to outwardly express their fandom and affinity for a brand. However, for it to be successful, the collaboration has to be an authentic fit.

Consumers have become increasingly savvy and for them to buy into something it needs to have a level of appeal and elevate how they express themselves. Fashion, toys and games, and other consumer product categories are key to franchise building, and we’re working with our partners to create a franchise plan for our anime titles. You’ll be seeing activations from BNTCA this year that integrate “fashion” into our play patterns and brands.

Spisak: Dr. Seuss Enterprises has partnered with many amazing brands and designers, from Cynthia Rowley and Billabong to Irregular Choice and Supreme, and more. We seek creative teams that are passionate about what they do and about our property. Our approach is to ensure we are working with best-in-class [licensees] to deliver quality products and experiences that our fans expect from Dr. Seuss.

Thompson: This is where we’ve seen an explosion of craft activity play patterns. Jewelry-making has plenty of shelf presence. We are also seeing a migration into making themed items like buttons or jewelry-style items you can place on your shoes, handbags, backpacks, etc.

Dekel: The toy and game business is very similar to fashion in that it must be led by innovation and freshness and creating an emotional connection with the consumer. We license to leverage the IP and create a statement in all we do. Toys are the fashion statement of the schoolyard.

Cathey: I don’t think toys will ever be the Met Gala, and I think “fashion” is certainly hand-quotable. That being said, social media has brought generations and continents together, and we’re all looking at the same things. Ten-year-old kids know who Basquiat is, maybe because they’re following Doja Cat or Jay-Z, or maybe because they’re hip to Supreme because their older brother likes it or they just saw it hit on some “like” interests from their YouTube preferences. Kids like seeing what they’re consuming boiled down into products or consumables, and that could be “toys” or “games.”

Can you imagine a Go Fish-style Karl Lagerfeld game? The intersection where art/fashion/design/music now meets is grandiose — it can trickle down to toys, and it has to a certain degree with fashion dolls. Fashion dolls are no longer Neanderthal hair, doilies, and burlap — the mini fashions are kinda nuts.

I guess we’ll see where The Weeknd collides with Toy du Jour. If the business piece can work, and the audience is there, you never know what might happen.

Interviews have been edited for length and clarity.

A version of this article was originally published in the 2023 Licensing & Entertainment Issue of The Toy Book. Click here to read the full issue! Want to receive The Toy Book in print? Click here for subscription options!