Toys have always been a global business, but the policies and climate of the ‘70s and ‘80s managed to push the bulk of manufacturing and packaging — with exceptions like Slinky, Wiffle Ball, and Lincoln Logs — out of the U.S. Decades later, the COVID-19 pandemic exposed the true weaknesses of the supply chain and how inflation, labor issues, rising costs for raw materials, and reliance on global shipping cartels could wipe out the financial upside of international production. When paired with recent concerns regarding tariffs and intellectual property (IP) theft, reshoring and nearshoring efforts are top-of-mind with manufacturers.

While a recent study from the Reshoring Institute revealed that nearly 70% of American consumers would prefer to buy — and pay more for — products labeled “Made in USA,” the industry faces several roadblocks to domestic production. Opening a new factory in the U.S. requires major upfront capital investment, machines and tooling sourced from overseas, and environmental considerations. Once built, a new facility must be operated by a workforce that, for the most part, no longer exists due to a labor shortage in the U.S.

As the toy industry knows well, with challenge comes opportunity.

RETAIL REINVENTED MANUFACTURING

Last year, Walmart reinforced its commitment to U.S. manufacturing with its America at Work initiative. A successor to Walmart founder Sam Walton’s 1985 Bring It Home to the USA campaign, America at Work is a commitment to purchase $350 billion in products made, grown, or assembled in the U.S. The retailer says that “jump-starting the manufacturing industry and rebuilding the middle class requires a national effort by companies, industry leaders, lawmakers, and others.” Walmart believes that its efforts will support 750,000 manufacturing jobs by 2030.

A key part of Walmart’s plan is the “American Lighthouses” concept that seeks to unite business leaders with government and local economic development groups to create regenerative supply chains in six key areas. For the toy and game industries, two of Walmart’s supply chain focus areas are of interest: plastics, and metals and motors.

In Ohio, Little Tikes, Step2, and Simplay3 produce rotationally molded toys and home products for the global market. Many of their products are large items that would be expensive to import. The companies’ central location makes it easy to ship directly to consumers or to U.S. retailers’ warehouses.

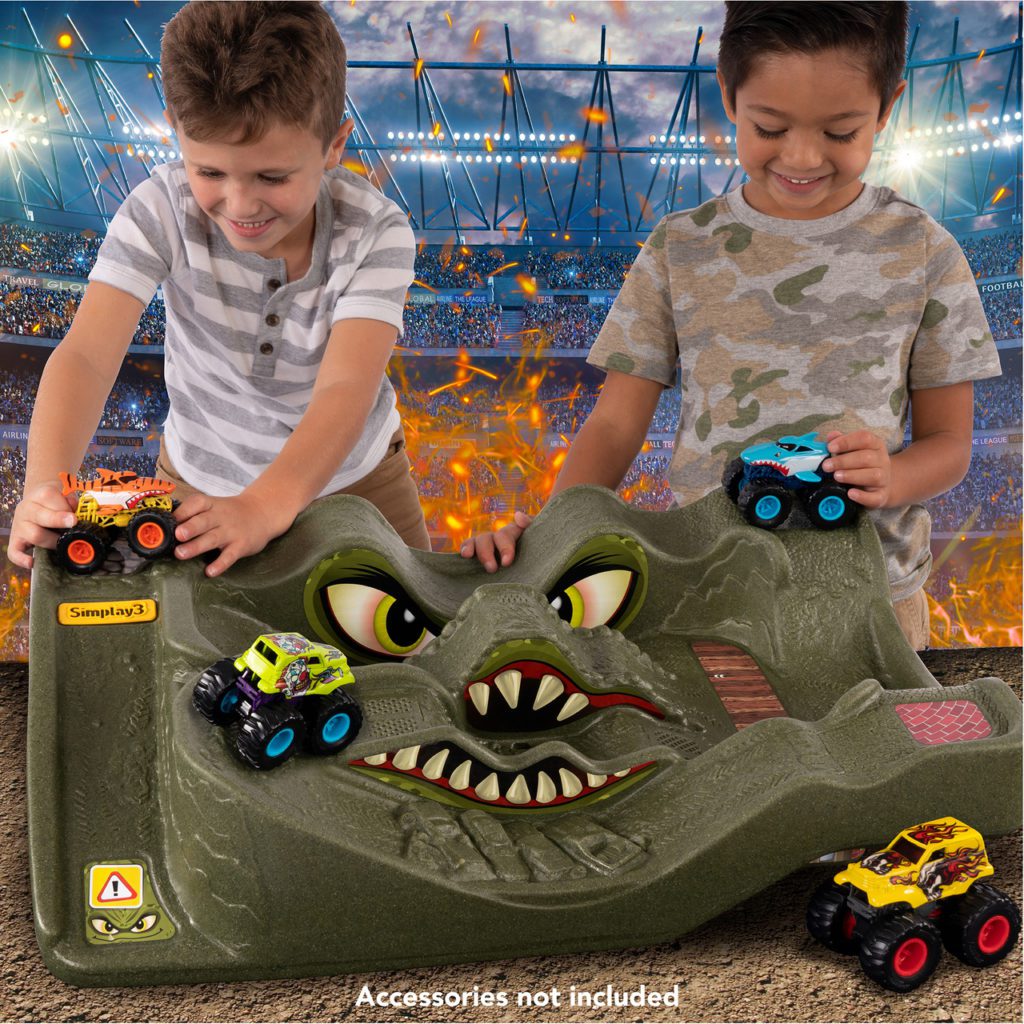

According to several industry experts, the vehicles category had consistent outages at retail last year, not only for die-cast cars and trucks, but also for playsets. As a result, Simplay3 collaborated with Walmart to bring a new product to market in record time.

“The Monster City Extreme Wheels Track was developed from a conversation with a buyer who had specific needs for a product,” says Brian McDonald, vice president of sales and marketing at Simplay3. “Since our design, engineering, and manufacturing are all in Streetsboro, Ohio, we were able to communicate and develop this product in 17 weeks.”

The double-sided playset is compatible with most 1:64-scale monster trucks and McDonald says this is just one example of what is possible when retailers source domestically.

In New Jersey, EastPoint Sports is using the success of one domestically sourced product, Kan Jam, as a springboard to launch an entire “Made in the USA” product segment that will debut at Walmart this spring.

“We are focusing on more manufacturing efforts in the U.S. that will ultimately create jobs and provide near-term sourcing opportunities,” says Jonathan Berkowitz, CEO of EastPoint Sports.

BRINGING HOME THE CLASSICS

Smaller, made-in-the-U.S. companies — including the American Bubble Co., Blu Track, Cubles, and LuxBlox — are emerging. Meanwhile, the largest domestic facility producing toys and games is manufacturing products for one of the largest toy companies: Hasbro.

Hasbro sold its facility in East Longmeadow, Massachusetts, to the Cartamundi Group in 2015, but the companies have since formed a partnership under which Cartamundi continues to manufacture select Hasbro products — such as Monopoly and Clue — in the U.S. Five years ago, production for certain Play-Doh products also returned to the U.S.

For Hasbro, diversification of the supply chain has been in the works for many years. Speaking to CNBC in 2019, late Chairman and CEO Brian Goldner said that decreasing reliance on China had been in the works since 2012, due in part to what he called “enterprise risk reasons.” At the time, Hasbro was producing about 50% of its global output in China and was hoping to be down to about one-third by 2023. Now, current Hasbro President and Chief Operating Officer Eric Nyman points out that the continued diversification of its supply chain is currently a delicate balance.

“Our biggest challenge in moving more manufacturing to new locations is ensuring we hold true to our company’s values of manufacturing a safe, high-quality product at a price providing great consumer value,” Nyman says. “As we continue to expand production into the U.S., we have an excellent team that is being smart and strategic about where we source our product.”

THE NUANCES OF “MADE IN USA”

The red, white, and blue “Made in USA” label that adorns domestically produced consumer goods is a symbol of American manufacturing. In a crackdown on what it called “rampant Made in USA fraud,” the Federal Trade Commission (FTC) formally published an enforceable rule last summer.

The rule says that companies cannot make unqualified “Made in USA” claims on labels unless the final assembly or processing of the product occurs in the U.S.; all significant processing that goes into creating the product occurs in the U.S.; and all, or virtually all, ingredients or components of the product are made and sourced in the U.S. Approved qualifiers include wording such as “Made in the USA of U.S. and China components” or similar that is truthful and not misleading.

“When we launched Simplay3, we decided that not only were we going to produce our products in the U.S., but that we would also support U.S. suppliers of component parts,” McDonald says. “We have heard of companies that could not ship an American-made product because they were waiting for additional components to arrive from offshore.”

Two years ago, CreateOn partnered with Magna-Tiles for its first collaborative line of magnetic play structures that it labels as “Designed and Assembled in USA.” Using imported Magna-Tiles as a base, CreateOn designs products that are printed, assembled, and packaged in Illinois. Vice President Steven Rosen says that he believes “a hybrid model [of sourcing] will be needed to be able to be responsive for the needs of the global supply chain” this year and beyond. He also says that a prime benefit to making toys in the U.S. is being able to refine the play experience.

“The biggest advantage to us is the ability to concept and create new products in-house within a day to see if the product is viable,” Rosen says. “We can let our family and friends play test them for us quickly.”

FUTURE OUTLOOK

Last fall, New Jersey-based LaRose Industries LLC — maker of Cra-Z-Art and RoseArt products — opened a 315,000- square-foot manufacturing facility in Jacksonville, Florida. Cra-Z-Art now maintains more than 1 million square feet of manufacturing space dedicated to producing toys, art supplies, craft kits, and school supplies in the U.S.

At the same time, Starplast USA, which makes toys under the StarPlay brand, revealed plans to invest nearly $18 million to open a second U.S. manufacturing facility in an existing building in Chesterfield, Virginia.

Crafts and plastics aside, there are still major issues with making toys in the U.S. that fall into complex categories, such as action figures, electronic toys, or anything involving metal. For more than two years, Emmy Klint has been working on a relaunch of her grandfather’s company, Nylint. The company was once a leader in pressed-steel toys alongside Tonka and Buddy L. Today, she says that there is just no infrastructure in place to make the products in the U.S., which means the first two Nylint reissues are being produced in China — something she hopes to avoid going forward.

“It has been a very long and difficult road and has made me even more certain that the next toys need to be made in the U.S.,” she says, cautioning that without major investment, that can’t happen.

In a business filled with creative individuals who work tirelessly to create positive play experiences for kids worldwide, the thought of growing the U.S. toy industry here at home is no longer spoken of as being impossible. At bare minimum, it’s now a consideration as the hassles of international plant shutdowns, freight issues, and rising costs have tipped the scales so that even the largest toymakers are ready to explore new possibilities.

This article was originally published in the February 2022 edition of the Toy Book. Click here to read the full issue!